Ethereum: What rising institutional demand means for you

- ETH funds registered positive growth, confirming the return of institutional demand.

- Ethereum continued to experience net demand, delaying a potential retracement.

Over the last few weeks, we have seen the return of confidence in Ethereum [ETH], just as has been the case with many top cryptocurrencies. This confidence boost has led to a bit of a FOMO situation and, more importantly, the return of institutional demand.

Is your portfolio green? Check out the ETH Profit Calculator

ETH funds provide an opportunity for investors to gain exposure to the cryptocurrency. Such private funds are an attractive avenue for institutions, and thus they often highlight what the institutional class of investors are doing.

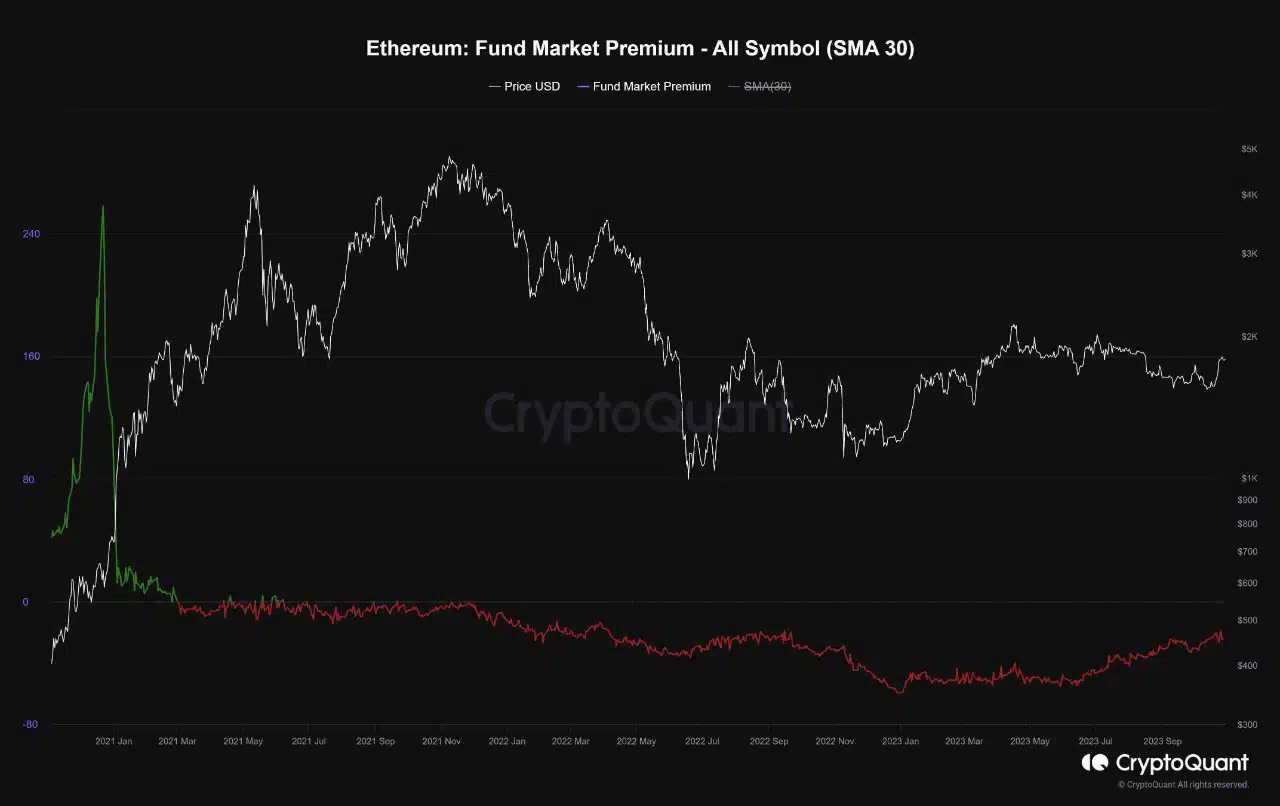

A recent CryptoQuant analysis confirmed that ETH funds were in an upward trajectory at press time, as indicated by the Fund Market Premium. The analysis revealed that ETH’s funds have been recovering since January 2023 and have maintained the same trajectory to the present.

This was an important observation, as it confirmed a recovery in ETH’s demand.

The same analysis noted that an upward trend in Ethereum funds would narrow the gap between the market value of Ethereum contracts and the market price. This rising trajectory was in tune with the growing confidence in the cryptocurrency in the derivatives market.

It reflected the positive growth observed in ETH’s funding rates in the last two months.

The last few days have been particularly fruitful for ETH’s Open Interest profile, based on a 30-day assessment. We also looked into the buy and sell profile and found that sell positions have been dwindling in the last few days.

The number of sells peaked at over 105,000 in the last two weeks of October. On the other hand, the buys peaked at slightly above 57,000.

ETH bears struggle to regain control

One might expect a pullback for ETH in the next few days, considering that it was recently overbought after a robust rally. However, the bears have been finding it difficult to subdue the price.

A potential reason could be the fact that many ETH holders are opting to HODL rather than taking short-term profits. Notably, an analysis of exchange flows revealed that the prevailing demand levels at press time were higher than sell pressure.

Read Ethereum’s [ETH] Price Prediction 2023-24

It is also worth noting that ETH exchange flows have cooled down considerably compared to the previously observed mid-month surge. ETH exchanged hands at $1,785 at press time.

While the bulls showed resilience and demand prevails, traders should still exercise caution because the market could still seek correction.