Ethereum whales shift large chunks out of exchanges as…

- The ETH supply on exchanges dropped to its record low at the time of publication.

- Supply held by top non-exchange addresses has shot up.

Ethereum [ETH] whales have increased their appetite despite the prevailing uncertainty in the market. One of these whale wallets, withdrew nearly 39,300 ETH in a series of transactions over the last month from world’s largest crypto trading platform Binance.

Is your portfolio green? Check out the Ethereum Profit Calculator

Highlighted by on-chain analytics firm Lookonchain through a tweet dated 9 June, the address which was created more than a month ago, accumulated ETH worth more than $70 million according to press time market price. Interestingly, each of these withdrawals came after a price drop.

A whale has withdrawn 15.2K $ETH ($28M) from #Binance in the past 3 hours.

The wallet was created 32 days ago and has withdrawn a total of 39.3K $ETH ($72M) from #Binance, each seemingly withdrawn after a price drop.

Is this whale accumulating $ETH for the future bull market? pic.twitter.com/0pjukPI4JL

— Lookonchain (@lookonchain) June 9, 2023

Bull run anticipation or…?

Recently, the American affiliate of Binance, Binance.US announced that it will suspend USD trading on the platform from 13 June and asked customers to withdraw their assets before the mentioned date. On the expected lines, there was a large flight of crypto assets out of the exchange.

However, it was not Bitcoin [BTC] but rather ETH that formed the majority of the withdrawn assets, as per latest data from research firm Nansen.

Historically, a large wave of withdrawals is seen as reduced sell-off risks and investors’ anticipation of a bullish surge. But in the current scenario, the accumulation could be a result of eroding confidence in centralized entities. Investors could be shifting funds to a safer place.

Meanwhile, data from Santiment showed that the percentage of ETH supply on exchanges dropped to its record low of 9.45% at the time of publication. Simultaneously, the supply held by top non-exchange addresses has shot up over the past month or so, indicating that whales were snapping up ETH in droves.

Investors still bullish on ETH

The FUD triggered by U.S. regulators since the start of the week have engulfed ETH as well. The largest altcoin by market cap exchanged hands at $1,750.39 at press time, plunging to its lowest level since end-march, as per CoinMarketCap.

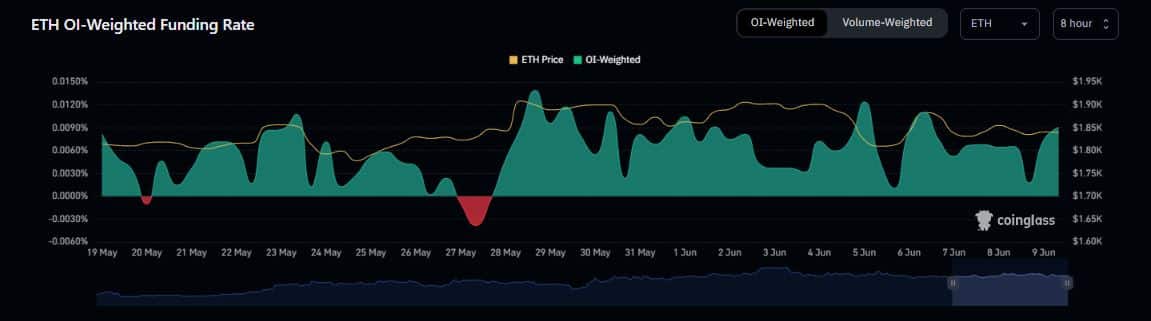

Despite the negative price action, most traders in the futures market continued to bet on ETH’s price rise. As per Coinglass, the funding rate for ETH was positive, reflecting the dominance of bullish long positions.

Read Ethereum’s [ETH] Price Prediction 2023-24

Recently, co-founder Vitalik Buterin outlined three crucial growth areas – L2 scaling solution, the wallet, and privacy transitions, which Ethereum needed to pass through to gain “full maturity”.