Ethereum turns deflationary: What it means for ETH prices in 2025

- Ethereum to potentially go back to being deflationary next year.

- ETH/BTC has been experiencing some fluctuations.

The supply of Ethereum [ETH] has been growing steadily at around 60K ETH per month for the last six months. However, following the recent 50 basis points rate cut, this growth has slowed significantly to between 30K and 40K ETH per month.

If this trend continues, Ethereum’s supply could return to being deflationary by early 2025, before it even reaches its pre-merge levels. With more rate cuts expected, the inflation rate might decrease further, setting the stage for future price growth.

Ethereum’s supply plays a crucial role in its market dynamics. Since the rate cut, ETH’s inflation rate has dropped, which suggests the supply could reach pre-merge levels in 2025.

This transition to deflation could drive increased demand for ETH, especially as monetary policies continue to evolve.

As interest rates drop, more users and investors may turn to Ethereum’s network, boosting overall demand and potentially pushing the price higher.

The reduced supply combined with steady or rising demand could support a long-term bullish outlook for Ethereum.

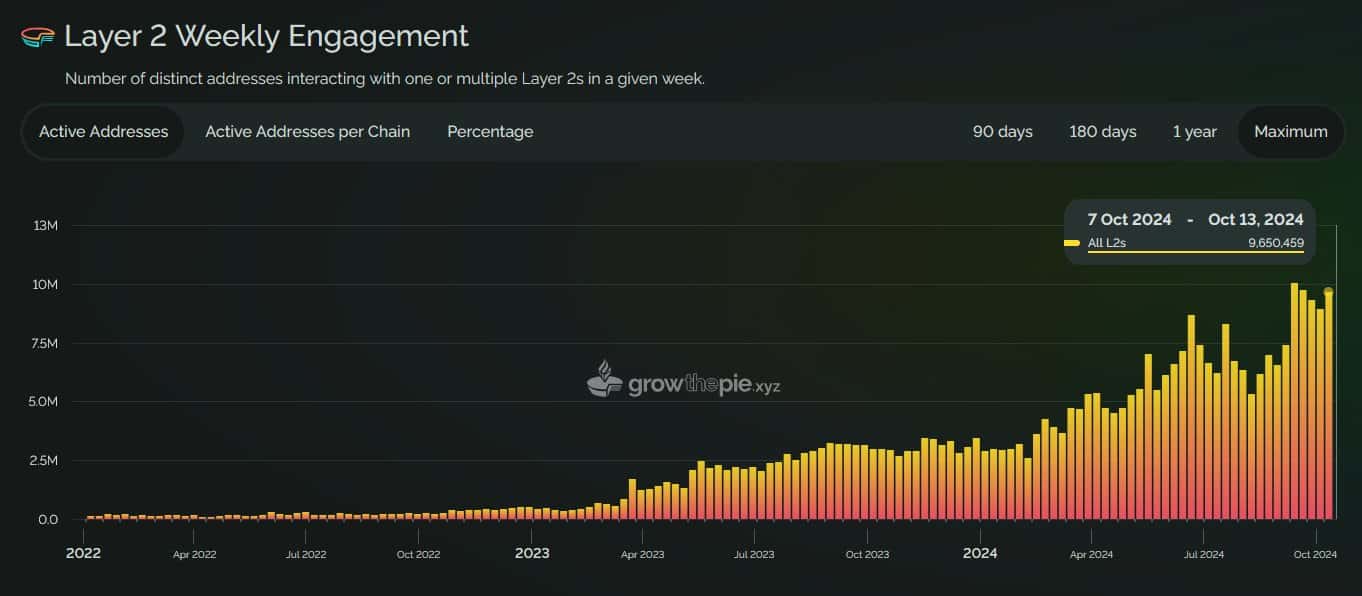

On top of supply changes, weekly active addresses on Ethereum’s Layer 2 networks are skyrocketing.

Currently, these active addresses have reached around 9.65 million, with projections suggesting that this number could multiply by 10 in the next few years as Web3 adoption grows.

This surge in activity on Layer 2 networks reflects increasing demand for faster and cheaper transactions on Ethereum, helping the network scale without compromising decentralization.

Higher user activity typically correlates with higher transaction fees, further reducing the overall ETH supply through burning mechanisms like EIP-1559.

Impact on ETH price

The impact of these developments on ETH’s price is significant. The current reduced inflation rate, combined with increased activity on Layer 2s, strengthens the long-term price outlook for Ethereum.

If the deflationary trend continues into 2025, it could lead to higher ETH prices, particularly as the supply decreases while demand remains high.

A run on the range low into the FVG and possibly demand, for longs. Conversely, a sweep on range high triggers shorts but a close above the range would mean no trade.

Meanwhile, ETH/BTC has been experiencing some fluctuations. Ethereum has lagged behind Bitcoin in recent months, and many analysts believe that ETH/BTC could go lower in the short term.

Source: TradingView

The pair is currently trading within the 0.03-0.04 range, and a bottom may form at 0.038 or even 0.036. Some even consider 0.03 as the worst-case scenario, though it’s unlikely to fall that low.

Read Ethereum [ETH] Price Prediction 2024-2025

Still, while ETH/BTC may remain weak through the end of 2024, the long-term outlook for ETH/USD is stronger, with 2025 expected to bring a rebound.

Despite short-term weakness in the ETH/BTC pair, ETH’s fundamentals suggest that its price could rise higher in 2025, making it a solid long-term bet for investors.