Ethereum’s active addresses decline by 18.23% YTD: Impact on ETH?

- ETH has declined by 6.18% in 24 hours.

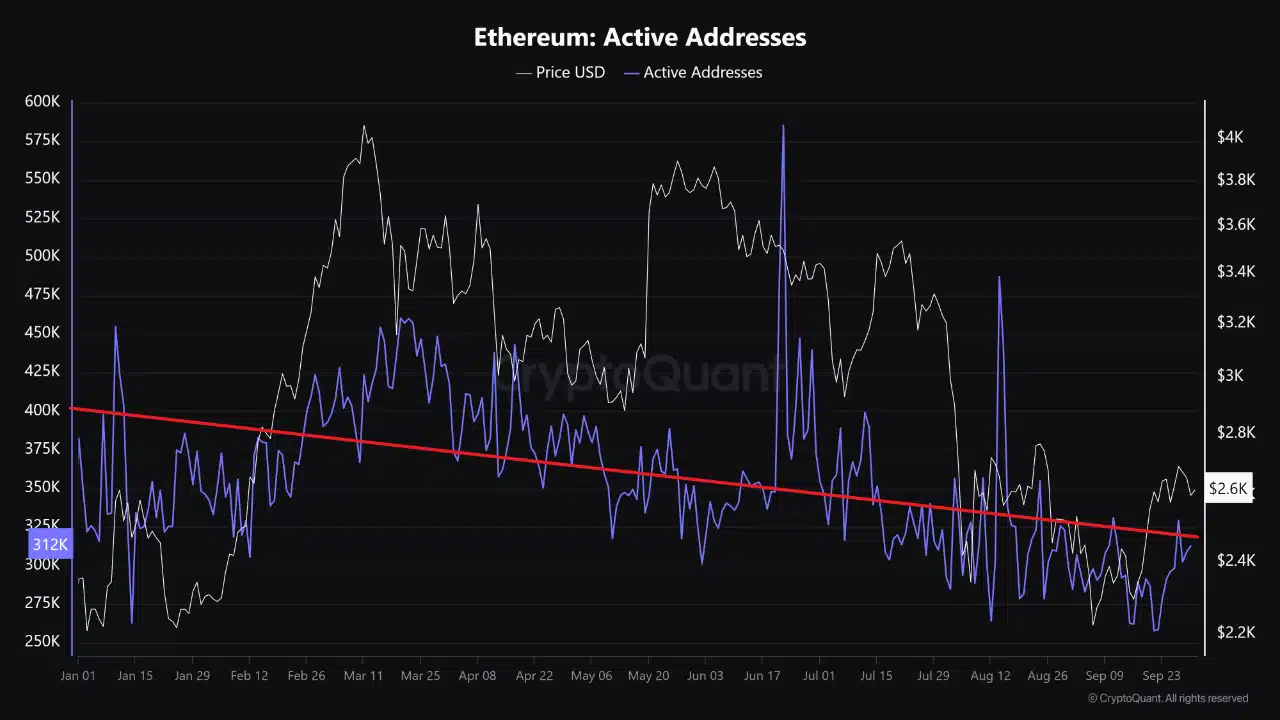

- Ethereum daily active addresses have declined by 18.32% from 382k to 312k YTD.

Ethereum [ETH] has experienced a sharp decline over the past week. Over this period, ETH has declined by 5.46%. In fact, as of this writing, Ethereum was trading at $2480. This marked a 6.18% decline over the past day.

Prior to this, ETH has been on an upward trajectory hiking by 1.57% on monthly charts. However, since hitting a high of $2729, the altcoin has failed to maintain an upward momentum. Thus, the recent losses are almost outweighing the monthly gains.

The recent losses on price charts are not an isolated case as the altcoin has also declined in other aspects especially active addresses.

Ethereum daily active addresses decline

According to Cryptoquant, just like Bitcoin [BTC], Ethereum has experienced a sustained decline in active addresses throughout the year.

Based on this data, Ethereum’s daily active addresses have declined from a high of 382k to 312k.

The analysts cited the main cause of the decline as the lack of new investors. Thus although 2024 has seen liquidity increase following the approval of Ethereum ETFs, on-chain activities doesn’t reflect it.

Equally the anticipated rally following Fed rate cuts has failed to materialize. This market failure means no new addresses have entered the market.

Implications for ETH price charts

Notably, a decline in daily active addresses as pointed out above usually leads to price dips.

