Ethereum to $4000 – The main hurdle before ETH’s price target is…

- Ethereum noted a decline in bullish conviction in the Futures market

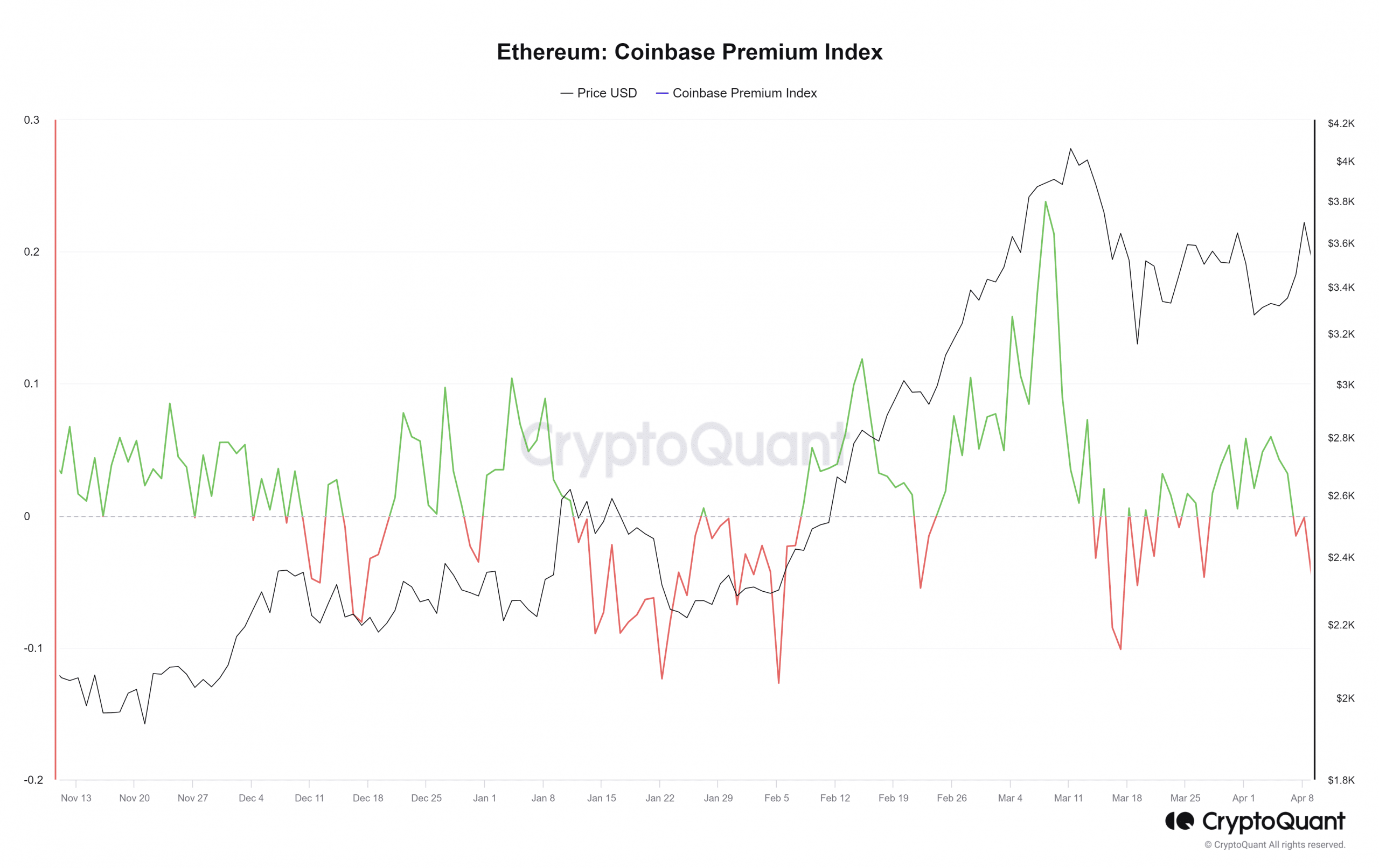

- Coinbase Premium Index showed traders from the U.S are adamant about the altcoin

Ethereum [ETH] rallied swiftly from $3.2k to $3.7k, making a 16.2% move in three days. However, the bulls were rebuffed at the same near-term resistance from a month ago – $3.7k.

