Ethereum’s [ETH] short-term price targets – Is the $2,300 resistance too strong?

![Ethereum's [ETH] short-term price targets - Is the $2,300 resistance too strong?](https://ambcrypto.com/wp-content/uploads/2025/03/Evans-1-min-1200x675.png)

- Ethereum’s MVRV and realized price hinted at early recovery, but $2,300 remains a strong resistance level

- Whale interest has grown and yet, rising reserves and falling gas alluded to short-term caution

Ethereum [ETH] recently reclaimed its realized price at $2,040 on the charts, signaling renewed optimism across the market. This move indicated that Ethereum could be entering a recovery phase after its prolonged bear market.

At press time, Ethereum was trading at $2,064.80, following a slight 0.10% decrease over the last 24 hours.

Historically, when Ethereum crosses its realized price, it marks the beginning of a bullish trend. Therefore, this could be a crucial turning point for ETH. However, it still faces several hurdles that could slow down its momentum.

What does MVRV analysis say about Ethereum’s price?

At the time of writing, Ethereum’s MVRV ratio stood at approximately 1.02. MVRV ratios below 1 historically mean that a market bottom is near, while ratios above 2.4 indicate overvaluation. Ethereum’s press time position, therefore, signaled that while in a recovery phase, the altcoin was not yet overvalued.

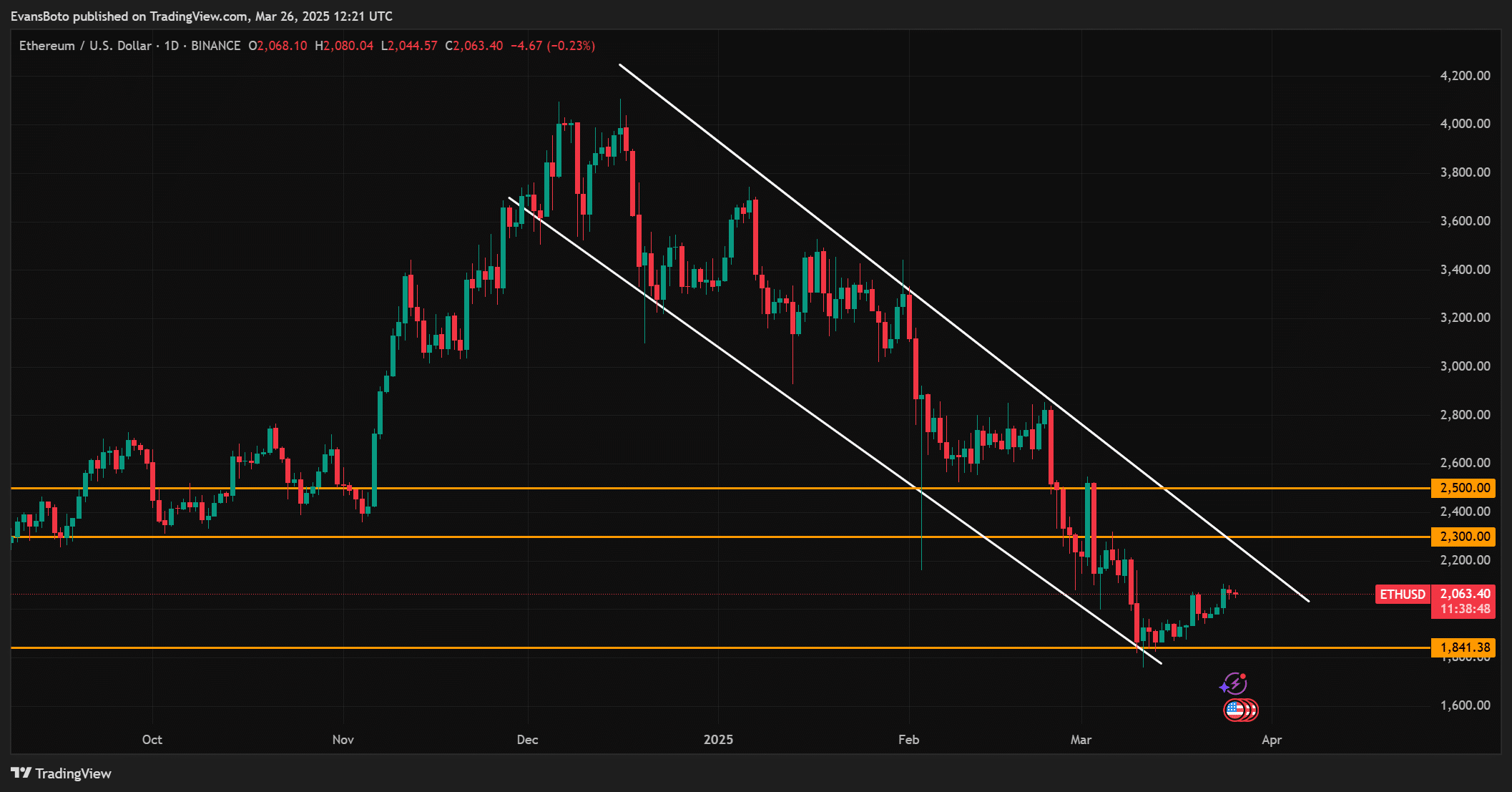

On the charts, Ethereum faces substantial resistance ahead at the $2,300-level. According to the MVRV Extreme Deviation Pricing Bands, this level marks a critical barrier that ETH must clear for a sustained bullish trend. ETH is also trading within a falling wedge channel near the upper boundary. Therefore, the price action around $2,300 will be pivotal in determining whether Ethereum’s recovery continues or stalls.

