Ethereum

Ethereum’s challenge – Record low fees and a 6% price decline mean…

It’s not been a good time for Ethereum lately, despite all the Spot ETF optimism.

- Ethereum’s network activity dropped over the last few months

- Price fell by 6%, but there may be chances of a trend reversal on the charts

With the wider crypto-market continuing to remain bearish, Ethereum [ETH] witnessed yet another setback. The latest development came from the blockchain’s network activity, as a key metric hit a record low. Let’s have a look at what’s going on with the king of altcoins.

A look at Ethereum’s network activity

IntoTheBlock recently shared a tweet highlighting this crucial update. As per the tweet, Ethereum’s fees hit a 9-month low of $18.2 million. Additionally, the blockchain’s gas fees also dropped to as low as 1 gwei. Even so, it is interesting to note that despite the drop in fees, the blockchain’s revenue remained high.

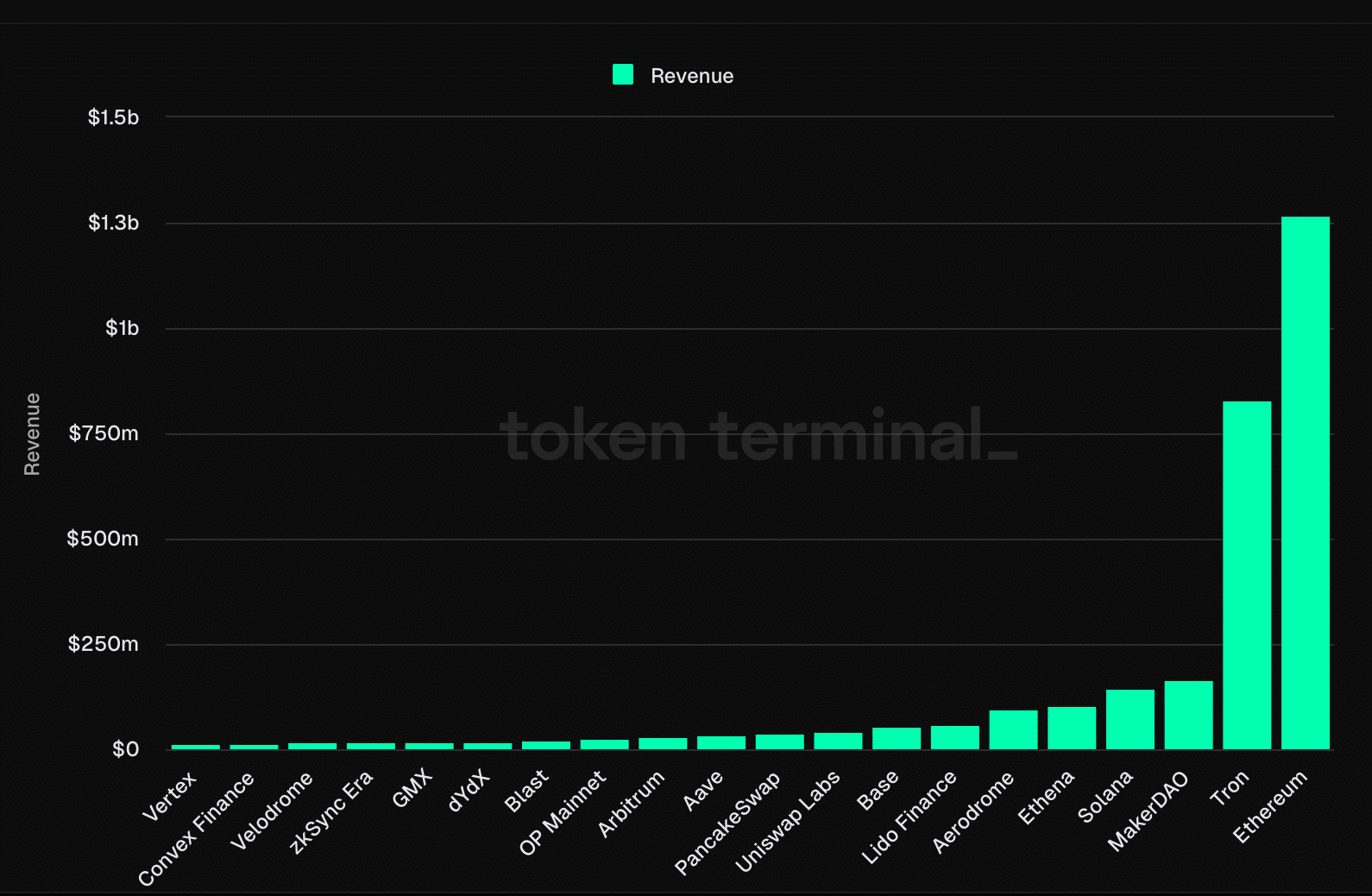

AMBCrypto’s observation of Token Terminal’s data revealed that ETH topped the list of cryptos in terms of revenue over the last six months. Apart from ETH, Tron and MakerDAO made it to the top three on the same list.

We then checked Artemis’ data to better understand Ethereum’s network activity.

We found that ETH’s daily active addresses dropped significantly over the last three months. Thanks to the same, the blockchain’s daily transactions also witnessed a slight drop over the same period. To date, ETH has processed more than 2.44 billion transactions with an average TPS of 14.

ETH bears are here

In the meantime, the market’s bears geared up and pushed the token’s price down on the charts. According to CoinMarketCap

, ETH’s price lost more than 9% of its value in the last seven days. In the last 24 hours alone, the altcoin dropped by 6%.However, the trend might change soon. Lookonchain recently revealed that a smart money with a 100% positive track record bought ETH, hinting that there may be chances of a price hike soon.

AMBCrypto’s analysis of Glassnode’s data suggested that Ethereum’s NVT ratio dropped too. A decline in this metric means that an asset is undervalued – A sign that the chances of a price hike might be high.

Finally, Ethereum’s whale vs retail delta had a value of 3, at the time of writing. For starters, this metric is used to identify large gaps between retail long percentage and whale long percentage. This indicator ranges from -100 to 100, with 0 representing whales and retail positioned exactly the same.

Is your portfolio green? Check out the ETH Profit Calculator

Since at press time it had a value of 3, it meant that whale positions were more – A sign that big-pocketed players in the market have been pretty confident in the token.