Ethereum

Ethereum wallets offer optimism and caution with ETH surge

Ethereum’s meteoric rise, fueled by diverse factors, explores wallet dynamics and a surge in new addresses. Yet, an impending correction looms as it navigates market complexities.

- Ethereum’s daily new addresses have been rising recently.

- ETH fell for the second day but maintained the $2,000 price range.

Factors beyond the latest ETF application drove the recent increase in Ethereum’s [ETH] price. The actions of addresses on the network have also played a significant role in influencing the movement of ETH.

Ethereum addresses show mixed accumulation patterns

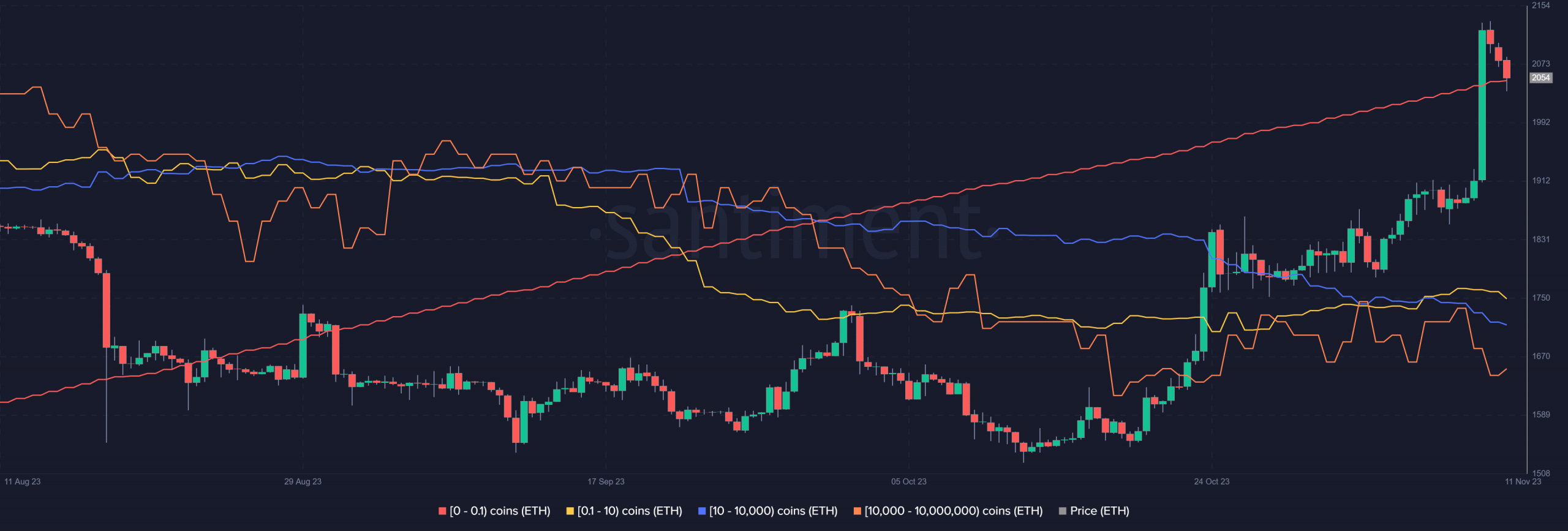

Santiment’s chart revealed a recent increase in the number of wallets holding less than one Ethereum over the past few days.

An analysis of the chart indicated that these wallets have been reaching various milestones. Currently, the number of such wallets is now over 103 million.

Furthermore, examining the address metric on Glassnode provides a daily trend overview.

The corresponding chart on Glassnode showed a continuous upward rise for this category of wallets. As of the latest data, the number of addresses in this tier was over 24 million.

Despite the optimistic trend in the number of wallets holding less than 0 ETH, caution arises when considering the 10,000 to 10 million tiers.

Analysis of the chart indicates a decline in the number of addresses within this range. More interesting is that the reduction came as the price of ETH increased.

Essentially, while some addresses are accumulating, this significant tier appears to be engaging in profit-taking.

Analyzing the Ethereum new addresses

Another strong on-chain metric for Ethereum is the increasing number of new addresses. Analysis of the new addresses metric on Glassnode revealed a consistent uptick in daily new addresses since around 6th November.

At present, this trend has continued, with over 77,000 daily new addresses recorded.

The growing number of new addresses signifies heightened attention on ETH. Depending on the wallet tiers these addresses belong to, Ethereum might experience an uptick in transactions.

Is ETH entering the correction phase?

Following its sharp rise, Ethereum has experienced a two-day decline as indicated by its daily timeframe chart. At the close of trading on 10th November, the ETH price had dropped by 1.99%, settling around $2,078.

Presently, it has further decreased by over 1%, trading at around $2,051. Despite these declines, the $2,000 price range has held steady, at least for the time being.

However, there is a possibility of additional downturns in the coming days as the price seeks to correct itself.

How much are 1,10,100 ETHs worth today?

As of the latest update, Ethereum is trending in the overbought zone on its Relative Strength Index (RSI). Typically, when an asset enters this zone, a price correction is highly likely.

Nevertheless, a price rebound might occur if the ongoing buying pressure persists and outweighs the selling pressure associated with corrections.