Ethereum: What these metrics say about ETH as we approach the last mile

- ETH staking pool witnessed a rise in the number of one-time depositors

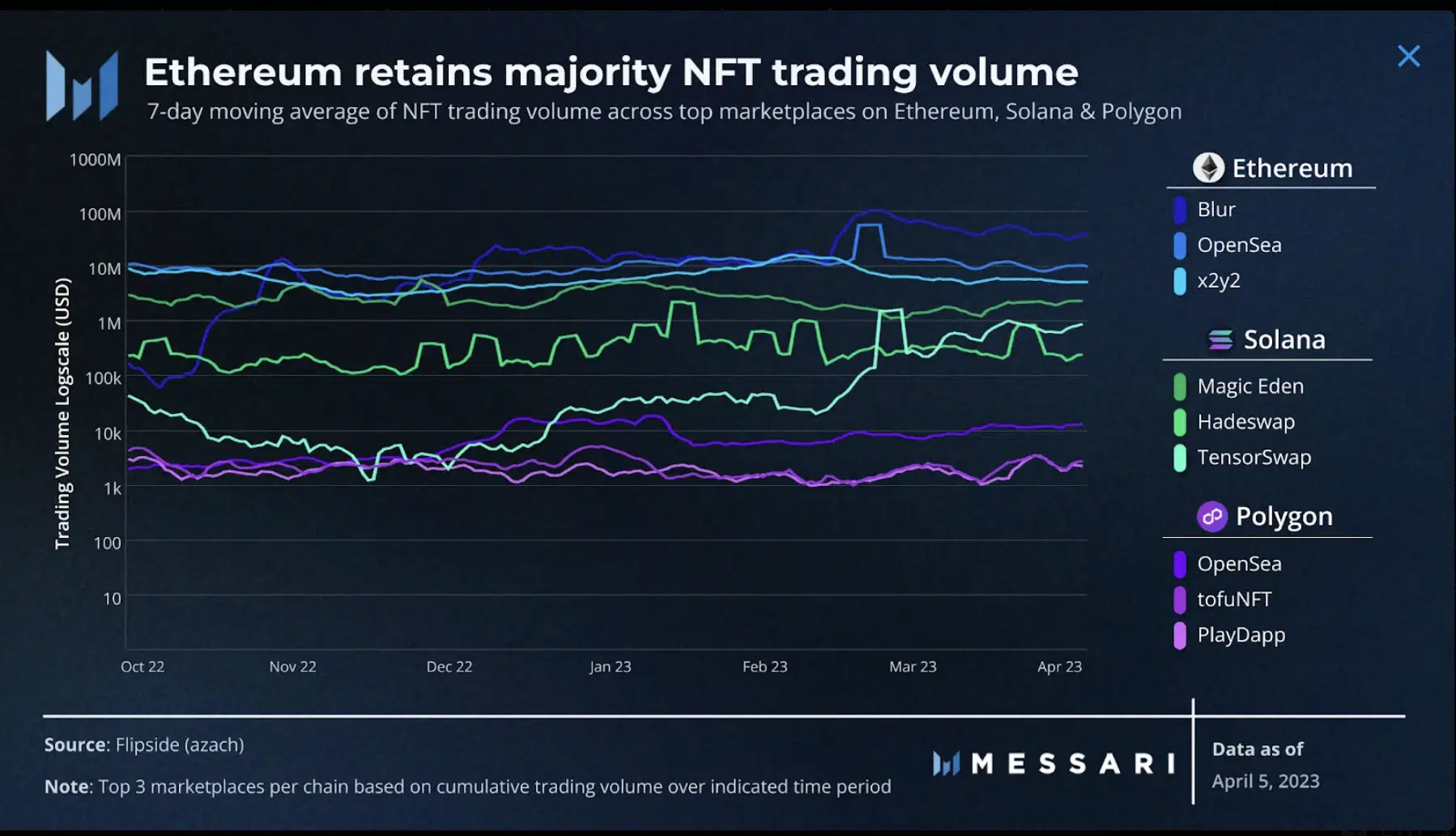

- ETH also managed to maintain its NFT trading volume as per data from Messari

The Ethereum [ETH] merge is set to come to an end, with its final upgrade — Shapella (Shanghai + Capella) — less than 36 hours away. The final event will let stakers withdraw their locked funds, thus enabling them to enter and exit their staking positions at any given point.

In anticipation of the Shapella upgrade, the ETH staking pool witnessed a surge in the number of one-time depositors. Data form Glassnode stated that staking pools usually witnessed recurring deposits.

However, that wasn’t the case anymore. Major events witnessed a spike in the number of one-time depositors.

The #Ethereum staking pool is mainly composed of recurring depositors owning multiple validators, making up to 1000 deposits daily.

However, major events such as the Beacon Chain genesis, the Merge, and the upcoming Shanghai upgrade have seen a surge in one-time depositors. pic.twitter.com/W6pkGUCtEN

— glassnode (@glassnode) April 10, 2023

How much are 1,10,100 ETHs worth today?

ETH are we ready to party?

