Ethereum: Will liquidations make $2000 a pipe dream

- Ethereum’s long positions face record-high liquidations, surpassing $58 million in May.

- Despite a slight price increase, Ethereum remains in a bearish trend around the $1,830 price range.

Ethereum’s [ETH] price has been trapped within the $1,800 price range for quite some time, but lately, we’ve witnessed a glimmer of hope with a modest surge. Unfortunately, even this slight upward movement hasn’t proven sufficient to safeguard certain traders’ positions from being forcefully liquidated.

Read Ethereum’s [ETH] Price Prediction 2023-24

Ethereum long liquidations hit monthly high

Glassnode Alerts reported that the Mean Liquidated Volume in Ethereum Futures Contracts’ Long Positions peaked on 27 May. According to the observed chart, the average amount of Ethereum Futures Long Liquidations exceeded 32,000 ETH, equivalent to over $58 million at the press time valuation. This made it one of the highest ETH Futures Liquidations in May.

In futures contracts, the mean liquidated volume signifies the average number of contracts forcefully closed or liquidated due to traders’ inability to fulfill margin requirements. When engaging in long positions for Ethereum futures contracts, traders are speculating on the price of ETH increasing.

However, if ETH falls below a specific threshold, traders’ accounts may lack sufficient funds to cover the losses, resulting in the unfortunate event of liquidation.

Ethereum’s 24-hour liquidation map

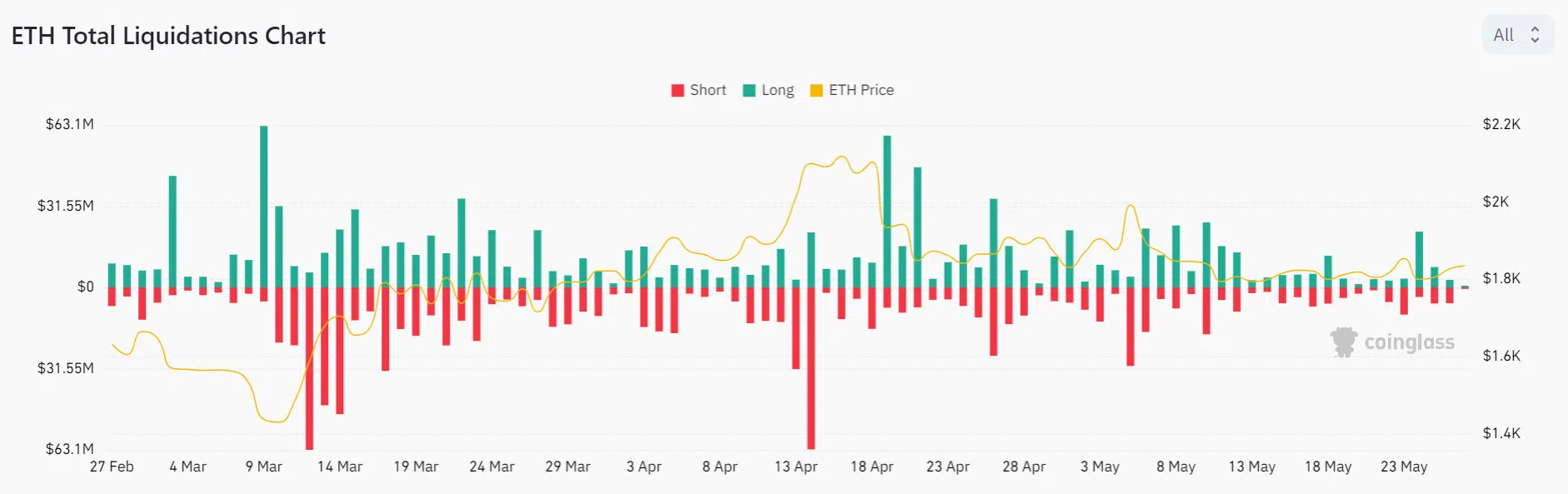

Examining the Ethereum liquidation within a 24-hour timeframe revealed a notable amount of liquidation activity. According to CoinGlass, ETH experienced liquidations totaling $8.42 million in the past 24 hours.

Further analysis indicated that long positions witnessed liquidations amounting to $2.48 million, whereas short positions faced liquidations totaling $5.94 million.

As of this writing, long positions accounted for over $600,000 in liquidations, while short positions stood at over $500,000. Taking a broader perspective by examining the ETH liquidation chart, it becomes evident that long positions experienced more liquidations in May when compared to short positions.

How much are 1,10,100 ETHs worth today?

Observing price swings in a daily timeframe

Analyzing Ethereum’s daily timeframe chart revealed a 1.26% increase in value at the close of trade on May 26. As of this writing, Ethereum was trading around $1,830, exhibiting a minor upward trend of less than 1%. Although ETH remained within a bearish trend, it was showing signs of weakening due to the recent modest growth it has experienced.

Notably, the Relative Strength Index (RSI) line indicated that ETH was approaching the threshold of transitioning to a bullish trend.