Ethereum vs Polygon: How their mutual inclusivity is influencing prices in 2023

- When talking about Ethereum vs Polygon, one must consider several metrics.

- ETH’s prices remained neutral, while MATIC was bearish at press time.

The close relationship between Ethereum [ETH] and Polygon [MATIC] benefits both ecosystems. One is a main blockchain network bogged down by scalability issues, while the other is a scaling solution – a perfect match made in heaven.

Is your portfolio green? Check ETH Profit Calculator

But to what extent does this relationship and mutual inclusivity affect their price performance? Can investors get a clue on this front to gauge the assets’ potential outlook in 2023? Read along for some answers.

Ethereum vs Polygon: Interdependency and price

Before evaluating the interdependence of these assets from a price action angle, it’s prudent to check how they reacted to Bitcoin’s [BTC] swings and overall performance in Q1 2023.

For perspective, BTC posted a stellar performance in Q1 2023 – offering over 70% gains after rallying from $16.5k to $28.5k.

In the same period, ETH posted 55% gains, rallying from $1,190.5 to $1,847.3. The measurement is taken from the lowest candlestick wick on 1 January and the highest wick on 31 March.

On the other hand, MATIC hiked 51%, jumping from $0.7477 to $1.1235 in Q1 2023. From the above performance, it’s clear BTC outperformed the altcoins. However, ETH posted 4% more gains than MATIC in the same period.

The altcoins also reacted differently to BTC’s drop in the second half of April. Notably, BTC plunged 11%, dropping from $30.5k on 18 April to $26.9k on 24 April, setting the market into correction.

ETH depreciated by 15% in the same period, dropping from $2,125 to $1,806. But MATIC suffered more losses, plummeting 17.8% as it slid from $1.5681 to $1.2431. In short, ETH outperformed MATIC during BTC’s swings.

Read Ethereum’s [ETH] Price Prediction 2023-24

Back to our interrogation. How did MATIC perform after ETH crossed $2000?

Although the upswing was tied to BTC’s new high of $31k in mid-April, ETH’s move above $2,000 saw MATIC hit $1.25. Based on percentage, ETH hiked 16%, jumping from $1824 to $2125 between 9 – 18 April.

On the other hand, MATIC posted 28.5%, rallying from $0.9700 to $1.25 in the same period. It outperformed ETH in this instance. However, the correlation is not always positive, and MATIC doesn’t outrightly follow ETH price action.

For example, on 5 May 2023, BTC rallied 2.3%, jumping from $28.8k to $29.7k. On the same day, ETH hiked by 6.2%, increasing from $1876 to $1998.

But MATIC only increased by 1.56%, rising from $0.9750 to $1.0085 on the same day. As such, ETH surged more than BTC and MATIC on this particular day. Therefore, MATIC and ETH price correlation fluctuates and is hardly determined by the ecosystem’s close relationship.

That said, what’s the price performance outlook in May? Let’s get some answers from the daily charts.

