Ethereum: Why a price move to $2.5K is a good prediction

- ETH accumulation has been increasing, suggesting a move toward $2,500.

- Market participants are not convinced that the coin is about to jump.

According to AMBCrypto’s evaluation of Santiment, active addresses on the Ethereum [ETH] blockchain have been rising. As of 18th December, the 24-hour active addresses was 395,000.

But at press time, the metric has climbed to 512,000. Active addresses measure daily interaction and speculation around a token.

Therefore, the increase suggests that there are more market participants involved in ETH transfers. Like the active addresses, Ethereum’s on-chain volume also increased.

At the time of writing, the volume was 13.02 billion. The rise in active users and volume implies a surge in network activity on the blockchain

ETH’ season to switch states

Also, this could be a bullish sign for ETH’s price. For a while, ETH has come under intense criticism for its inability to replicate Bitcoin’s [BTC] form. Likewise, ETH has also been unable to outperform many other altcoins.

However, this does not mean that ETH will not have its season.

One reason for this assertion is the number of new ETH wallets created. Based on Glassnode’s data, new addresses on Ethereum have been growing.

This indicates a surge in traction which could translate to a positive move for the price action. On a Year-To-Date (YTD) basis, ETH’s value has increased by 84.11%.

However, the cryptocurrency has been stuck between the $2,000 and $2,300 levels for some time. A look at the ETH/USD daily chart showed that a bullish thesis could soon be validated.

This was because of the Exponential Moving Average (EMA). At press time, the 20-day EMA (blue) had crossed over the 50-day EMA (yellow).

This position is bullish and could be termed a buy/long trend. So, traders may need to desist from opening short positions.

But the Awesome Oscillator (AO) revealed that ETH’s bullish season may not happen in a few days. At the same time, it may not be far away.

$2,500 or nothing

At the time of writing, the AO had formed red bars. However, the red bars were decreasing in height, suggesting a weak bearish momentum.

Also, the increase in the Accumulation/Distribution (A/D) indicator means a move to $2,500 could be possible in the short to mid-term.

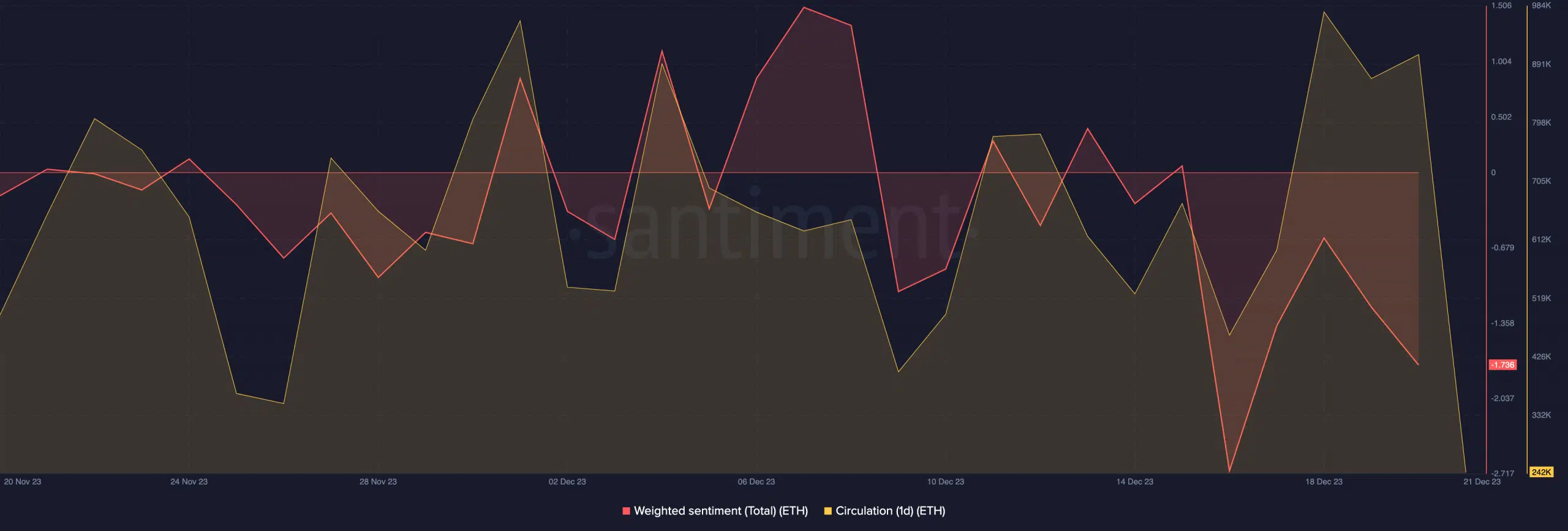

In the meantime, market participants are not all bullish on ETH. This was indicated by the Weighted Sentiment.

At press time, the Weighted Sentiment was -1.736. This negative reading is a confirmation of the bearish bias most market players have.

Read Ethereum’s [ETH] Price Prediction 2024-2025

Considering ETH’s circulation, on-chain data showed that it decreased to 242,000. This decrease implies that the number of ETH engaged in transactions has reduced compared to the hike on the 20th of December.

Price-wise, the drop in circulation suggests low selling pressure for ETH. So, it may be unlikely to see a nosedive in ETH’s value soon.