Ethereum ETH upgrade debate: How will EIP 3074 impact ETH’s future?

- Developers were in two minds about 3074 EIP in Ethereum’s recent developers call.

- Price of ETH plummeted, on-chain metrics remained positive.

Ethereum’s [ETH] latest Dencun upgrade was a success that helped many L2 solutions reduce fees to extremely low levels.

After this upgrade, the Ethereum developers set their sights on their upcoming upgrade, Prague, on their recent call.

New developments

Ethereum’s Pectra upgrade, expected in late 2024 or early 2025, is expected to bring new features to crypto wallets, enhancing user experience.

Ethereum Improvement Proposal (EIP) 3074, enables regular crypto wallets to function like smart contracts.

One key aspect of EIP-3074 is its ability to give standard wallets, like MetaMask, smart contract capabilities.

Additionally, it allows a third party to cover the gas fees associated with a user’s transaction, potentially making transactions more affordable for users.

It also includes features such as transaction bundling, reducing the need for multiple signatures, and sponsored transactions, allowing wallets to delegate funds for others’ use, similar to ERC-4337’s account abstraction.

Some developers argue that the proposed changes to EIP 3074 to allow broader use cases and global message revocation significantly increase its complexity, making it harder to implement and potentially introducing security risks.

Because of these circumstances, developers have decided to conduct a separate breakout meeting to discuss the technical aspects of EIP 3074.

Their aim is to reach a consensus on its implementation in a way that satisfies everyone, given its controversial nature.

State of ETH

The developments being made to the Ethereum network may heavily influence the price movement of ETH going forward.

At press time, ETH was trading at $3,170.97 and its price had fallen by 4.48% in the last 24 hours. However, the volume at which ETH was trading at, had grown by 9.33% in the same period.

The speculation around Spot ETFs around ETH was one of the major drivers of price movement for ETH in the last few days.

Is your portfolio green? Check out the ETH Profit Calculator

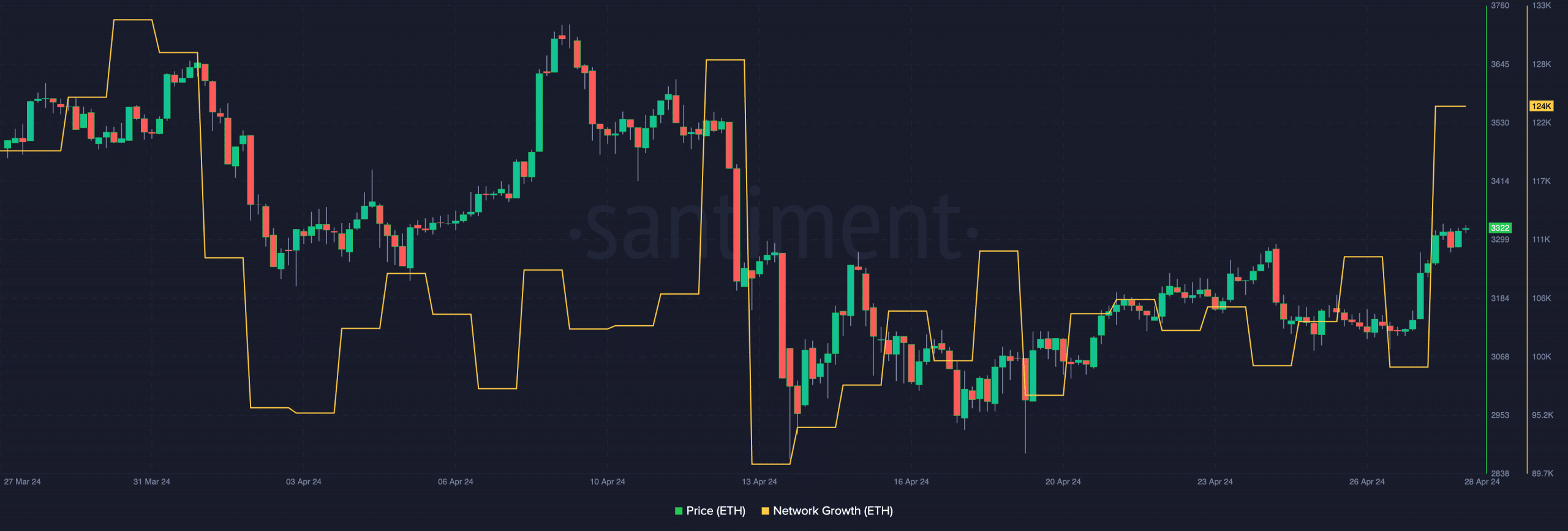

Despite the recent decline in price, the onchain metrics provided a positive picture. The network growth for ETH had also grown during this period, indicating that the number of new addresses showing interest in ETH had surged.

This renewed interest may help ETH see further bullish momentum going forward. Along with that, the velocity had also risen, indicating a heightened trading frequency for ETH.