Ethereum

Ethereum whales bulk up on ETH holdings – What for?

Although demand for ETH has grown in the last week, its price remains in a narrow range, as poor sentiments continue to build up.

- There has been a notable surge in ETH accumulation amongst a cohort of whale investors.

- While the coin has seen increased demand in the last week, poor sentiments continue to beat down its price.

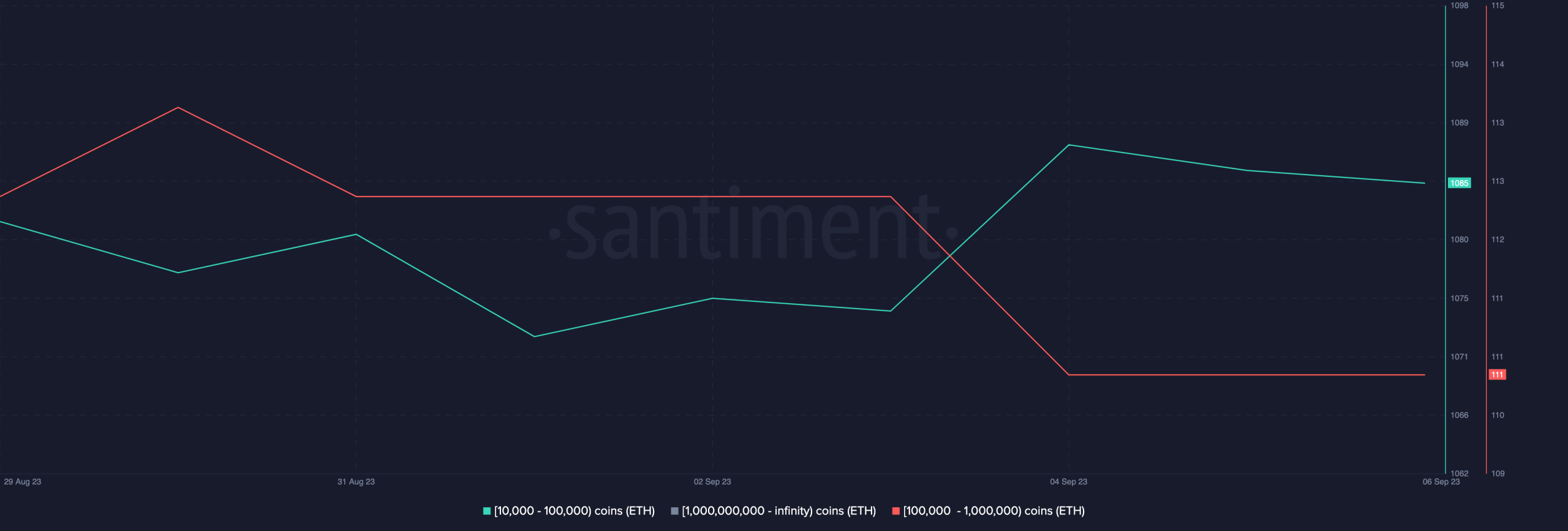

Ethereum [ETH] accumulation amongst whales that hold between 10,000 and 100,000 coins rallied to a weekly high on 4 September, data from Santiment revealed.

Read Ethereum’s [ETH] Price Prediction 2023-24

According to the on-chain data provider, the cumulative count of this whale investors cohort climbed from 1075 to 1088 between 3 and 4 September, as they collectively purchased around 260,000 ETH worth nearly $425 million during that period.

However, the count of much bigger ETH whales has since declined. Data from Santiment revealed a 2% drop in the count of ETH whales that hold between 100,000 to 1,000,000 coins in the past three days.

Much ado about nothing?

While a cohort of ETH whales has intensified accumulation in the past few days, the coin’s whale transaction volume has generally declined in the last month. Data from IntoTheBlock

revealed a 27% decline in ETH whale transactions worth between $1 million and $10 million.For transactions above $10 million, trade volume has plummeted by 11% in the last 30 days.

The decline in whale transaction volume can be attributed to ETH’s narrow price movements. The price per ETH has been range-bound since July and has not yet broken out of the $1,600-$1,800 range.

At press time, the leading altcoin exchanged hands at $1,628, per CoinMarketCap. This has caused whales to be hesitant to make large transactions.

While the coin has seen increased demand in the last seven days, its price has failed to move accordingly. As per IntoTheBlock, the count of new addresses created to trade ETH daily has risen by 30% in the last week. Likewise, the daily active address count has increased by 10% during the same period.

Is your portfolio green? Check out the ETH Profit Calculator

A jump in an asset’s network activity is typically a precursor to a price rally. However, with prominent bearish sentiment across the general market, ETH’s price remains in consolidation.

Depicting the state of uncertainty in the ETH spot market, on a daily chart, key momentum indicators Relative Strength Index (RSI), and the Money Flow Index (MFI) have been flat since the month began. This often suggests a lack of investor interest, uncertainty about the market’s future direction, or a period of consolidation.