Data from the Twitter handle glassnodealerts further pointed out that the number of addresses in profit reached a 16-month high of 66,500,400. This could be taken as a clear indication of budding investor interest in the king of altcoins ahead of the final upgrade.

? #Ethereum $ETH Number of Addresses in Profit (7d MA) just reached a 16-month high of 66,500,400.833

View metric:https://t.co/9t2b8JZ83s pic.twitter.com/EuJg0LezFd

— glassnode alerts (@glassnodealerts) April 10, 2023

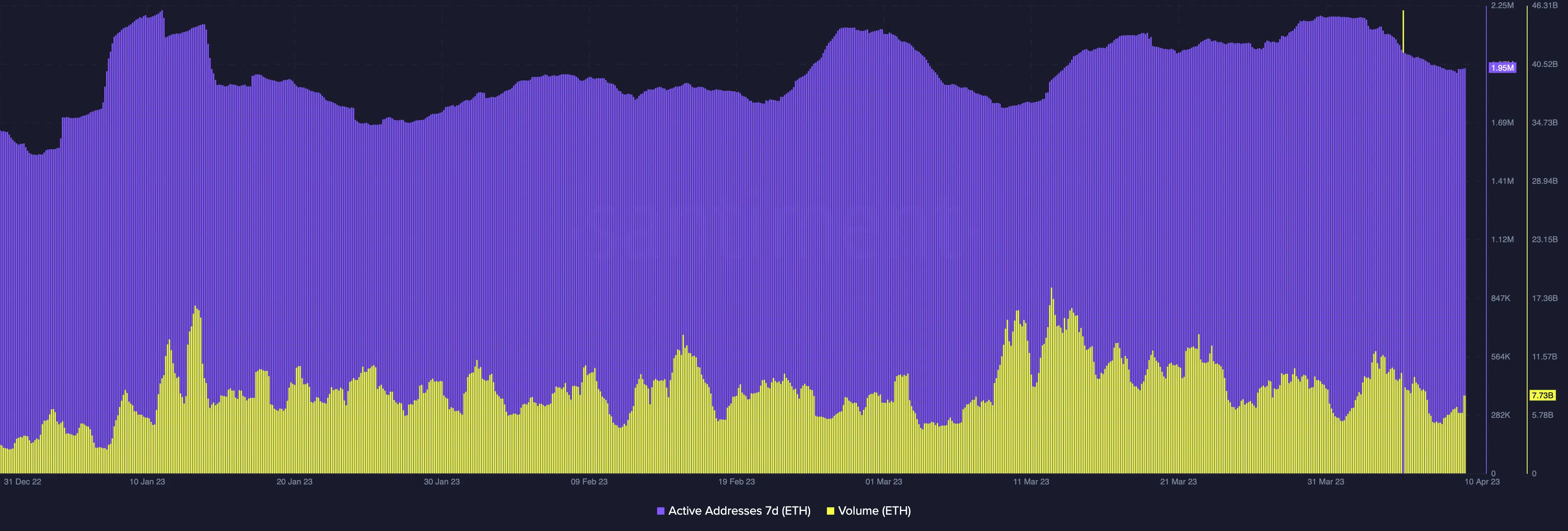

Data from Santiment showed that ETH witnessed a slight surge in the volume and number of active addresses at the time of writing. At press time, the number of active addresses stood at 1.95 million and was extremely close to the figure it had been on the day before. Thus, nothing different from the usual.

Additionally, the volume on the ETH network did witness a slight spike as compared to the previous day. As of 10 April, ETH saw a volume uptick to stand at 7.77 billion. Additionally, the volume could witness a rise especially over the next day or two.

Glassnodealerts also reported that the total value in the ETH 2.0 Deposit Contract reached an all time high on 10 April. This was the second day in a row that the ETH 2.0 Deposit Contract reached an all time high. A surge of this kind indicated that the market was in favor of the altcoin. It also showed investor and trader confidence in ETH.

Furthermore, as per another update by glassnodealerts, ETH’s realized cap also reached a four-month high at the time of writing.

? #Ethereum $ETH Realized Cap just reached a 4-month high of $169,126,039,626.23

View metric:https://t.co/JEcbTHEjsD pic.twitter.com/fJYCFcvuq1

— glassnode alerts (@glassnodealerts) April 10, 2023

So where does that leave ETH then?

Considering the price front of ETH, at press time, the altcoin was trading at $1,886 after witnessing a 1.5% surge in the last 24 hours. Additionally, ETH had witnessed a massive growth of 6.16% in the last seven days as per data from CoinMarketCap.

Is your portfolio green? Check out the Ethereum Profit Calculator

As per the chart given below, ETH’s Relative Strength Index (RSI) was moving towards the overbought region after witnessing a slight correction in its upward trend. Furthermore, the Moving Average Convergence Divergence (MACD) saw a the signal line overlapping the MACD line.

This did not look good for the price trend of ETH. It could also mean that the altcoin could witness a price correction over the next few hours.

Despite a confusing and fuzzy stance on the price front, ETH managed to maintain its dominance on the NFT front. As per data from Messari, the Ethereum network managed to retain its trading volume in the NFT space.