Ethereum whale transactions surge: Decoding the spike in large transfers

- Ethereum recently witnessed a surge in large transactions.

- ETH has fallen below its $4,000 milestone but remains close.

Ethereum [ETH] has witnessed a sharp increase in large transactions, with weekly volumes spiking over 300% to $17.15 billion before cooling to $7 billion.

Whale activity exceeding $100,000 has surged, coinciding with Ethereum’s rally to $4,000.

As exchange netflows suggest reduced selling pressure, the market eyes key psychological resistance, with bullish momentum and strong support levels shaping the outlook.

Analyzing Ethereum’s large transaction activity

Ethereum has recently seen a significant uptick in large transactions.

AMBCrypto’s analysis of the transaction chart on IntoTheBlock showed that weekly transaction volume surged over 300% to hit $17.15 billion on the 6th of December before falling to $7 billion at the time of writing. T

he increase has sparked curiosity about the direction and implications of these transactions, especially as Ethereum’s price approaches key psychological levels.

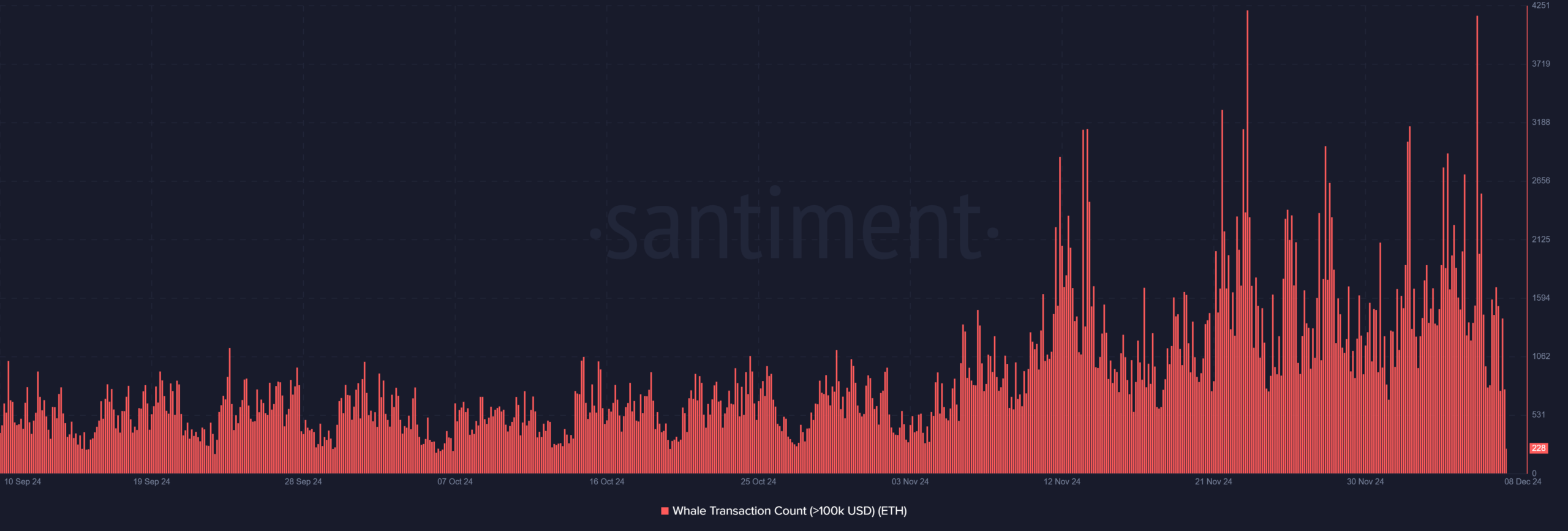

Additionally, the large transaction chart on Santiment reveals a sharp rise in the number of whale transactions exceeding $100,000 in value, suggesting increased institutional or high-net-worth activity.

The spike aligns with Ethereum’s recent rally to $4,000, indicating that some whales may be taking profits or redistributing holdings.

The whale transaction count chart demonstrates periodic peaks, underscoring strategic moves during volatile price phases.

Exchange netflow and price correlation

The exchange netflow chart shows alternating inflows and outflows, with recent significant outflows suggesting reduced selling pressure. The analysis of the chart showed a negative netflow of over 17,000.

This behavior typically signals a bullish sentiment as traders move assets into cold storage. However, the price has faced resistance near $4,000, which coincides with the psychological barrier and profit-taking activity.

