Ethereum whales dump 440K ETH, but THESE signs hint at a recovery

- Whales have caused significant selling pressure, with Ethereum testing critical support levels.

- Active addresses and rising transaction counts suggest Ethereum may regain market momentum soon.

Whales have sold over 440,000 Ethereum in the past week, causing a significant shift in the market.

Recent reports showed that one wallet sold 8,074 ETH at an average price of $2,431, while another transferred 10,000 ETH worth $23.44 million to Binance in just two days.

Ethereum’s [ETH] price at press time stood at $2,354.64, marking a 5.46% drop over the last 24 hours.

This large-scale panic selling has raised concerns, but some investors believe Ethereum may find support at the current levels.

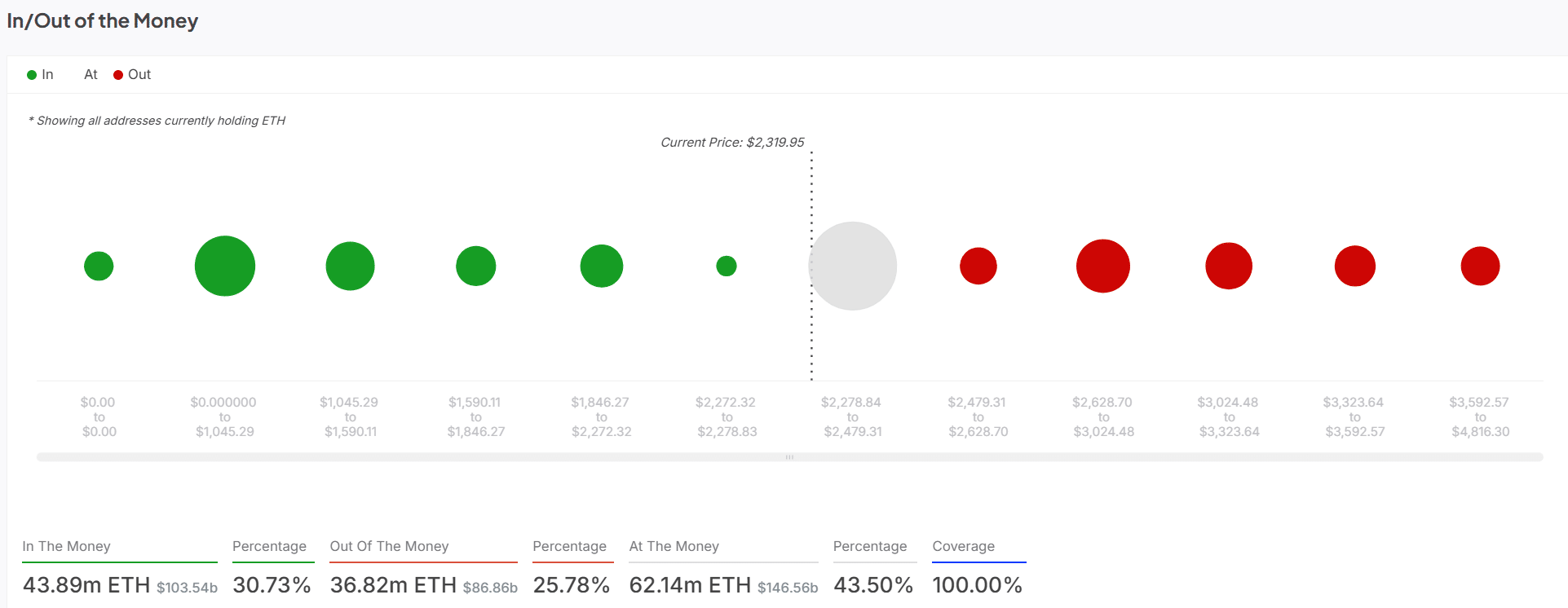

In or out? Understanding the market sentiment

Ethereum’s in/out-of-the-money data provides a valuable glimpse into market sentiment. At the time of writing, 43.5% of addresses were “in the money,” with most clustered between the $2,479.31 and $2,628.70 price levels.

However, a substantial 36.82% of addresses fall “out of the money,” particularly those with ETH purchased between $2,479.31 and $3,024.48.

This indicates a significant portion of investors are holding at a loss, which may increase selling pressure if the price continues to fall.

