Ethereum

Ethereum traders increasingly bullish as taker buy-sell ratio hits new high

Buy orders are returning to Ether’s futures market, suggesting a correction in negative sentiment. However, with the coin’s…

- ETH’s taker buy-sell ratio has risen steadily since 10 September

- With strong resistance at $2000, ETH investments have continued to return very low profits

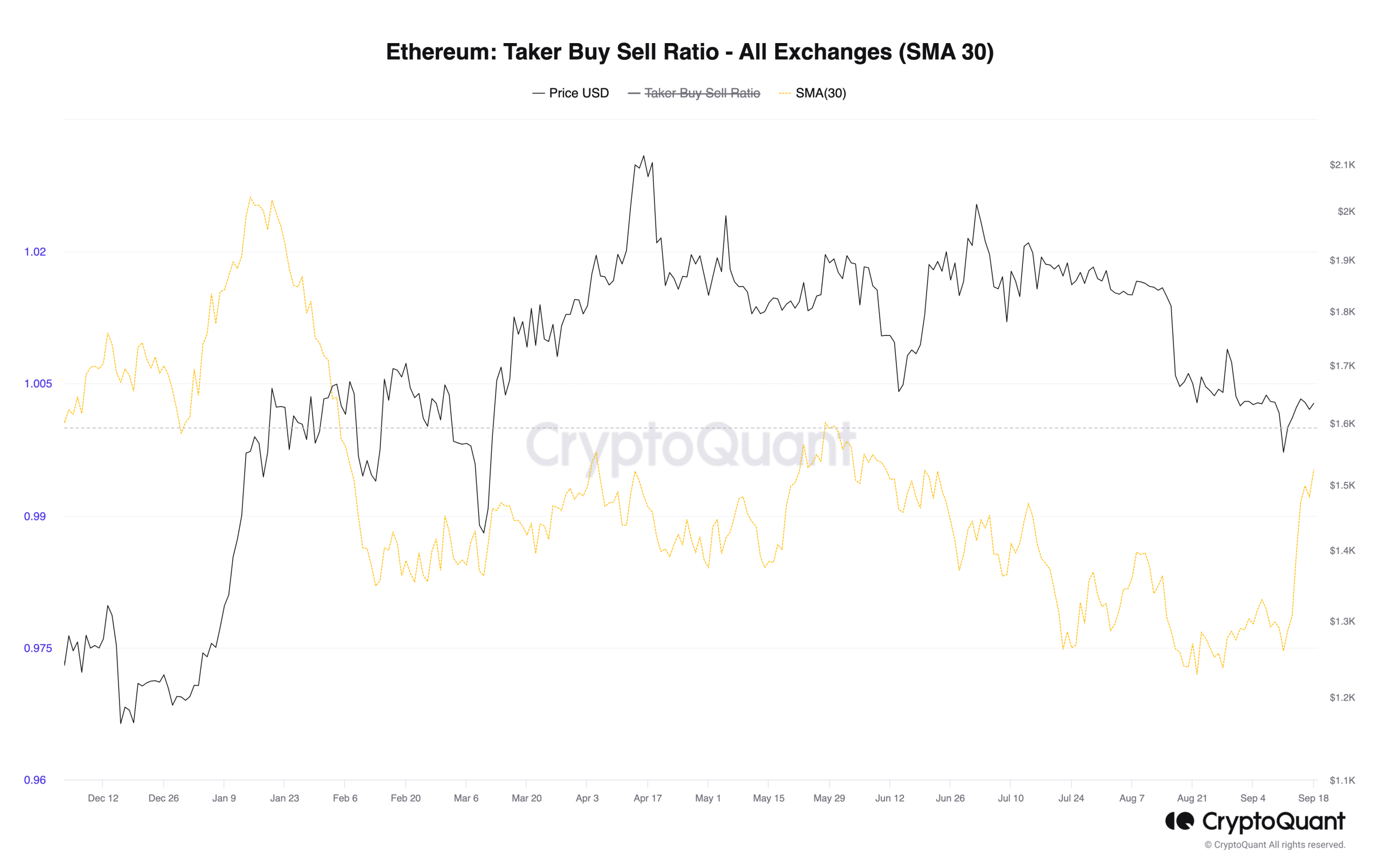

Ethereum’s [ETH] taker buy-sell ratio assessed on a 30-day simple moving average (SMA) has climbed to its highest level since 23 June. This, according to data from CryptoQuant.

The taker buy-sell ratio is a metric that measures the ratio between the buy volume and sell volume in an asset’s Futures market. A value greater than 1 indicates more buy volume than sell volume, while a value less than 1 indicates more sell volume than buy volume.

Read Ethereum’s [ETH] Price Prediction 2023-24

A steady decline in this metric suggests that the Futures market for the asset concerned has become plagued by more sell orders than buy orders.

Due to the significant resistance faced by ETH around the $2000-price level, its taker buy-sell ratio has trended south since 29 May. In fact, by 28 August, it had fallen to its lowest level this year.

Although still below 1, CryptoQuant analyst ‘Greatest_Trader’ has now claimed

that the surge in ETH’s taker buy-sell ratio since 10 September represents a re-emergence of positive sentiment. This might help drive up the altcoin’s value.“This surge suggests a potential change in sentiment among market participants, indicating a shift towards a more bullish stance. Should this metric continue its upward trajectory and venture into positive territory, it could herald the onset of a new phase characterized by bullish price action. In such a scenario, Ethereum’s price might experience an upsurge, potentially targeting higher resistance levels.”

ETH promises little to no returns for now

While positive sentiments might be returning to ETH’s Futures market, the general market appears rife with bearish activity. This, as gleaned from the consistent decline in the daily count of profitable transactions involving the alt.

According to Santiment, the ratio of ETH’s daily on-chain transaction volume in profit to loss has fallen over the last month. With a figure of 0.85 at press time, it suggested that for every ETH transaction that resulted in a loss, only 0.85 returned profit.

Is your portfolio green? Check out the ETH Profit Calculator

Also, after peaking at 23% on 29 July, the coin’s Market Value to Realized Value (MVRV) has dropped. This metric tracks when an asset becomes overvalued or undervalued in relation to its historical price movements and the price at which it was last moved.

Finally, with a reading of 18% at press time, the count of ETH holders who would log profit on their investments if they sold the coins has plummeted since the end of July.