Ethereum

Ethereum whales now hold 57% of supply – Impact on ETH?

Ethereum’s whale dominance suggests strong bullish sentiment, but could trigger liquidity-driven price corrections.

- Whale dominance in Ethereum pointed to strong bullish sentiment and potential price growth

- Concentrated holdings raised concerns about liquidity risks and potential market corrections

Ethereum [ETH] whales are increasingly dominating the network, with 104 wallets now holding over 100,000 ETH, accounting for more than 57% of the total supply.

This significant shift in Ethereum’s distribution raises important questions about its future, particularly regarding market control and price movements. As these whales continue to accumulate, their growing dominance points to strong bullish sentiment.

However, with such concentrated holdings, how might this influence Ethereum’s price trajectory moving forward?

Whale accumulation and long-term holders: Bullish sign or a bear trap?

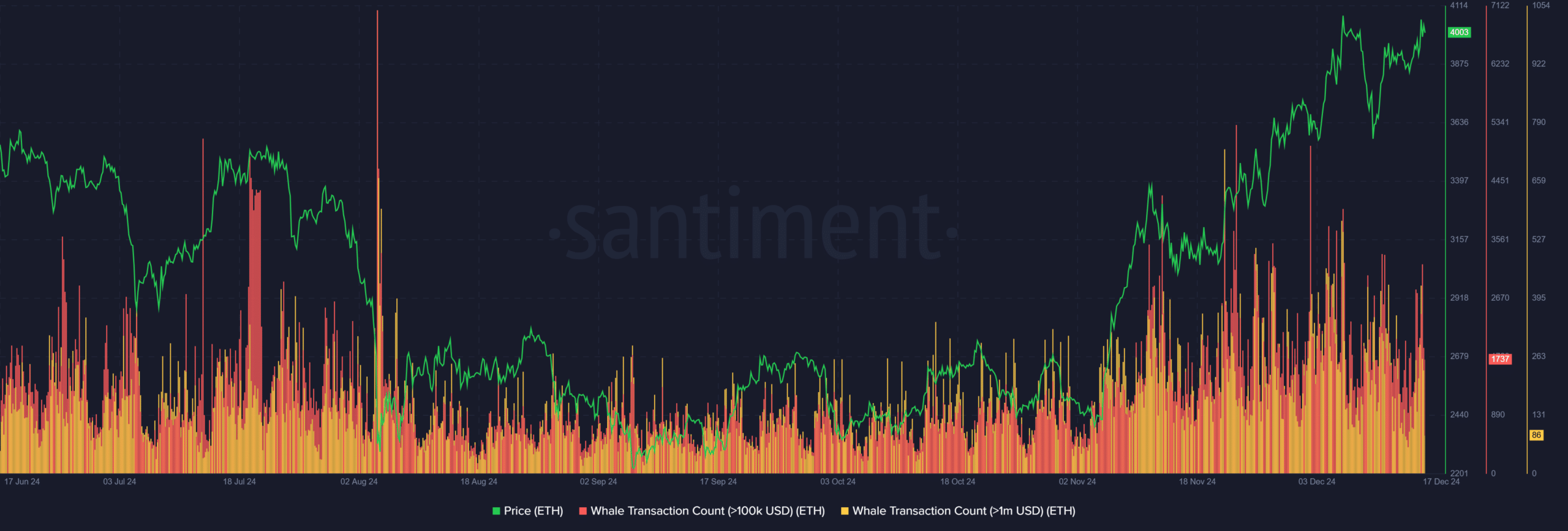

Ethereum’s whale accumulation has intensified alongside notable price rebounds, reflected in rising whale transaction volumes exceeding $100k and $1M.

These large investors, often categorized as long-term holders (LTHs), act as stabilizing forces during volatile cycles, reducing supply shocks when sentiment turns bearish.

Their strategy of accumulating during dips and holding through uncertainty aligns with Ethereum’s upward price trajectory in late 2024.

However, this concentration raises a critical question: is this a bullish sign or a bear trap? While growing whale dominance hints at sustained confidence and bullish momentum, it also magnifies downside risk.

A coordinated sell-off or exhaustion of buying pressure could trigger sharp reversals, highlighting the fragile balance between accumulation-driven optimism and a potential liquidity-driven correction.