Price performance and technical analysis

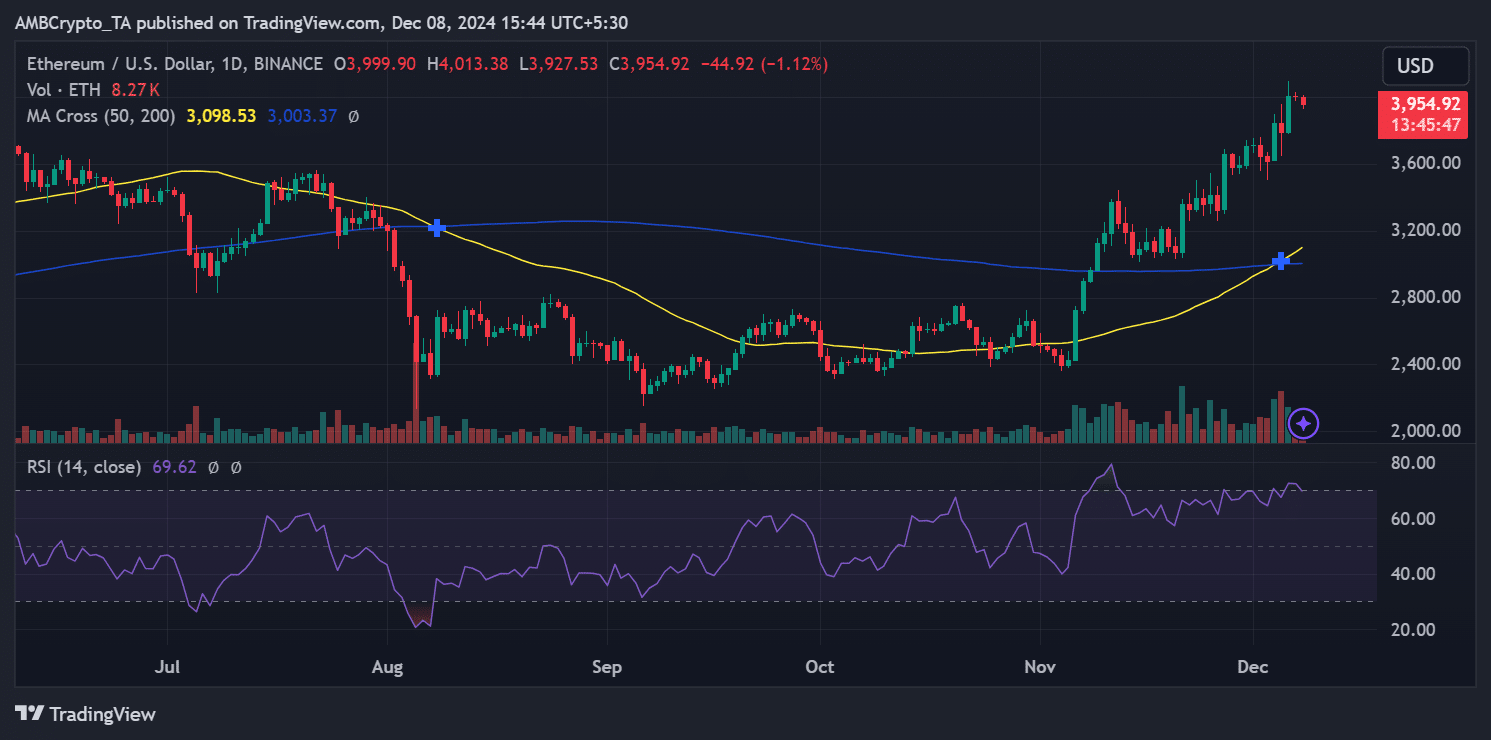

Ethereum’s price chart reflects a consistent uptrend since early November, with the 50-day moving average offering robust support throughout.

The recent rally to $4,000 was characterized by increased volume, as seen on the price chart, suggesting strong market participation during the move.

However, the RSI reading of 69.62 indicates that Ethereum is approaching overbought territory, often leading to short-term price correction or consolidation.

Interestingly, the MACD remains in bullish territory, with its signal line well above the zero level, indicating continued upward momentum.

The histogram shows reducing bullish intensity, hinting at a possible slowdown, but not necessarily a reversal.

Key support levels lie at $3,800 and $3,500, which align with the 50-day moving average and previous resistance levels, now turned into support.

The surge in large transactions highlights growing interest and activity among whales, likely driven by Ethereum’s improving fundamentals and bullish sentiment.

Read Ethereum’s [ETH] Price Prediction 2024-25

The price action suggests Ethereum is in a healthy uptrend, with key support levels holding strong and momentum indicators favoring further upside.

However, resistance at $4,000 must be closely watched, as the market could face a temporary cooling-off period before attempting higher levels.