However, despite the decline in active addresses, the current market condition could set Ethereum for a significant recovery on price charts.

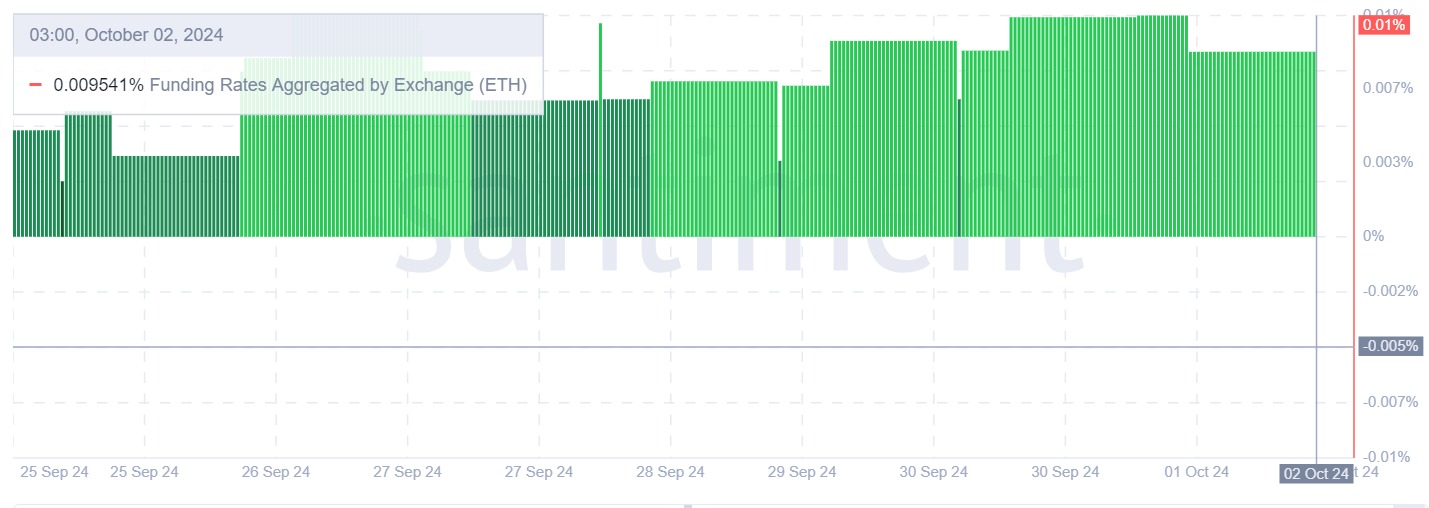

For example, Ethereum’s funding rate aggregated by exchange has experienced a sustained rise remaining positive over the past week. This signals a rising demand for long positions as investors anticipate further gains.

The fact that investors are holding long positions despite the price decline suggests market confidence.