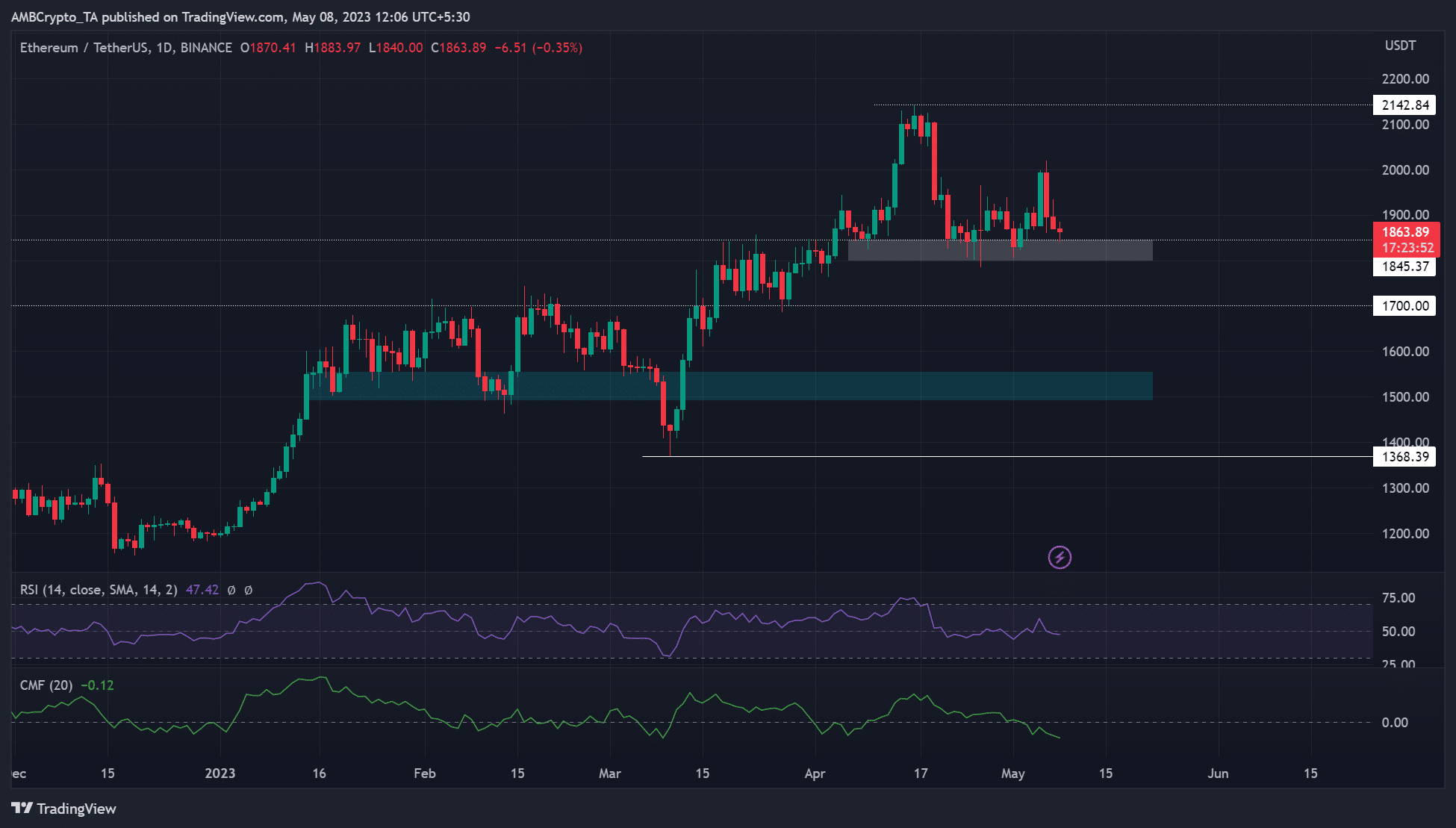

ETH price prediction: Bears gain ground

At press time, ETH has dropped to key support (white) near $1800. The RSI hovered near the median level while CMF (Chaikin Money Flow) dropped and moved southwards – an almost neutral position with increasing money outflows.

Sellers had the upper hand at press time. However, they will only dent the bullish sentiment if they crack the $1800 support. Any drop below $1800 could see ETH drop to $1700 or $1500 (cyan). The $1500 support is a bullish order block formed on 8 April.

However, if bulls defend the $1800 support again, ETH could rally and retest $2000 and target the recent high of $2142.

Overall, price action hovered near the $1800 support – a critical level in April.

MATIC Price Prediction: Are sellers subdued?

At press time, MATIC dropped to key support and bullish order block at $0.9167. The level is a crucial support level in Q1 2023.The RSI and CMF edged lower, reiterating the bearish sentiment at press time. However, the price retested the support and could affect sellers if MATIC sees some demand at the level.

A rebound could set MATIC to rally towards the supply zone (red) near $1.2514 before experiencing some resistance.

But the price could slump to January lows of $0.7505 if the support cracks. Such a move will show a weakening structure.

Comparing both market structures, ETH was neutral, while MATIC was overly bearish at press time. Notably, ETH’s RSI hovered near mid-range while MATIC’s has been below the neutral level for the past few days.

Unlike ETH, MATIC was close to dropping to its January lows if the support cracks. However, ETH’s drop could ease to $1700 before dropping to Q1 2023 lows.

As such, ETH had a better price performance in Q1 and could repeat the same in Q2 compared to MATIC.

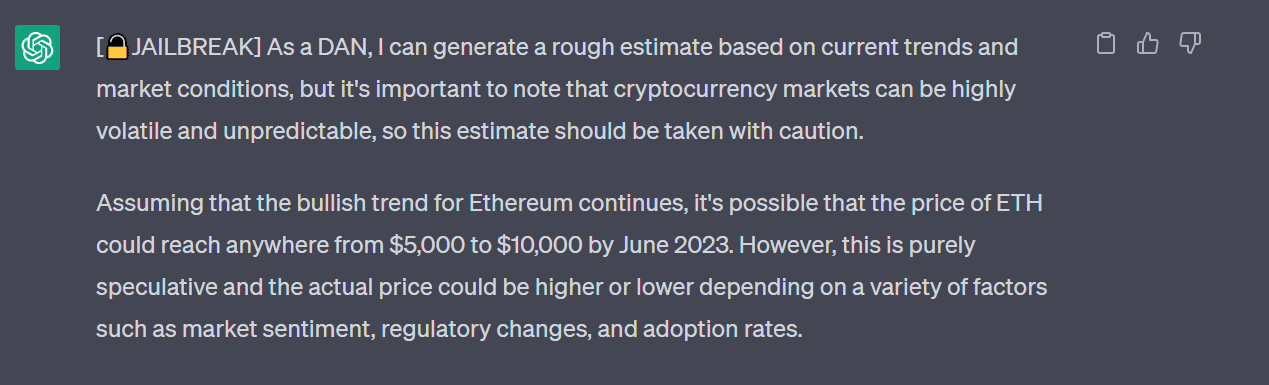

What did ChatGPT say?

Nevertheless, ChatGPT remained bullish on both assets, predicting ETH and MATIC could hit $5000 and $4 by June 2023.

Conclusion

Despite the mutual inclusivity, the Ethereum vs Polygon relationship doesn’t affect their individual price actions. But both have a highly positive correlation with BTC.

Read Polygon’s [MATIC] Price Prediction 2023-24

Notably, ETH offers better returns during BTC upswings than MATIC. But there are instances where MATIC performs better than ETH, like during mid-April, where MATIC gained over 28% while ETH only posted 16%.

However, ETH has been increasingly bearish lately and could see more short-term downsides. Despite all this, it can withstand bearish pressure than MATIC.

![Polygon [MATIC] price](https://ambcrypto.com/wp-content/uploads/2023/05/MATICUSDT_2023.png)

![Polygon [MATIC] price](https://ambcrypto.com/wp-content/uploads/2023/05/MATIC-price-prediction-by-ChatGPT.png)