Ethereum’s 4-month decline on THIS front is not good news – Why?

- ETH registered a moderate uptick, hiking by 3.39% on the monthly chart

- Ethereum’s MVRV score declined over the past month

Over the past month, Ethereum has seen a reversal of its fortunes. Previously, the altcoin seemed to be failing to maintain any upward momentum at all.

However, at the time of writing, Ethereum was trading at $2441. This marked a 3.39% hike on the monthly charts, with the altcoin gaining on the weekly and daily charts too.

As expected, prevailing market conditions have left many in the Ethereum community deliberating over the altcoin’s trajectory. One of them is Cryptoquant’s analyst Burak Kesmeci. According to him, ETH’s current MVRV levels may present a buying opportunity.

Ethereum MVRV score declines for 4 months

In his analysis, Kesmeci posited that Ethereum’s MVRV score has continued to decline over the past 4 months. According to him, ETH MVRV has failed to surpass its March levels of 2.25 points, with the same now sitting at 1.22 points.

To put it in context, ETH’s MVRV score has fallen for the last 120 days, hitting a low of 1.93. What this means is that for the altcoin to register another rally, it must reclaim its March levels of 2.25.

Simply put, for ETH to rally on the charts again, its MVRV score must register an uptick. By extension, what this also means is that since the altcoin didn’t note any uptick on the charts, right now, there is little potential for a bull run.

What does ETH’s chart say?

While the analysis provided by Kesmeci points to conditions that need to be met for ETH to rally, it’s essential to check other market fundamentals and determine what the current situation is.

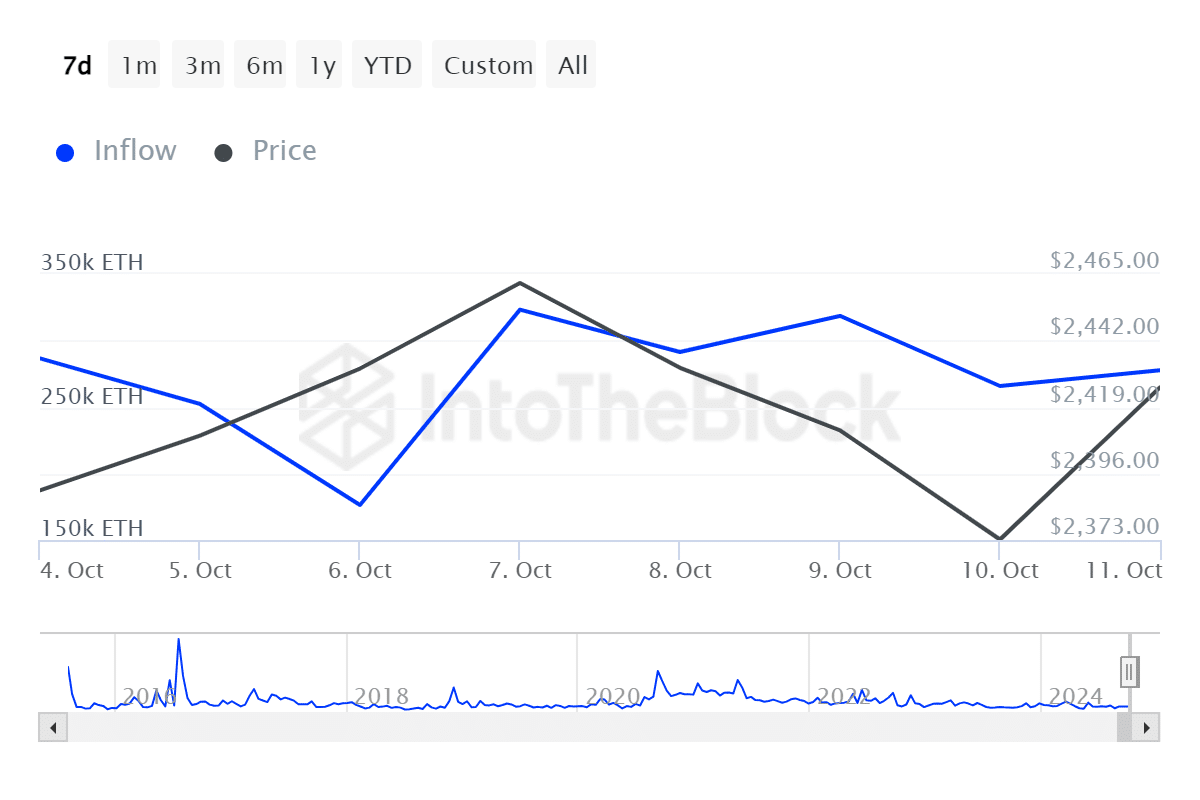

For starters, Ethereum’s large holders’ inflow has increased by 57.46% from a low of 176.29k to 277.58k over the past week.

Usually, a spike in large holders’ inflow highlights strong buying activity and could be a sign of positive momentum.

Additionally, Ethereum’s Open Interest per exchange rose by 8.89% from $2.25 billion to $2.4 billion.

This suggested that investors have been continually opening new positions, while holding existing ones.

