Ethereum whales offload $530M in ETH: Will this trigger a price plunge?

- ETH faces sell-off fears amidst increased whale activity.

- Ethereum dump continues as large holders transfers $538.5 million worth of ETH.

Ethereum [ETH], the second largest cryptocurrency by market cap has recently experienced a moderate recovery in its price. In fact, as of this writing, ETH was trading at $2366 after a 1.76% increase in the past 24 hours.

Prior to this, ETH was in a downward trajectory hitting a low of $2150 in the last week. Over the past 40 days, the altcoin has declined by 11.09%.

Despite the gains on daily charts, ETH remained relatively low from its recent local high of $2820 and 51% from its ATH of $4878.

Although the altcoin has gained over the past day, the market is still facing sell-off fears following unprecedented whale activities. As noted by Whale Alert, ETH has experienced massive transfers into exchanges.

Ethereum whales are on the move

In a series of transactions, Whale Alert has uncovered massive ETH transfers to various exchanges. These transfers total a whopping $538 million that have been sent to various exchanges including Kraken, Binance, Arbitrum, and coinbase.

Based on the report, Binance received $188.6 million worth of ETH, Kraken received $127.2 million while Coinbase and Arbitrum recorded $34 million and $188.6 million, respectively.

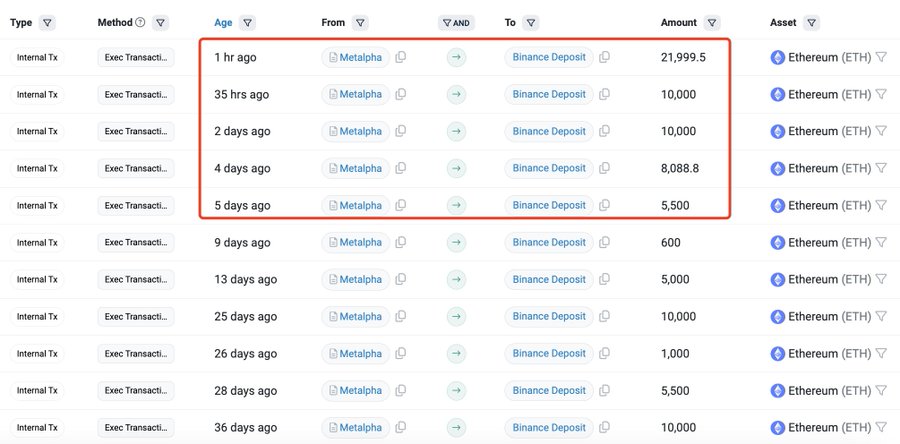

This transaction occurs as Metalpha has also been on a depositing spree over the past few days. According to Lookonchain, the Hong Kong-based firm has deposited $51.16 million worth of ETH in the past hours.

Over the past five days, Metalpha has deposited $128.7 million worth of Ethereum to Binance.

These massive transactions have caught the attention of the ETH community as transfers into exchanges imply preparation to sell.

If these holders sell, it will result in selling pressure which will force prices to drop further as supply on exchanges increases.

What ETH charts suggest

While gains on daily charts may give hope, recent whale transactions leave markets at a crossroads. Such whale activities imply a lack of confidence in the altcoin’s direction a phenomenon that has been witnessed over the past week.

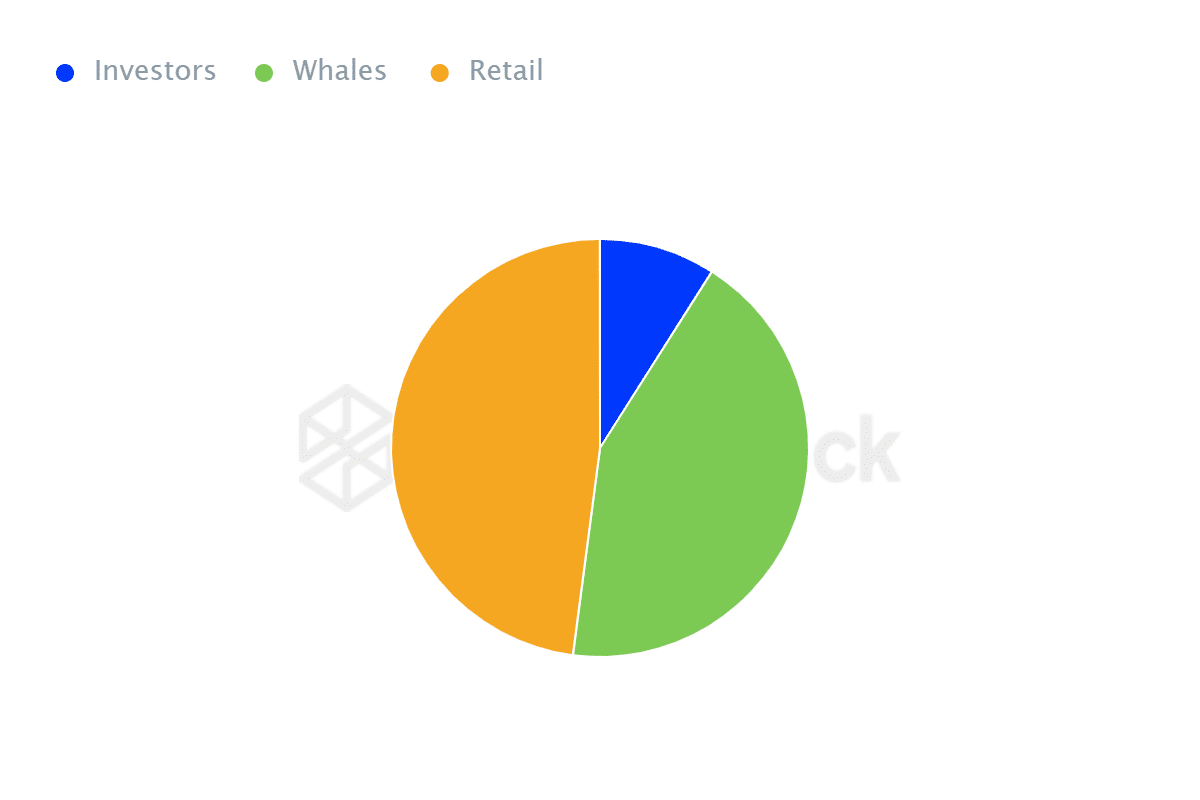

For starters, Ethereum’s ownership by concentration has changed drastically leaving retail traders dominating the market.