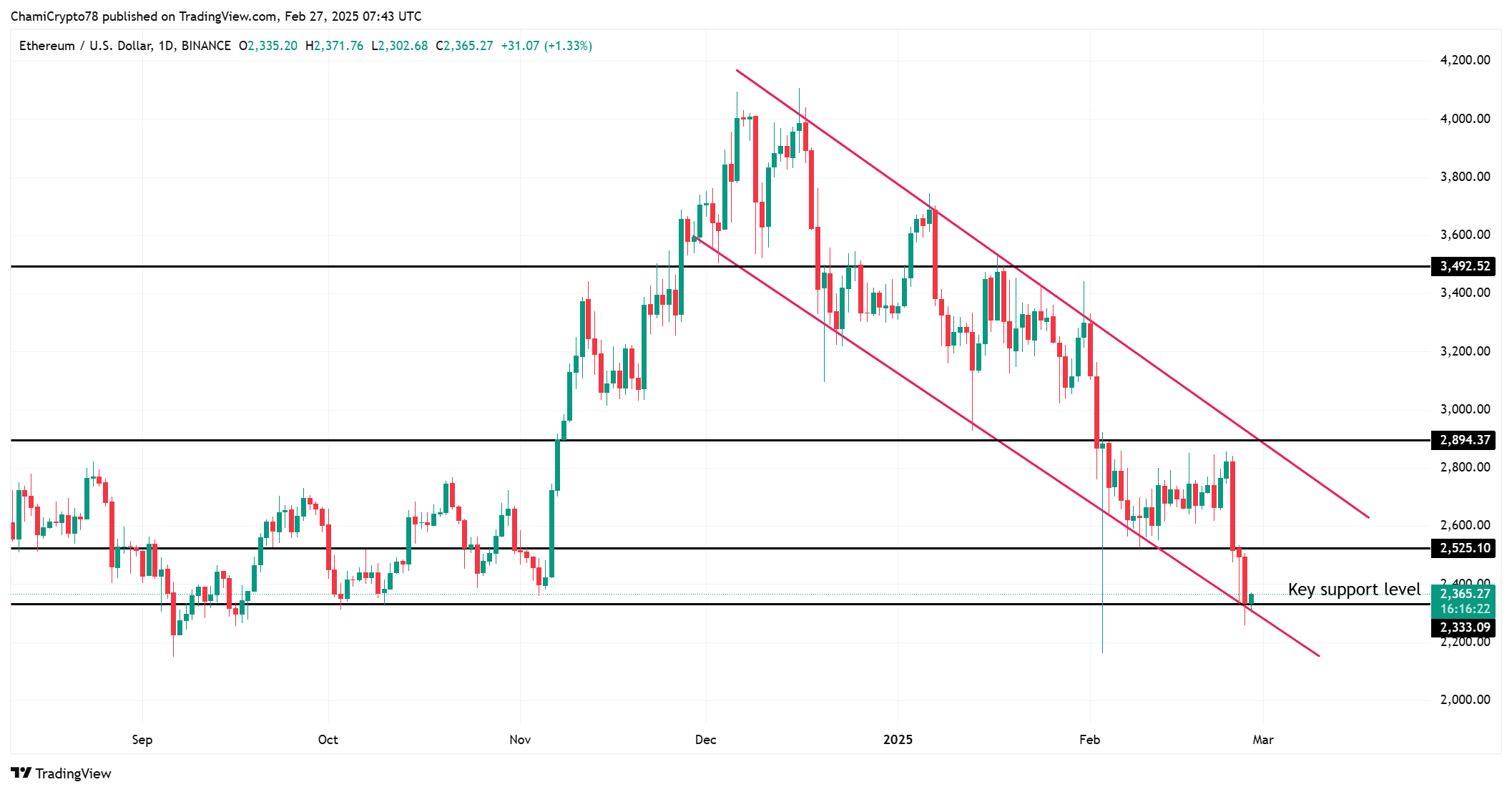

ETH price action: Is support holding?

Ethereum has been on a downward trend, with its price hovering near critical support at $2,347.21. If this level fails to hold, ETH could drop to the next major support at $2,272.32.

However, the price has recently bounced off the $2,347.21 zone, signaling that the support could still be intact.

In the short term, ETH may face resistance at the $2,479.31 level. If it breaks above this price point, the market could potentially see a reversal.

