Ethereum: Traders anticipate price recovery as losses trickle in

- ETH’s NRPL has returned to negative territory.

- On-chain metrics revealed traders remain steadfast in coin accumulation.

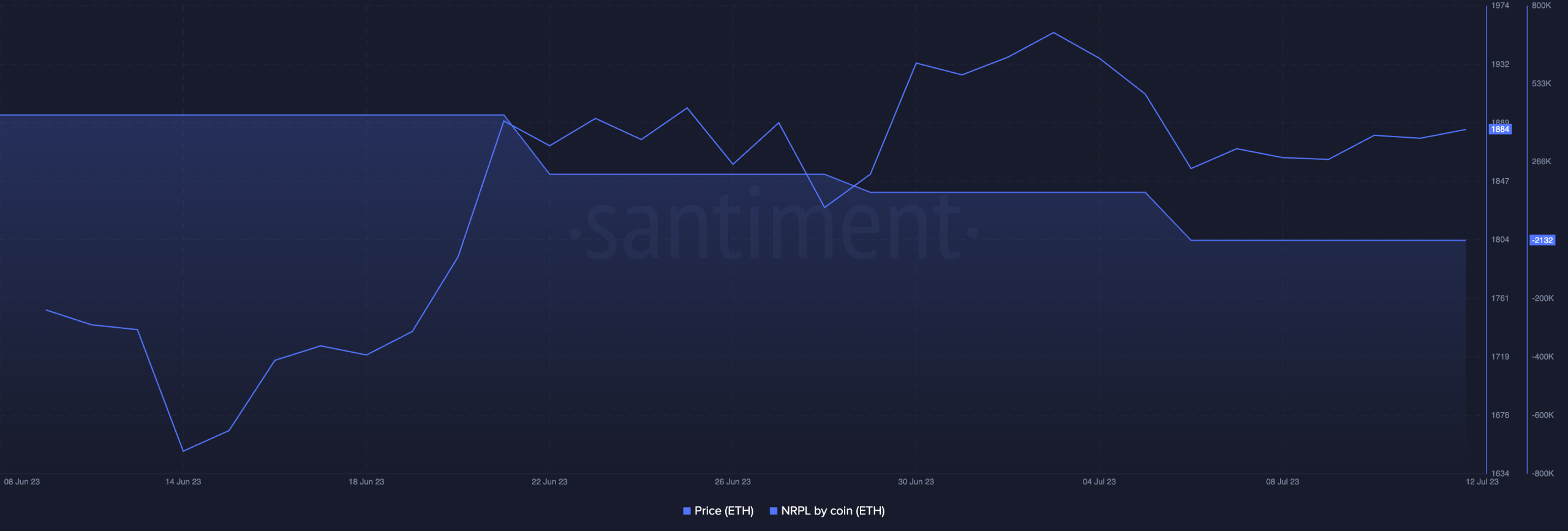

After a few weeks of Ethereum [ETH] traders posting gains on their investments, the alt’s consolidation around the $1800 price range has caused its Net Realized Profit/Loss (NRPL) indicator to return to the negative territory, data from Santiment showed.

Read Ethereum’s [ETH] Price Prediction 2023-24

ETH’s NRPL posted a negative value of -2166.27 on 6 July for the first time in the last three weeks. At press time, this metric was -2134.

Generally, when an asset’s NRPL goes negative, it often signals a higher probability of future positive price movement. The negative NRPL for ETH suggests that many investors who purchased ETH in the past are currently holding underwater positions. This situation can create buying pressure as these investors seek to recover their losses. Consequently, this phenomenon has historically been associated with potential price growth.

Is the leading altcoin well poised for the same?

Although positioned underwater, traders refuse to let go

Per data from CoinMarketCap, ETH exchanged hands at $1,883 at press time. Within the same period, its value rallied by 0.25%, while trading volume dipped by almost 20%.

On-chain assessment of the alt’s exchange activity confirmed decreased selling pressure. While ETH grappled with severe price volatility in the last month, its exchange reserves decreased steadily. According to data from CryptoQuant, with 15.14 million ETH coins housed within exchanges at press time, the alt’s exchange reserves fell by 4% in the last month.

Further, the month so far has seen several ETH long positions being opened across known exchanges. While there was a momentary surge in short-ETH positions on 8 July, traders returned to placing bets in favor of continued price growth, data from Santiment revealed.

Realistic or not, here’s ETH’s market cap in BTC’s terms

While the coin’s weighted sentiment laid in the negative territory – highlighting the impact of the price volatility on investors’ sentiments – it was positioned in an uptrend at press time, poised to cross the center line. At the time of writing, ETH’s weighted sentiment was -0.81.

On a daily chart, ETH took a middle position within its Bollinger Bands indicator. When the coin’s price rests in the middle of the Bollinger Bands, the price is trading around the moving average line, neither close to the upper band nor the lower band. This situation suggests a period of relative price stability or consolidation.