According to IntoTheBlock, retail traders control 47.93% of the ETH market while whales control 43.07%. This sets the altcoin for a further decline when whales reduce their holdings as retail traders are emotional sellers.

Equally, a decline in whale holding suggests large holders lack confidence in the altcoin’s direction.

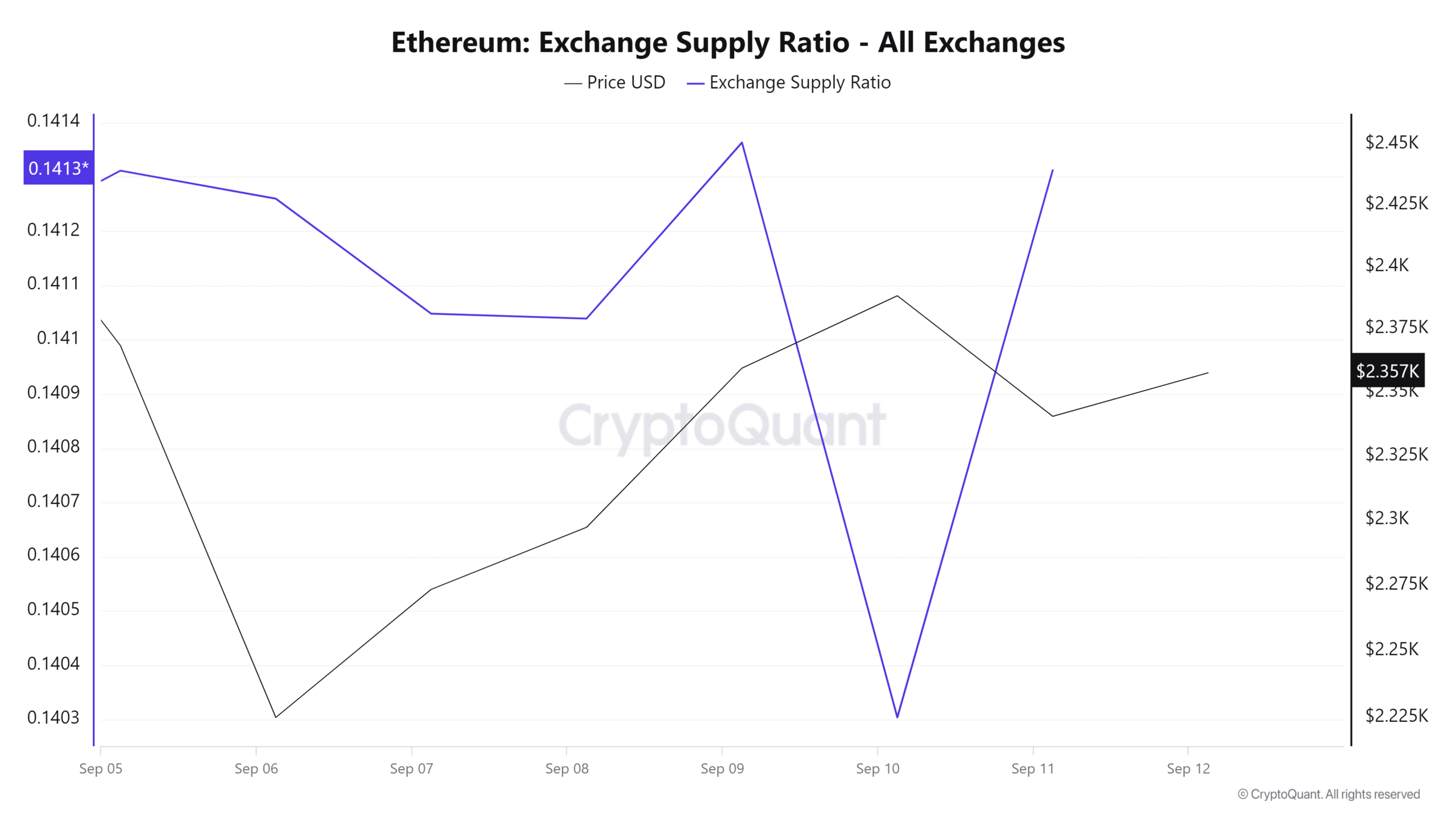

Additionally, the exchange supply ratio has spiked over the past day suggesting increased supply on exchanges.

When the supply ratio increases as more assets are transferred into exchanges, it suggests holders are preparing to sell because of an anticipated price drop.

Therefore, these whale transactions suggest large holders are preparing to sell which signals a lack of confidence in ETH’s future price movements.

If these whales sell, ETH will face massive selling pressure which will drive prices down to an eight-month low of $2114.

![Three days ago, Uniswap [UNI] attempted a breakout from a parallel channel, surging to hit a local high of $7.6. However, the altcoin faced strong rejection.](https://ambcrypto.com/wp-content/uploads/2025/06/Gladys-83-400x240.jpg)