The local top coincided with a massive influx of ETH to exchanges on 8 April, according to AMBCrypto’s latest analysis. While the sentiment had been bullish, it has begun to shift over the last 24 hours.

U.S investors refuse to believe in ETH’s rally

Source: CryptoQuant

The Coinbase Premium Index represents the percent difference in prices (USDT pair) between Binance and Coinbase. This index has fallen since 5 April to show that Binance ETH prices were greater.

In other words, it reflected a lack of bullish enthusiasm from U.S investors, since they can’t trade on Binance and have to rely on Coinbase. Hence, despite the sharp bounce to $3.7k, sentiment west of the Atlantic has been muted.

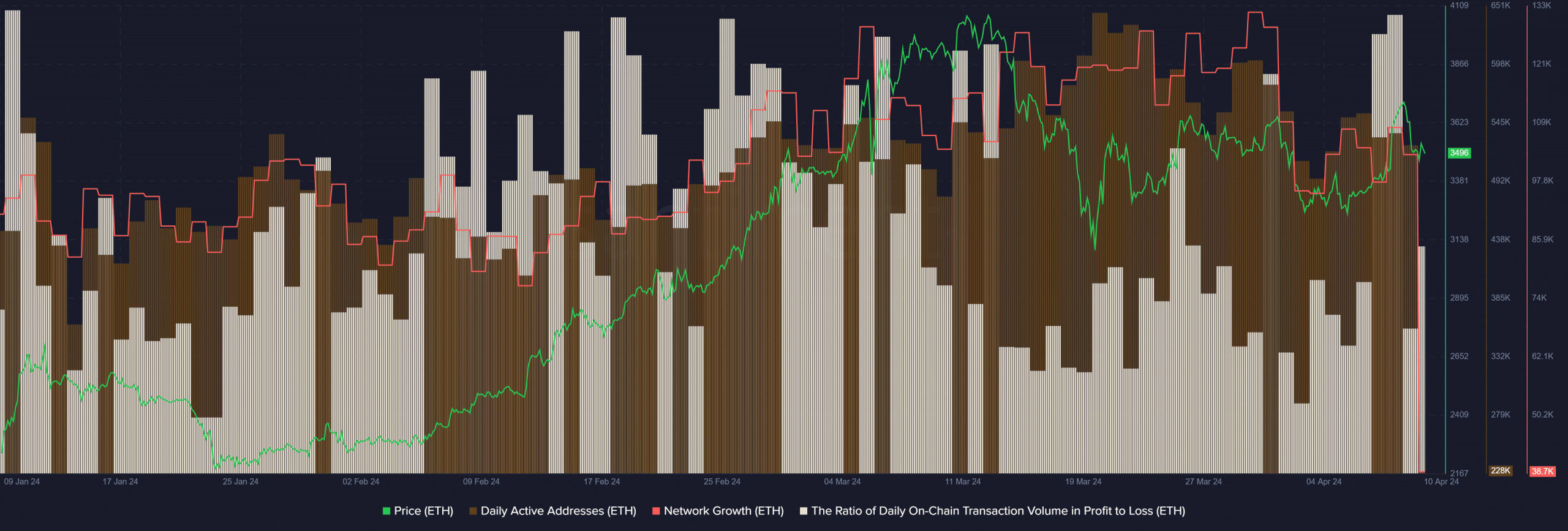

Source: Santiment

The ratio of daily on-chain transaction volume in profit to loss metric from Santiment leapt to 3.01 on 8 April. Since February, this metric has faced a glass ceiling at 3. Therefore, traders could keep an eye on this metric’s daily readings to understand if a short-term price depression might be inbound.

Daily active addresses and network growth metrics saw a slump on 30 March. They continued to trend lower over the past ten days. This was a sign of a lack of user adoption and organic demand for Ethereum. It raised the question – What is the short-term sentiment like in the spot and Futures ETH markets?

