Ethereum: Why this weekend could set the stage for a $3K breakthrough

- Ethereum has all the right reasons to push for a $3K gamble this weekend

- But first, a few speed bumps need to be addressed

Amid post-election liquidity, altcoins are pushing to new highs. Ethereum [ETH] has surged over 15%, breaking past $2.9K for the first time in 90 days. Meanwhile, Bitcoin’s historic drop in reserves is fueling FOMO, setting the stage for alts to follow suit.

However, ETH faces headwinds: a dormant whale holding $1.14 billion in ETH has reactivated, sparking fears of a sell-off. Despite strong inflows, ETH still trails Solana, which is closing in on $200.

With Bitcoin targeting $78K, ETH’s path to reclaiming dominance might be a tough climb.

The upcoming weekend will be crucial for Ethereum

Bitcoin dominance slipped from nearly 61% after hitting its ATH to around 58% at press time. Meanwhile, Ethereum’s market share has climbed during the same period, now approaching 14%, signaling a capital shift into altcoins.

As expected, the mid-November cycle is crucial for the altcoin market. With the election buzz settling and the market entering a phase of extreme euphoria, altcoins are poised for a potential surge.

However, this scenario may only play out if Bitcoin holds its ground in the $74K – $78K range. A BTC consolidation would create the ideal conditions for investors to focus on high-cap alts, aligning with the current market mood.

The FOMC rate cut further supports short-term holders to hold onto their BTC. While some dumping may occur over the weekend, a major downward spiral is unlikely.

Ethereum bulls are poised to take advantage of this situation. As weaker hands shake out, fear might drive investors into Ethereum, potentially setting the stage for a push toward $3K.

Still, plenty of hurdles ahead

After a shaky start to November, Ethereum’s resurgence is noteworthy. In October, ETH struggled, facing three rejections and failing to break above $2.7K, with pullbacks that hindered its momentum in the bull market.

Meanwhile, Solana has emerged as the top altcoin, breaking through the $160 ceiling with minimal setbacks. In fact, SOL recently flipped BNB to secure the 4th spot and is now approaching a $100 billion market cap.

So, it’s not hard to imagine Solana stealing the spotlight again. On top of that, the 8-year-old whale cashing in on gains could stir negative sentiment, potentially holding Ethereum back from testing $3K.

