Ethereum: When can you expect a rally based on this metric?

Top altcoin ETH was trading at the $2200 level and below $3000, ETH is undervalued. However, the current ETH fees have dropped to their lowest level in 2021. It has hit December 2020 level, based on the following data from Santiment.

Average ETH Fees | Source: Twitter

Average ETH fees have not been seen at this level since the peak it hit five weeks ago. The highest fee was $69.57 and it has dropped close to the $3 level. Based on the chart, this could mean a price rally two weeks from now. Buying ETH at the $2200 level, with a target of $2800 offers an ROI of nearly 30% in two weeks. That amounted to a high short-term ROI, even by the standards of altcoins that offer high short-term ROI.

Other factors influencing ETH’s price are the open interest and daily volume of ETH futures.

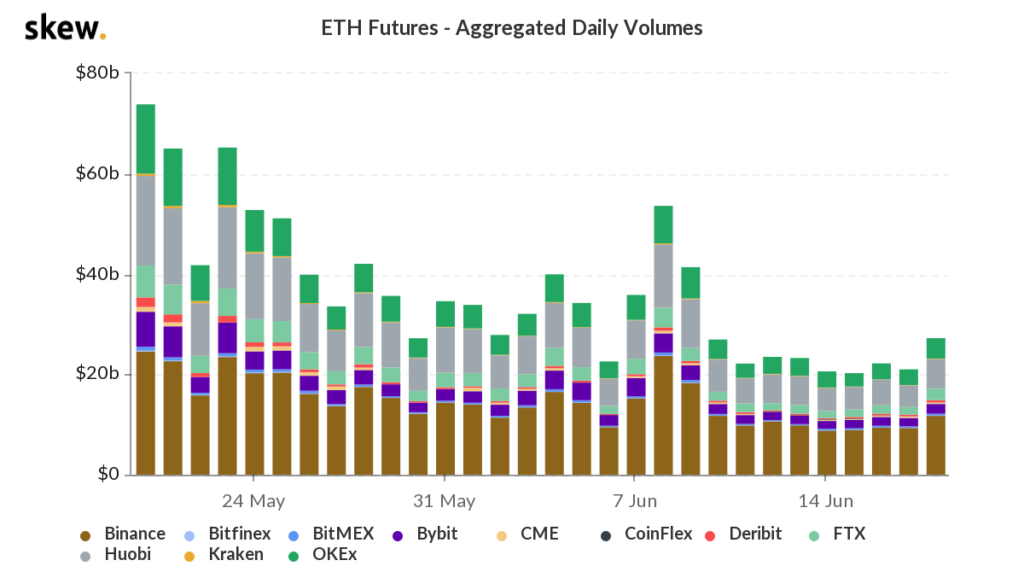

ETH Futures Daily Volume | Source: Skew

Based on data from Skew, ETH Futures Daily Volume was increasing during the last week of May 2021 level. This points towards a rally, however, the volume needs to recover to the $40 billion level for the price to cross $2800. ETH’s high correlation with Bitcoin is a factor that is contributing to the selling pressure on ETH.

Bitcoin continues to trade below the $40000 level. The price was rangebound and the rangebound price action has led to ETH’s price drop as well.

At the same time, investment inflow has dropped and the large transactions on the network have continued dropping. This could either mean an accumulation or a drop in investor demand and interest. In either case, the volatility is likely to increase. The increased volatility can result in an altcoin bull run led by ETH if institutional investors continue to remain interested and increase ETH balances. Investors like Grayscale, which recently diversified into other altcoins may focus on ETH when the volatility increases. An increase in the fees, from the current level, would be indicative of an increase in ETH’s price in the short term.

ETH’s rally is critical to that of DeFi, NFT Marketplace tokens, and other altcoins. At the same time, a rally in ETH is likely to increase the overall market capitalization of DeFi with several projects following ETH closely in terms of price action and correlation.

![Aptos [APT]](https://ambcrypto.com/wp-content/uploads/2025/06/Gladys-12-1-400x240.webp)