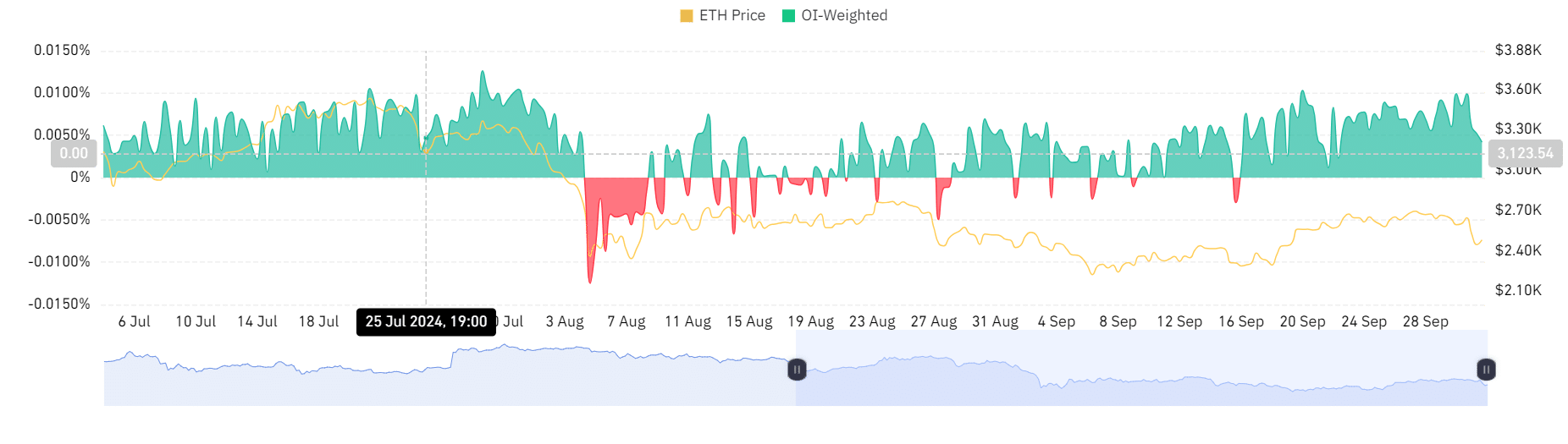

This demand for long positions is further supported by a positive Open Interest Weighted funding rate.

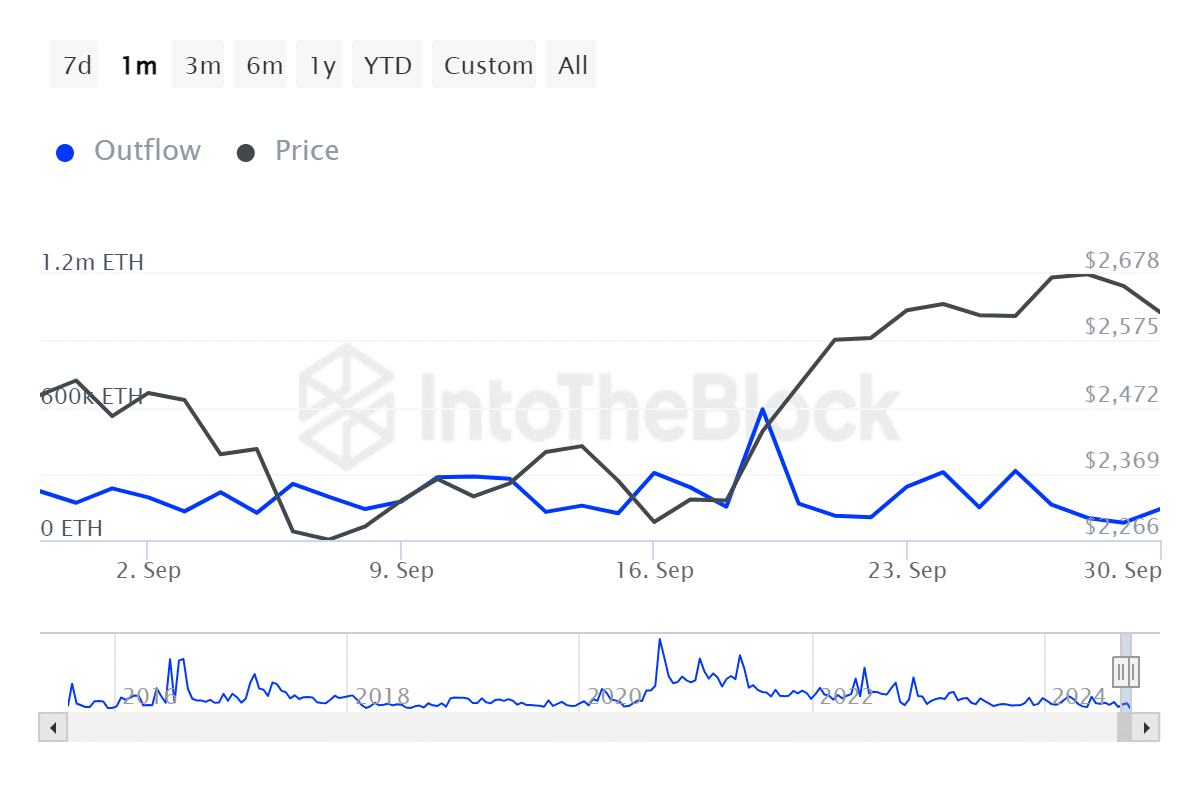

Additionally, Ethereum’s large holders outflow has declined from a high of 311.95k to a low of 139.39k. This suggest that large holders are still accumulating their assets and continue to hold their positions despite market downturn.

Such holding behavior suggest confidence with the altcoin’s future.

Read Ethereum’s [ETH] Price Prediction 2024–2025

Therefore, despite the decline in active addresses, ETH has shown strength on price charts. This implies that the market is enjoying overall positive sentiment.

As such, ETH could recover and reclaim the next significant resistance level at $2668. However, if the current decline persists, ETH will find its support at $2728.