Ethereum

Ethereum whales start to vanish – What does this mean for ETH?

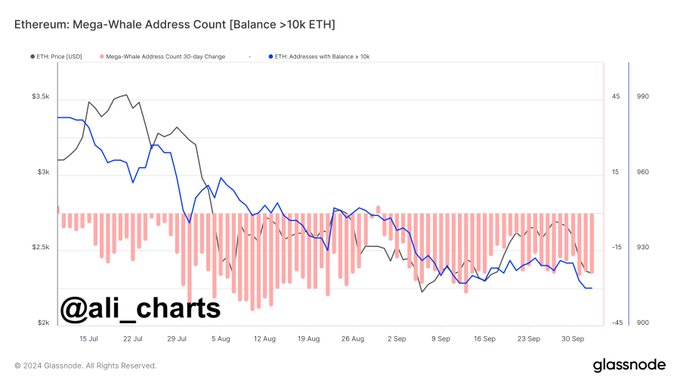

- Ethereum whales holding more than 10,000 ETH have fallen by over 7% since July.

- 62% of Ethereum holders are in profit as the net inflow is primed for a probable increase.

Ethereum [ETH] has displayed a clear downtrend in the number of whales holding more than 10,000 ETH since July.

This drop, by more than 7%, is rather significant, considering large holders do act to dictate market directions.

A swift fall in whale engagement indicates changes in sentiment and strategy for high-net-worth investors.

This is indeed a shift worth keeping track of, particularly for those monitoring the king of altcoin’s long-term market outlook.

Majority of Ethereum holders are still in profit

Despite the whale activity reduction, 62% of Ethereum holders are still in profit.

This might suggest that despite some recent volatility in the past months, the market is still somewhat friendly for the majority of investors.

Profitable holders are usually more likely to hold on to their assets and not make sudden sell-offs, which may grant a sort of stability to the market.

Rising net inflows signal increased market activity

Ethereum has also seen a series of periods of spikes in net inflow, which indicate a growing demand and activity on the network. The inflow, after yesterday’s dip, seems to build up once again.

Movements like these usually precede a stronger price action, as the heightened inflows can ensure increased buying pressure.

A battle between bulls and bears

AMBCrypto further analyzed Coinglass’ Long/Short Ratio to assess the market direction. The data revealed an array of fluctuations between short and long positions.

As of this writing, the ratio stood at 1.01, indicating that long positions have started to dominate the market.

Read Ethereum’s [ETH] Price Prediction 2024–2025

Although the drop in Ethereum whales is notable, the broader market sentiment remains positive.

With 62% of holders in profit and inflows increasing after recent dips, Ethereum could be at the cusp of a more extensive price surge.