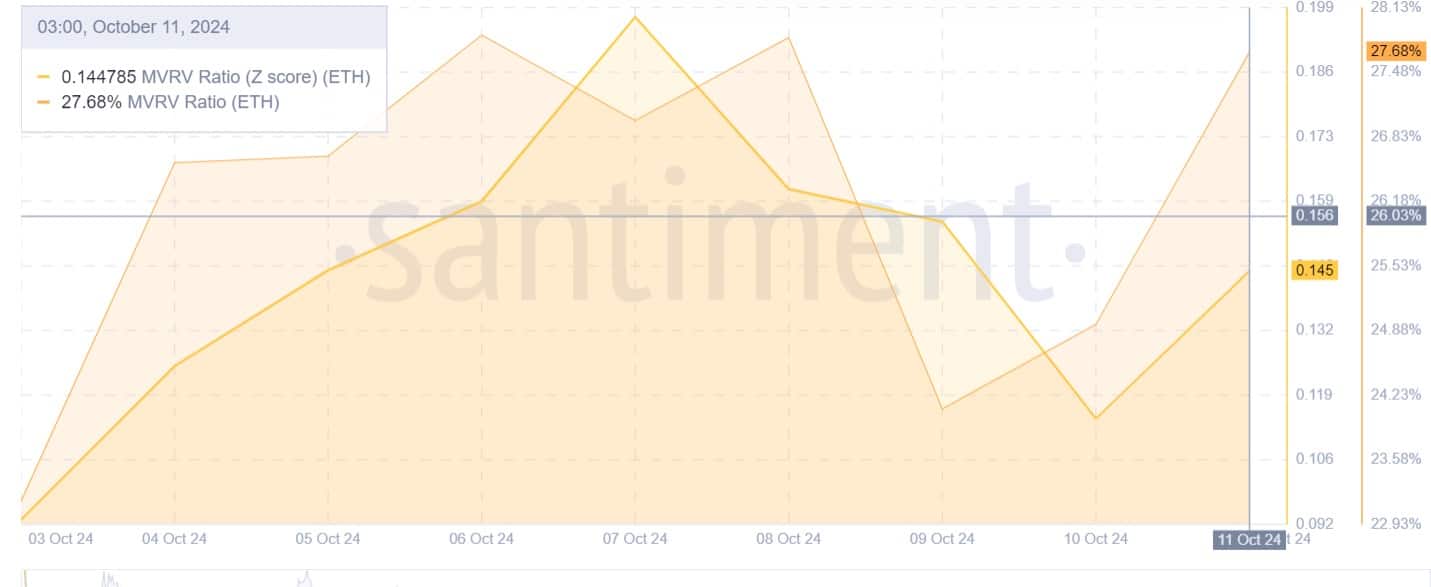

Furthermore, Ethereum’s MVRV Z Score at 0.145 indicated that ETH has been experiencing a healthy market environment.

At this level, prices are stabilizing after a market correction. Thus, it implied that the prevailing market conditions are not a speculative bubble nor undervalued.

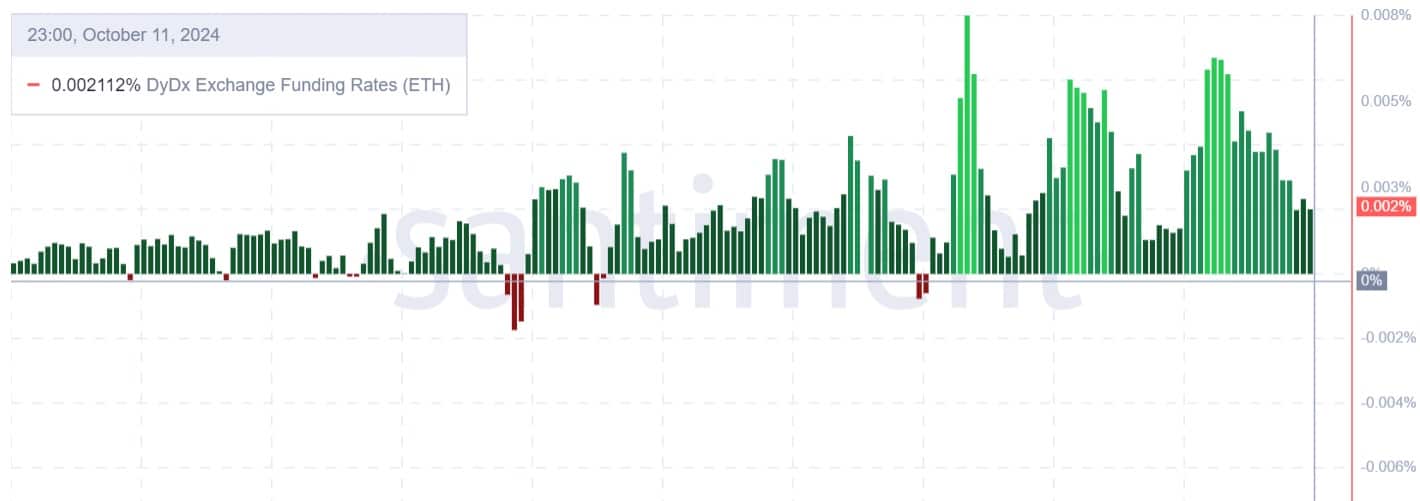

Finally, Ethereum’s DyDx Exchange funding rate has remained positive throughout the past week. This alludes to high demand for long positions, with investors willing to pay premiums for their positions during the market downturn.

Simply put, while ETH is yet to rally and it’s early to say a rally has arrived, the current conditions provide a favorable environment for a potential upswing. As such, if current market conditions hold, ETH will hit its $2557 resistance level in the short term.