Ethereum: Why whale accumulation may not deter a price plunge

- Despite its price compression, ETH hit its highest whale activity in 16 weeks.

- If history repeats itself, ETH might drop to 2019 lows.

Lately, Ethereum [ETH] has been witnessing a significant increase in network activity and accumulation. And the suspects in this regard have been whales who have found the coin dip to $1,650 as a chance to scoop up ETH at a lower price.

Read Ethereum’s [ETH] Price Prediction 2023-2024

Cult-like whales for ETH

According to Santiment, ETH’s whale activity reached its highest in 16 weeks due to the increase in this venture. Also, addresses holding between 10 and 10,000 ETH rose to 355,000 while ETH $100,000 transactions also spiked.

? #Ethereum's network has picked up in large address activity during this drop below $1,650 and its highly volatile price conditions. The amount of wallets holding between 10 and 10,000 $ETH has risen back up to 355K, and $100K+ transactions have surged. https://t.co/X137U93ZYu pic.twitter.com/J9lyMoeBmf

— Santiment (@santimentfeed) August 24, 2023

When something of this nature happens, it means that these large addresses are convinced that ETH’s price action in the long term would be profitable. On two separate occasions, AMBCrypto had reported how whales have increasingly interacted with Ethereum.

However, the presence of these large investors has not been felt with the ETH value. At press time, ETH consolidated, making a 1.70% drop in the last 24 hours. And according to on-chain, Ethereum’s price volatility fell to 0.009.

Therefore, it is likely that ETH will continue to compress and trade around the same $1,600 in the short term.

However, this accumulating trend has led to discussions about whether it can shield the cryptocurrency from another potential price plunge. Despite the increased accumulation, various factors indicate that Ethereum might still be vulnerable to capitulation.

Will ETH fall back to $1200?

One person who shared this sentiment was Benjamin Cowen, the CEO and co-founder of Into The Cryptoverse. According to Cowen, ETH’s market structure was similar to that of the summer of 2019 when the price dropped about 30%.

People tell me this time is different.

I doubt it pic.twitter.com/lB3xrLD6AM

— Benjamin Cowen (@intocryptoverse) August 24, 2023

Cowen also went ahead to compare 2023’s Year-To-Date (YTD) performance with 2019. While doubling down that history would repeat itself, Cowen noted that,

“ETH closing below the yearly open (like it did in 2019) would put it below $1195.”

Interestingly, most comments from the analyst’s post on X (formerly Twitter) seemed to agree with his projection. For some, ETH would surely drop to $1,200.

However, there were a few who argued that 2019 was different from 2023 because Decentralized Finance (DeFi) adoption was rarely visible four years back. And now that Ethereum has the DeFi ecosystem backing, history may not repeat itself.

Is your portfolio green? Check the ETH Profit Calculator

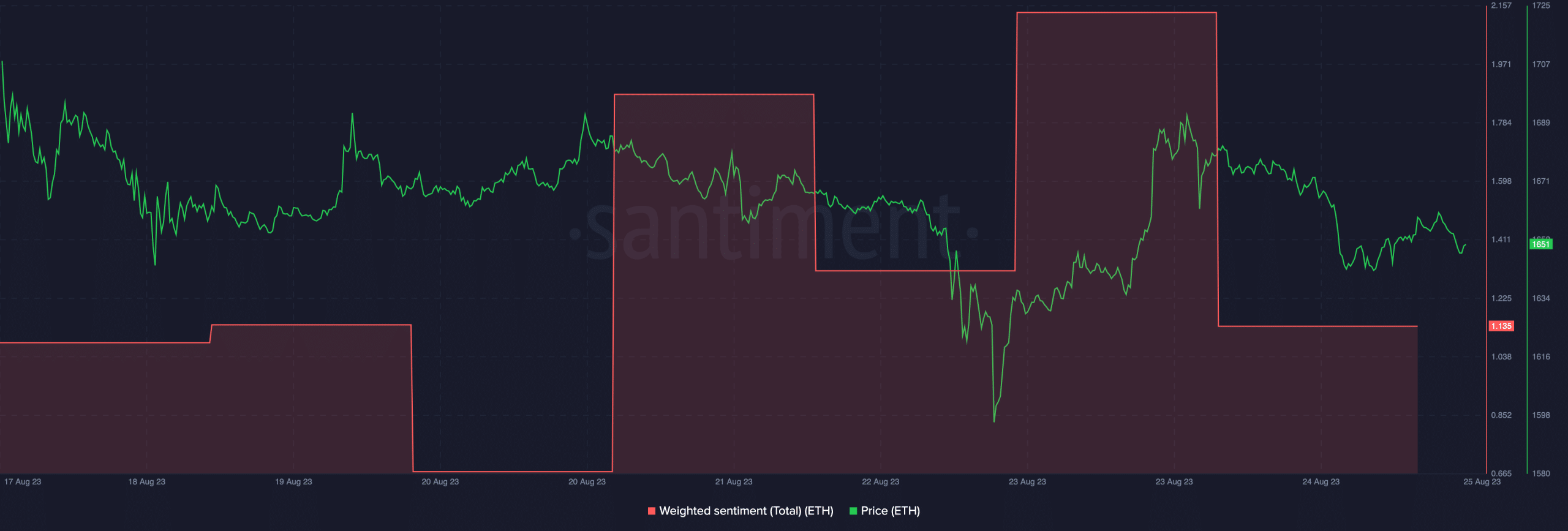

At the time of writing, ETH’s weighted sentiment was down to 1.135. The weighted sentiment considers the perception and commentary market participants have toward an asset.

Therefore, the decline suggests that the broader market does not view ETH as a cryptocurrency that could be profitable anytime soon.