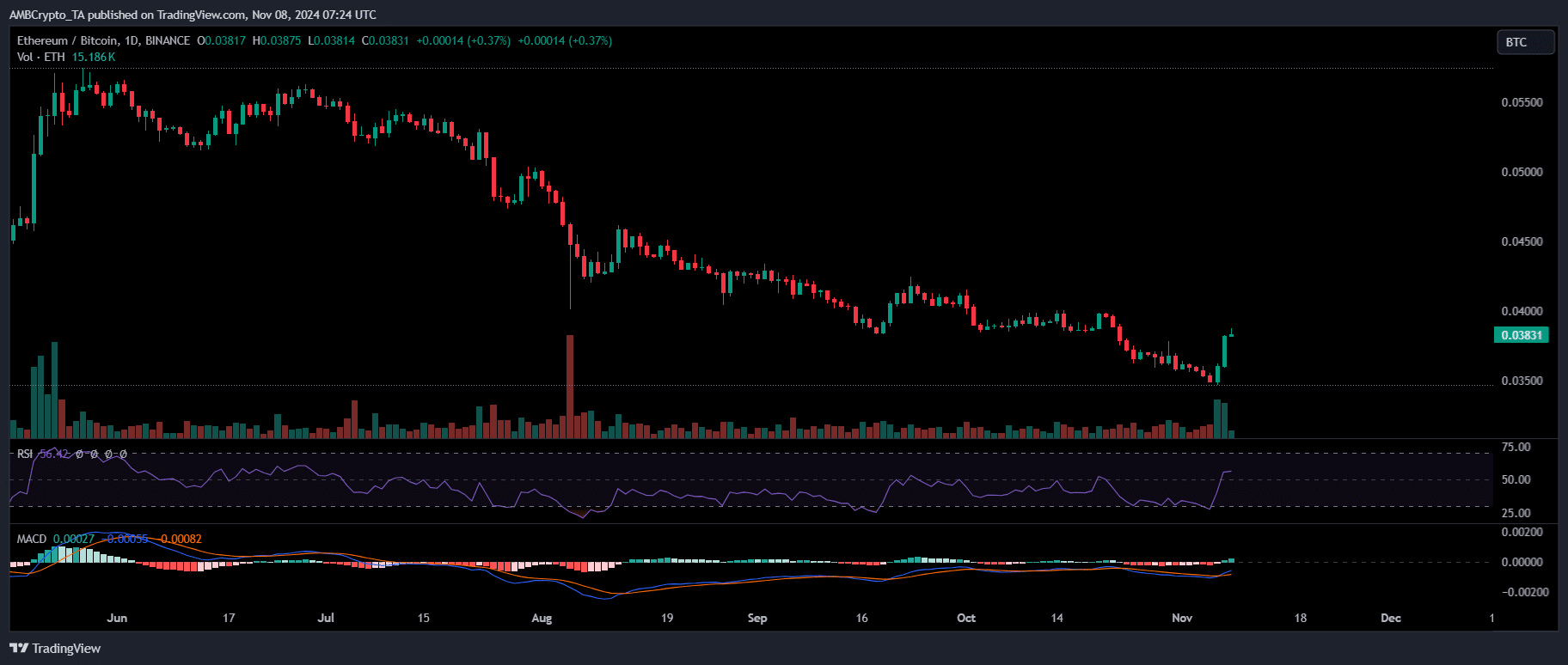

Despite these challenges, Ethereum’s growing dominance over Bitcoin has caught the attention of AMBCrypto. After more than 5 months, ETH has finally outperformed BTC.

As a result, the 80% profit cohorts are likely to hold on to their ETH, making a weekend pullback less likely. This is supported by several factors: BTC holding steady in the $74K-$78K range, ETH attracting liquidity, and short-term holders staying put.

However, the influence of whales and long-term holders cannot be overlooked. If dormant whales start to reawaken, it could put ETH in a difficult position. A strong catalyst may be needed to help Ethereum navigate these potential challenges.

The catalyst ETH needs is here

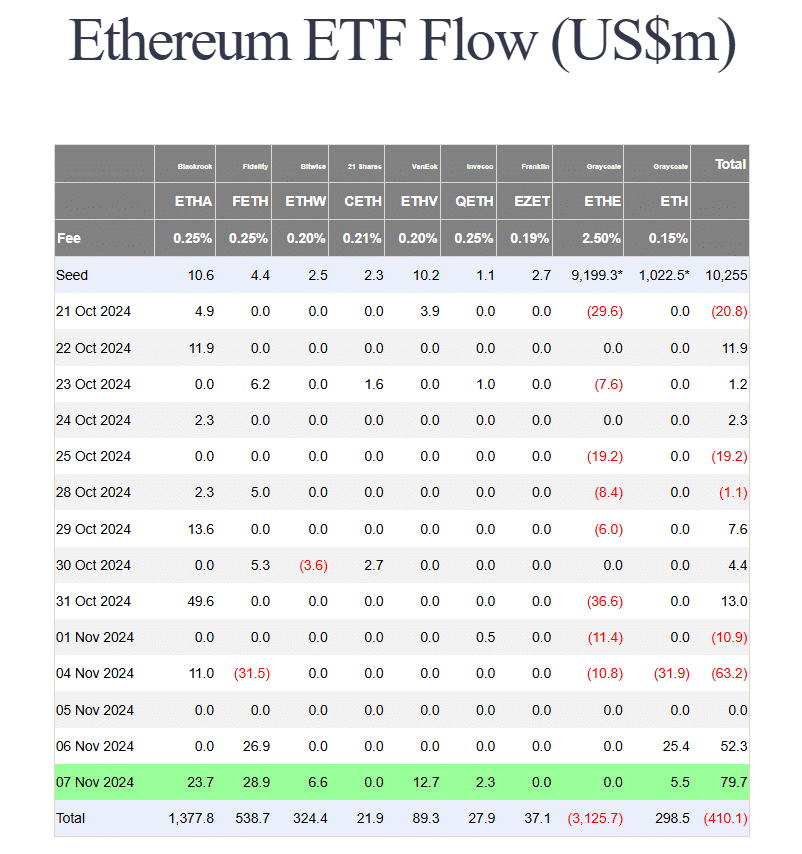

Over the last two weeks, cumulative flows have been -$75M, largely due to factors that stalled ETH’s rally in October. Yet, the key factors that held ETH back this year – poor performance from the ETH ETF and low seasonality – are now likely reversing.

Even modest, steady flows could help lift ETH, especially as Ethereum remains the only altcoin, besides Bitcoin, with a visible and available ETF product.

In short, Ethereum’s growing exposure to the institutional landscape could act as a key catalyst, helping to mitigate any sideways pressure that could push ETH lower.

Read Ethereum’s [ETH] Price Prediction 2024–2025

Despite concerns over ETH failing to attract liquidity from its ETFs, a reversal in this trend would spark the right momentum, enabling Ethereum to stay in the long game and potentially reclaim its dominance.

With spot ETFs seeing the highest inflows of close to $80 million, breaking a two-month slump, there is a strong possibility of ETH hitting $3K by the end of this month.