Ethereum

Ethereum: Whale prepares for rally in the face of subdued prices

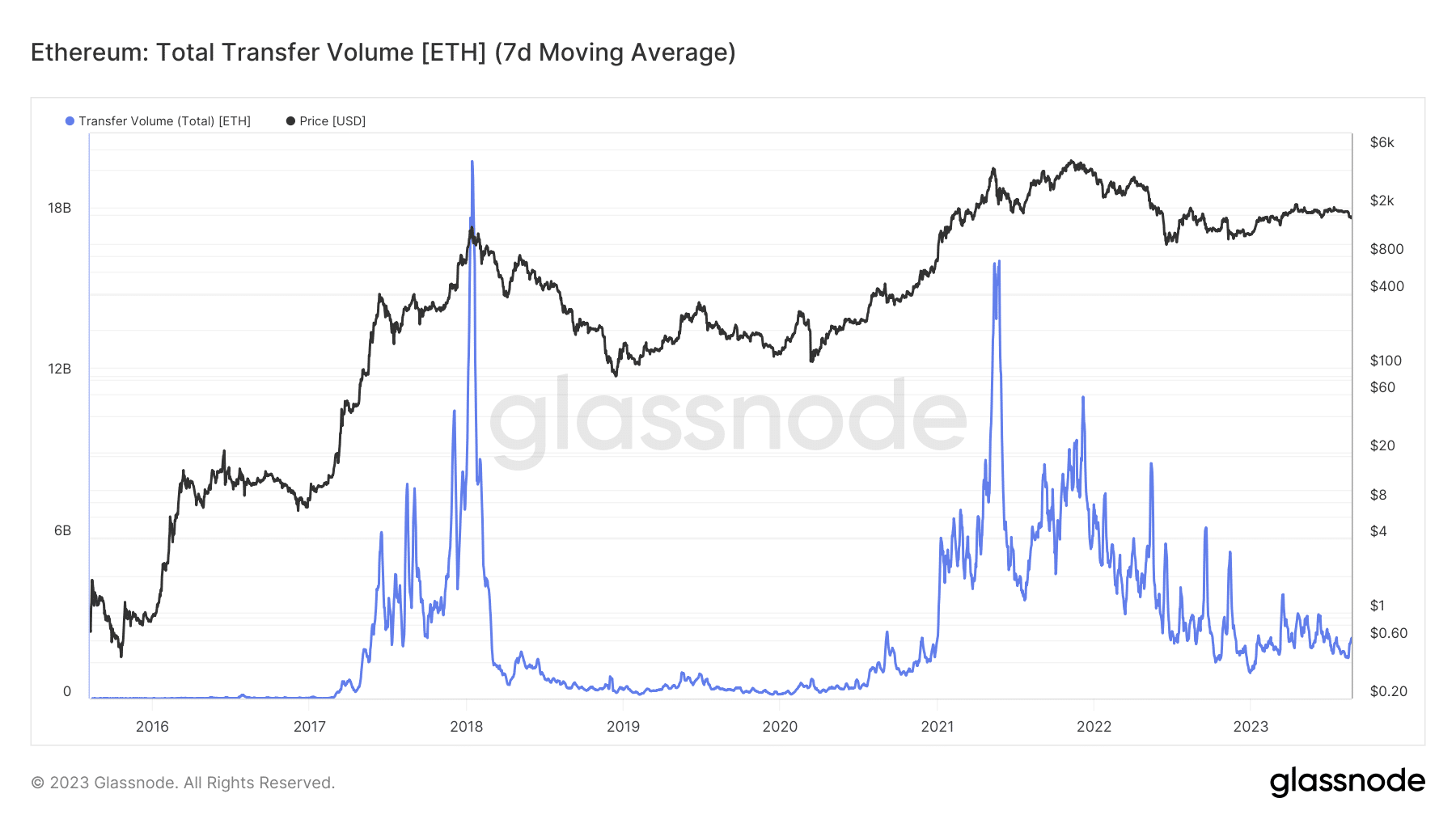

Surging transfer volume battles price woes as a solitary whale dances with millions. Consequently, markets ponder a potential bullish crescendo.

- Ethereum’s transaction volume saw a monthly high of over $3.7 billion.

- ETH outflow dominated as a whale moved more ETH out of exchanges.

Ethereum’s [ETH] transfer volume reached a monthly peak, yet its price remained under pressure at press time. The question thus arises: in which direction is this volume trending? Additionally, what insights can we glean from this recent whale activity?

Read Ethereum’s [ETH] Price Prediction 2023-24

Ethereum’s flow sees monthly high

A recent update from Glassnode Alerts highlighted that Ethereum experienced a notable surge in its monthly transaction volume. The accompanying chart revealed that the transaction volume had surpassed $93 million.

? #Ethereum $ETH Transaction Volume (7d MA) just reached a 1-month high of $93,473,799.10

View metric:https://t.co/pG8mKdFJjA pic.twitter.com/ei67FXLgQ8

— glassnode alerts (@glassnodealerts) August 23, 2023

At the time of writing, a glance at Glassnode’s transfer volume chart revealed that more than 2 billion ETH were transacted on 23 August. The trading value of ETH at $1,678 on that day equated to a transfer of over $3.7 billion in ETH.

While not an overwhelmingly high volume, it marked the first instance within the month when such a substantial volume was observed.

Is Ethereum flowing in or out?

Examining the Ethereum transaction volume might create the impression that more ETH was being sold due to the ongoing downtrend. However, a closer analysis of the netflow data from Glassnode revealed a contrary scenario.

The chart provided indicated that a larger amount of ETH has recently been exiting exchanges. This shift in direction followed a notable influx of over 61,000 ETH, valued at approximately $1,800 each, into exchanges, signifying a change in momentum.

Subsequently, a consistent sequence of outflows has been accompanied by limited inflows that cannot overshadow the observed outflow. This pattern implied that a greater number of ETHs were departing from exchanges, thereby reducing overall liquidity.

This trend could result in a scarcity of ETH on exchanges, potentially triggering an upward price movement.

ETH whale movements signal bullish sentiment

A recent report by Lookonchain suggested that a particular Ethereum

whale’s activity might indicate preparations for an upcoming bull run. As per the data compiled by Lookonchain, this whale has been engaging in a pattern of purchasing and withdrawing ETH since May.A giant whale bought 2,000 $ETH ($3.36M) from #Binance again 2 hrs ago.

The whale has withdrawn a total of 42,800 $ETH ($72M) from #Binance since May 8.

Seems to be accumulating $ETH for the upcoming bull run.https://t.co/bJtc42cPrl pic.twitter.com/Nf4M7wXW3G

— Lookonchain (@lookonchain) August 24, 2023

In a recent transaction, the whale procured an additional 2,000 ETH, translating to a value exceeding $3 million. Considering the cumulative actions, this entity has withdrawn more than 42,000 ETH, equating to approximately $72 million.

Interestingly, this ongoing accumulation trend by the whale persisted despite the downward trajectory that ETH has experienced over the past few months.

Is your portfolio green? Check out the ETH Profit Calculator

ETH’s trend remains negative

As of this writing, ETH was undergoing a slight decrease of less than 1% based on the daily timeframe chart. The chart revealed that ETH’s trading value hovered around $1,660 and had only marginally moved beyond the oversold threshold on its Relative Strength Index (RSI).

This observation suggested that the prevailing bearish trend remained strong at press time.