Whale activity and user activity – What do they mean for Ethereum?

Whale activity continues to support the mid-term bullish case for ETH. Notably, BlackRock recently accumulated 1.25 million ETH worth around $2.5 billion – A sign of heightened institutional interest.

However, on-chain metrics pointed to some mixed signals. Ethereum’s exchange reserves increased to 18.375 million ETH, up +0.18% in the last 24 hours. Rather than indicating demand, this uptick may suggest growing sell-side pressure as more ETH is being deposited into exchanges – Often a precursor to potential profit-taking.

Meanwhile, user activity has remained strong, with 20,913 active addresses recorded – A +0.99% hike over the same period. This uptick in active wallets hinted at sustained network engagement, a positive sign for ETH’s fundamental health.

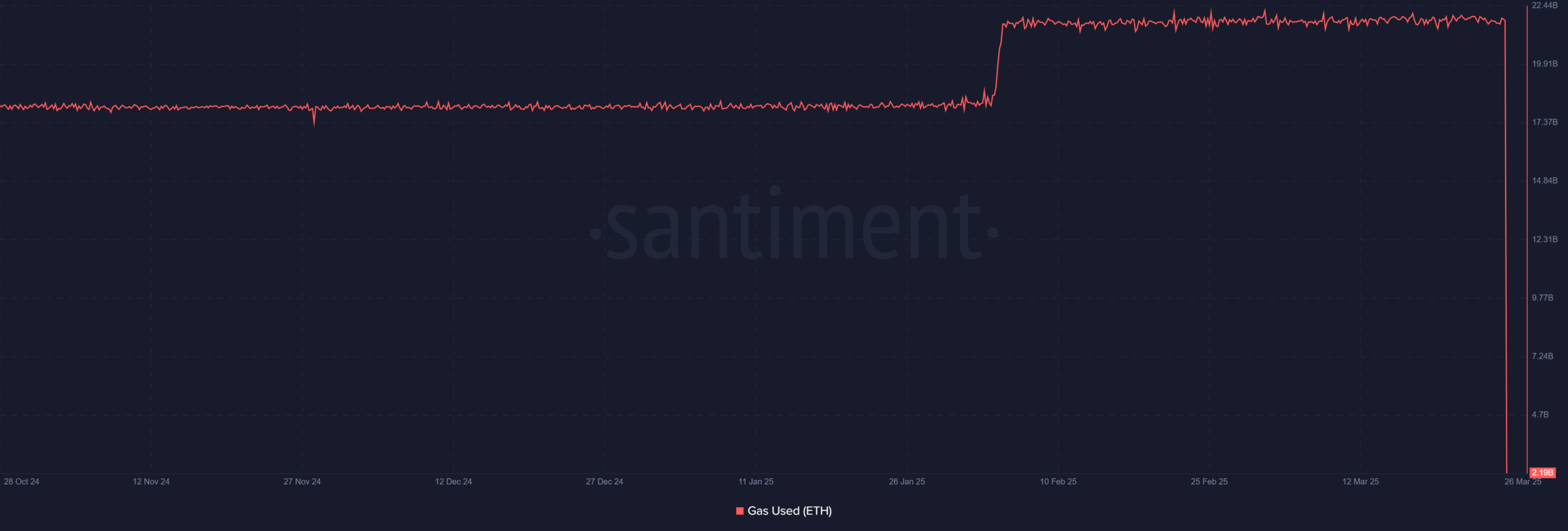

On the contrary, Ethereum’s gas usage dropped sharply to 2.19 billion ETH – A steep decline from recent highs near 22 billion. This could reflect lower transaction volumes or fall in smart contract execution – Potentially signaling a short-term cooldown in network activity.

Ethereum faces strong resistance – What’s the next step?

As predicted previously by AMBCrypto, Ethereum now faces a critical resistance zone between $2,200 and $2,250. Breaking above this zone could pave the way for a retest of the $2,400-level.

However, if ETH struggles to maintain its momentum, it could face a pullback to the $2,000-support level. Therefore, market participants will need to watch for signs of either a breakthrough or a potential reversal.

Conclusion

Ethereum has seen some strong signs of recovery, with positive MVRV ratios and growing institutional interest. However, the $2,300-resistance remains a significant hurdle.

While ETH has the potential to break through this level, overcoming it will require sustained buying momentum and the clearing of key barriers. Given the prevailing market conditions, Ethereum is likely to face challenges in breaking this resistance in the short term.