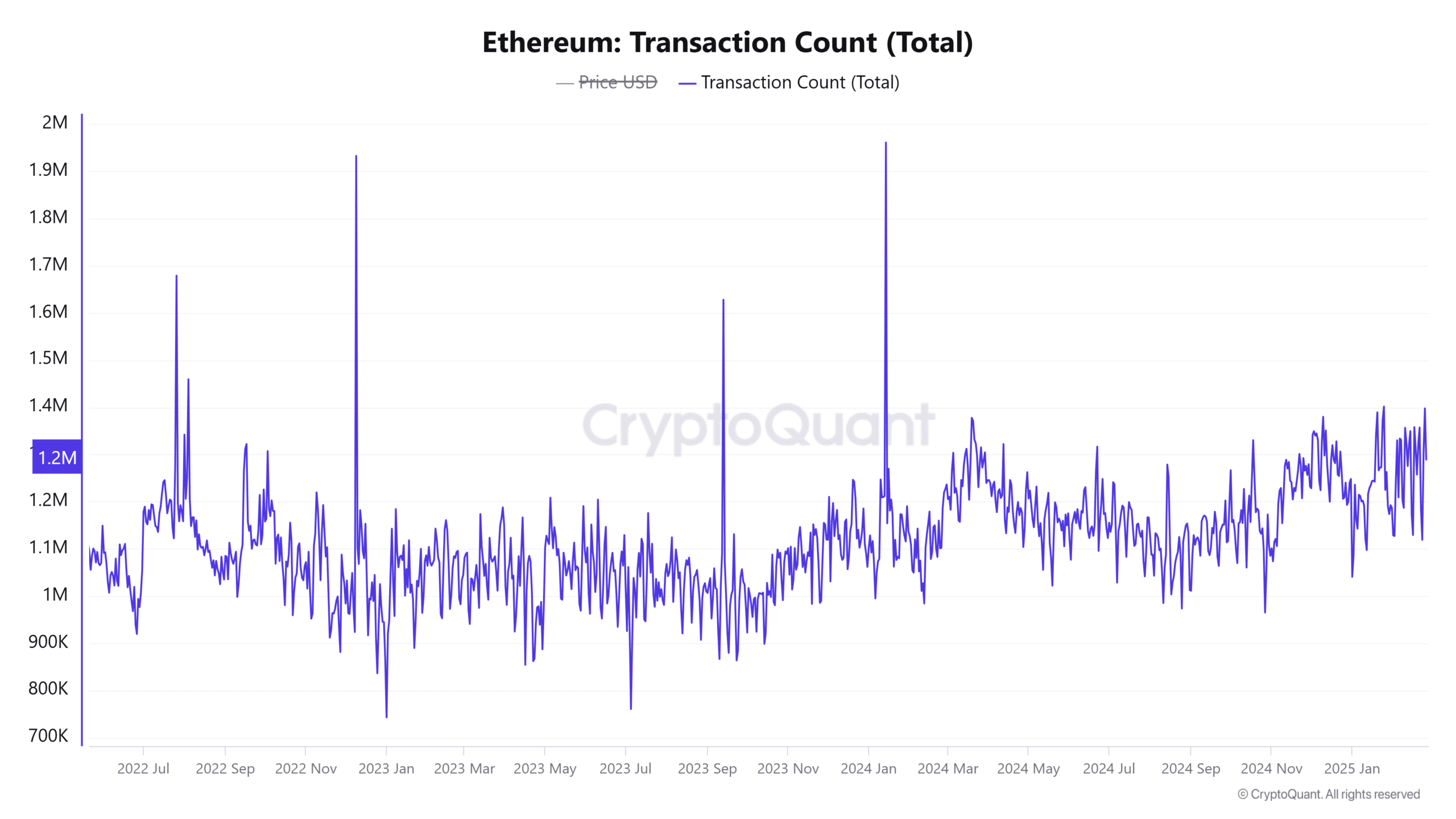

Active addresses and transactions: Market participation

Despite the price drop, Ethereum’s network activity remains consistent. Active addresses have increased by 1% in the past 24 hours, with 21,283.3K unique addresses engaging with the network.

Additionally, the total number of transactions has risen by 0.96%, signaling that investors, although cautious, are still involved in Ethereum.

This activity suggests that Ethereum’s fundamentals remain intact, and the market could potentially rebound if confidence returns. While the market faces selling pressure, engagement levels show that retail investors are still active.

Ethereum will likely bounce back from support

Given the current market dynamics and Ethereum’s recent price action, ETH is likely bouncing back after hitting the support zone at $2,347.21.

The selling pressure may be partially attributed to the Bybit hack, where $1.4 billion worth of ETH was affected, triggering some panic in the market.