Ethereum’s $4K dreams face hurdle as whales take profit – What now?

- Ethereum’s sell pressure from large holder flows outperformed inflows from the same category.

- A recap of the mixed signs, and why ETH could be on the verge of a retracement.

Holders have been holding on to hopes that Ethereum [ETH] could rally above $4,000 before the end of 2024.

While the cryptocurrency demonstrated signs of maintaining the bullish momentum achieved in November, a sizable pullback could be brewing.

Whale activity indicates that ETH sell pressure might be building up. An unsurprising outcome considering that the previously robust momentum has seemingly cooled off.

On top of that, ETH large holder activity has been growing and may be contributing to bearish momentum.

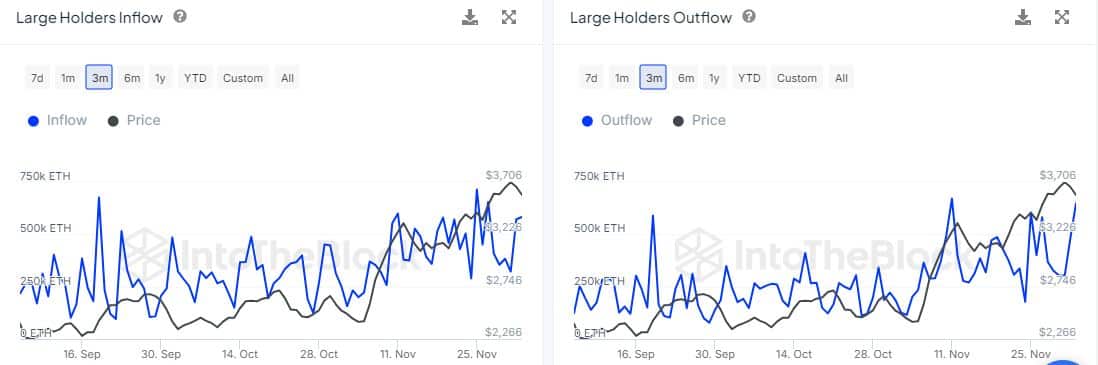

IntoTheBlock data revealed that large holder outflows peaked at 647,220 ETH on the 3rd of December. Large holder inflows also grew in the last three days and peaked at 582,710 ETH as per the latest data.

The difference between inflows and outflows suggested that there was more sell pressure from whales than demand. This was not the only sign demonstrating bullish weakness.

Ethereum ETF inflows remained bullish so far this week. However, they declined considerably compared to a week ago.

For context, Ethereum ETFs had positive flows on the 3rd of December at $132.6 million, an improvement from $24.2 million during the previous day.

Ethereum ETFs soared as high as $332.9 million on Friday last week. This means ETF inflows declined considerably.

Is bullish demand weakening?

While one may view the disparity as a sign of shrinking demand, it is worth noting that demand may grow or decline from one day to another.

However, the above observations do highlight the slowdown in ETH bullish demand during the weekend.

While large holder flows and Ethereum ETFs signal potentially declining demand, spot flows painted a different picture.

Spot inflows peaked at $285 million in the last 24 hours and $252.69 million on the 3rd of November.

The positive spot flows were in tune with ETH’s price action. This bullish demand contributed to the cryptocurrency’s recovery in the last two days.

ETH exchanged hands at $3,731 at the time of writing, recovering from the initial sell pressure observed at the start of the week. However, there is one major reason for the growing expectations of a retracement.

Read Ethereum’s [ETH] Price Prediction 2024–2025

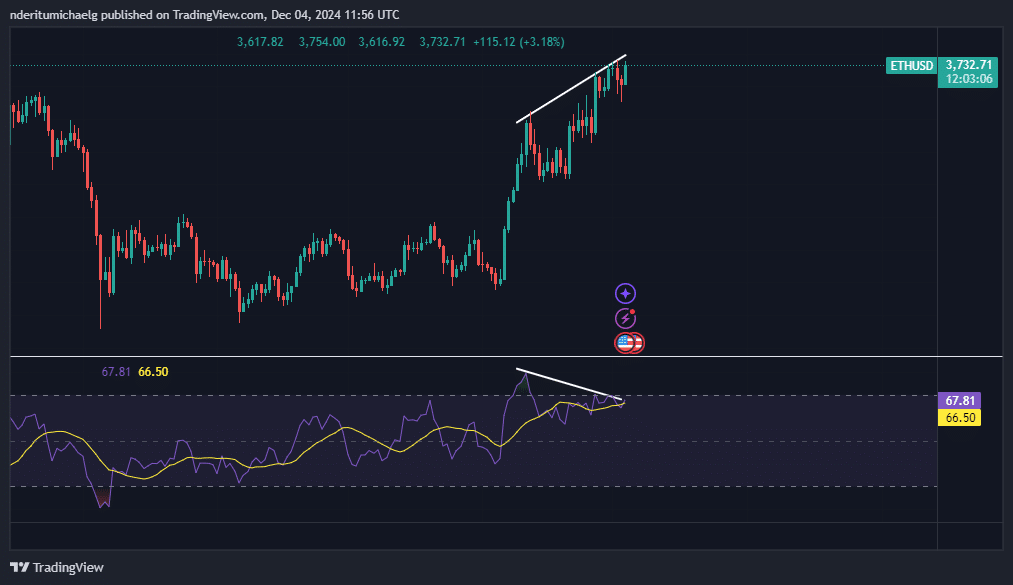

ETH’s price action has been forming a bearish divergence with the RSI. This suggests that a sizable pullback could be on the cards.

A retracement from the current level could see price dip all the way to the $3050 price level. This is one of the more recent support levels or the cryptocurrency.