Open Interest data supported idea of bearish market sentiment

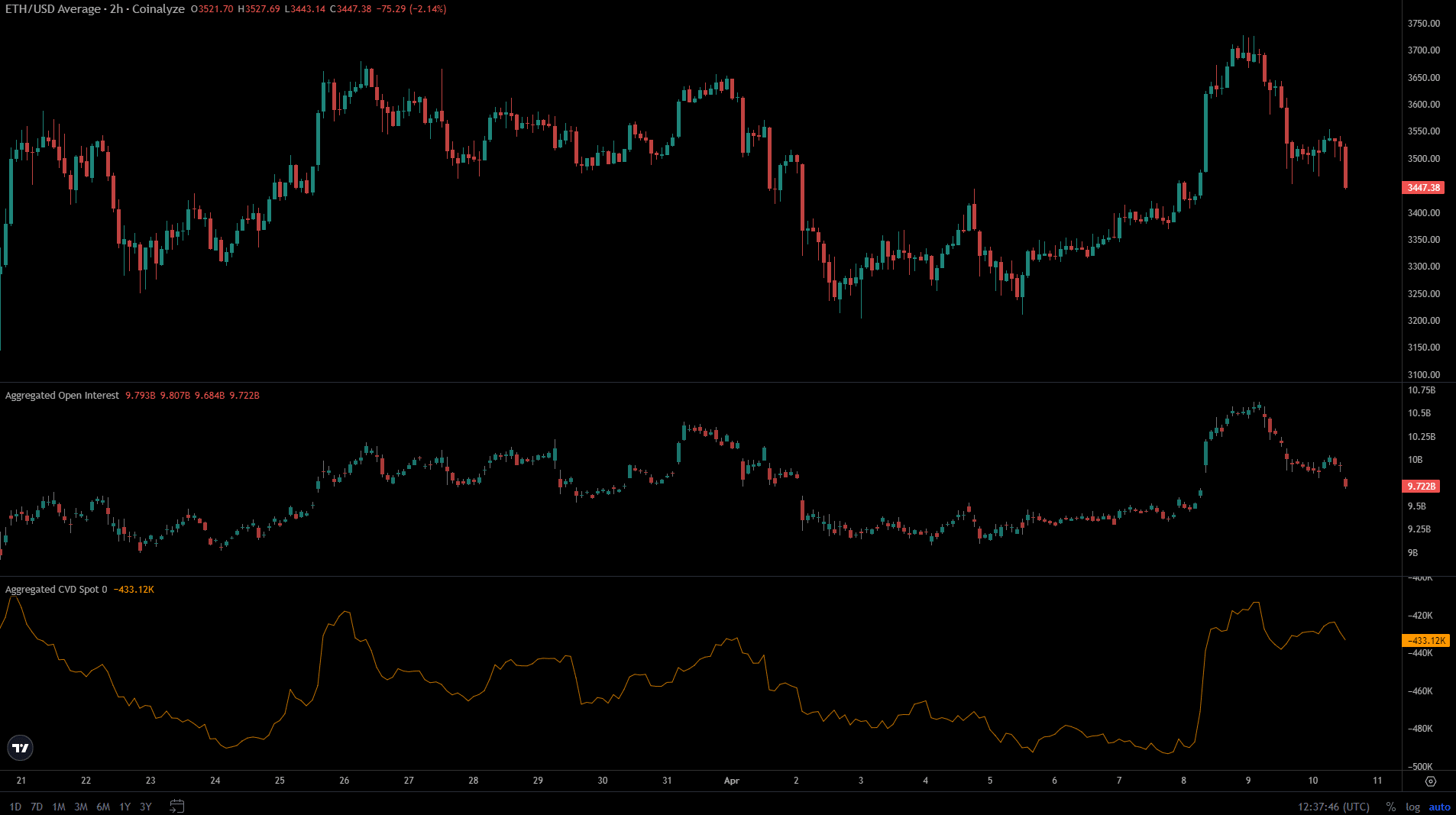

Source: Coinalyze

When ETH faced rejection at $3.7k, the Open Interest also took a turn south. Over the last 36 hours, the OI has fallen from $10.6 billion to $9.72 billion. A drop in prices, alongside the Open Interest, seemed to be a sign of bearish sentiment.

Read Ethereum’s [ETH] Price Prediction 2024-25

The spot CVD also began to fall lower, but it has not retraced all the gains it made since the 8th. That being said, the period from 26 March to 8 April saw Ethereum’s spot CVD trend south. It highlighted that spot market participants were not bullishly convinced yet, but there was a chance of a turnaround should ETH break past the $3.7k-mark.