Ethereum’s gas prices slipping but what does it mean for NFT buyers

Petrol prices may be climbing worldwide, but in the crypto world, it’s a very different story. In fact, since February 2022, it’s been a good time to take that road trip you’ve been thinking of. And by road trip, we mean running that pending smart contract on Ethereum.

Yes, gas fees are indeed coming down. However, the aftereffects have not been as expected.

Put away the antacids!

Indeed, Santiment agreed that gas fees were on the way down. However, “affordable” doesn’t necessarily mean cheap. For many Ethereum users, fees could be lower still, especially when compared to alts like Solana [SOL] and Binance Coin [BNB].

? #Ethereum's fees have been much more affordable than we've seen for the past 8+ months. The average gas fee sits at just $5.81. For comparison, average fees bloated to $69.57 on May 11, 2021, and $62.85 on November 8, 2021. https://t.co/Z0APC5w08N pic.twitter.com/E9bUuOj1tE

— Santiment (@santimentfeed) April 6, 2022

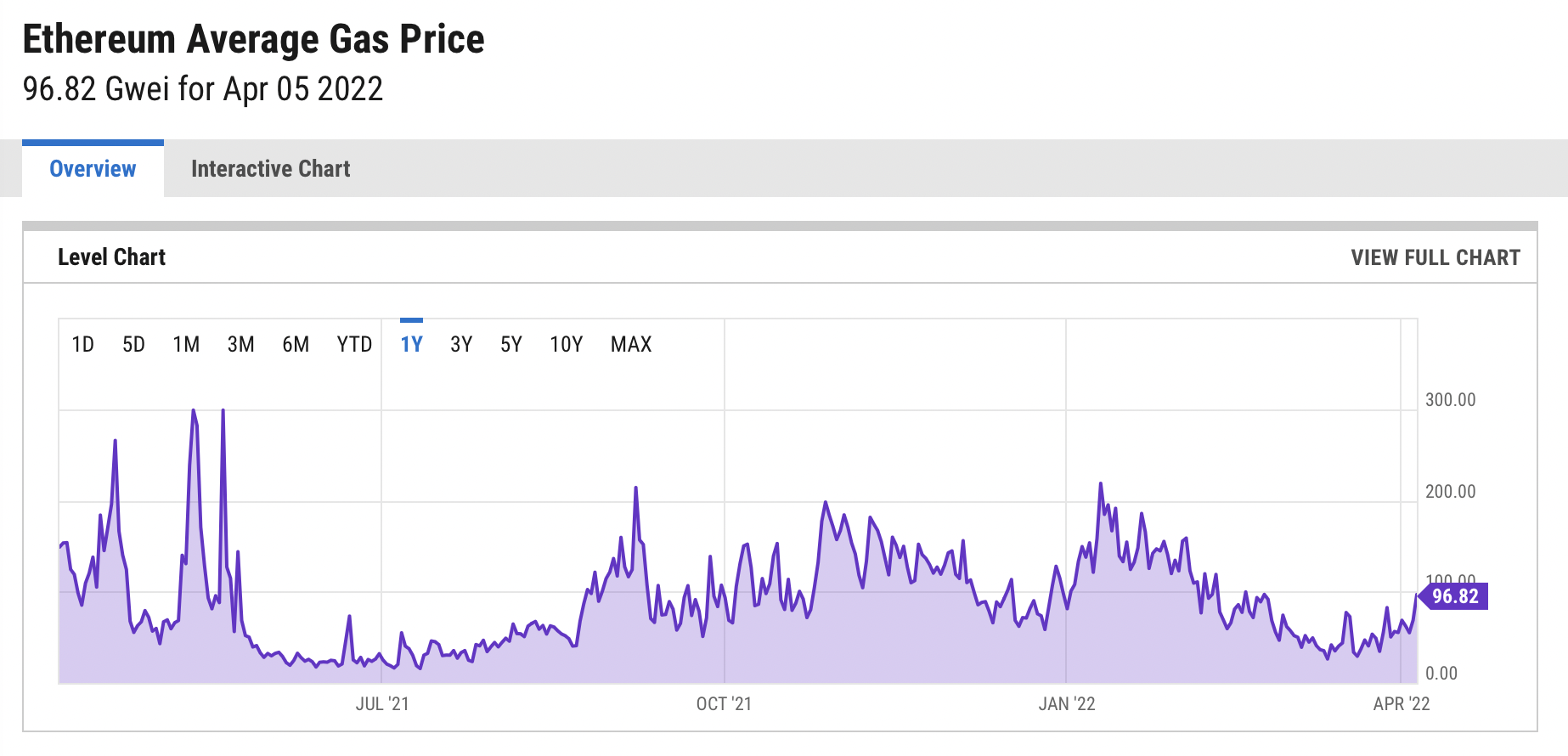

On 5 April, the average gas price was around 96.82 gwei – an uptick when compared to prices seen in March. However, this was the highest average gas price on record since 23 February 2022.

Source: ycharts.com

Naturally, you might expect that NFT lovers were over the moon and that many used this opportunity to expand their collections.

However, the facts point to a different outcome.

OpenSea or Dead Sea?

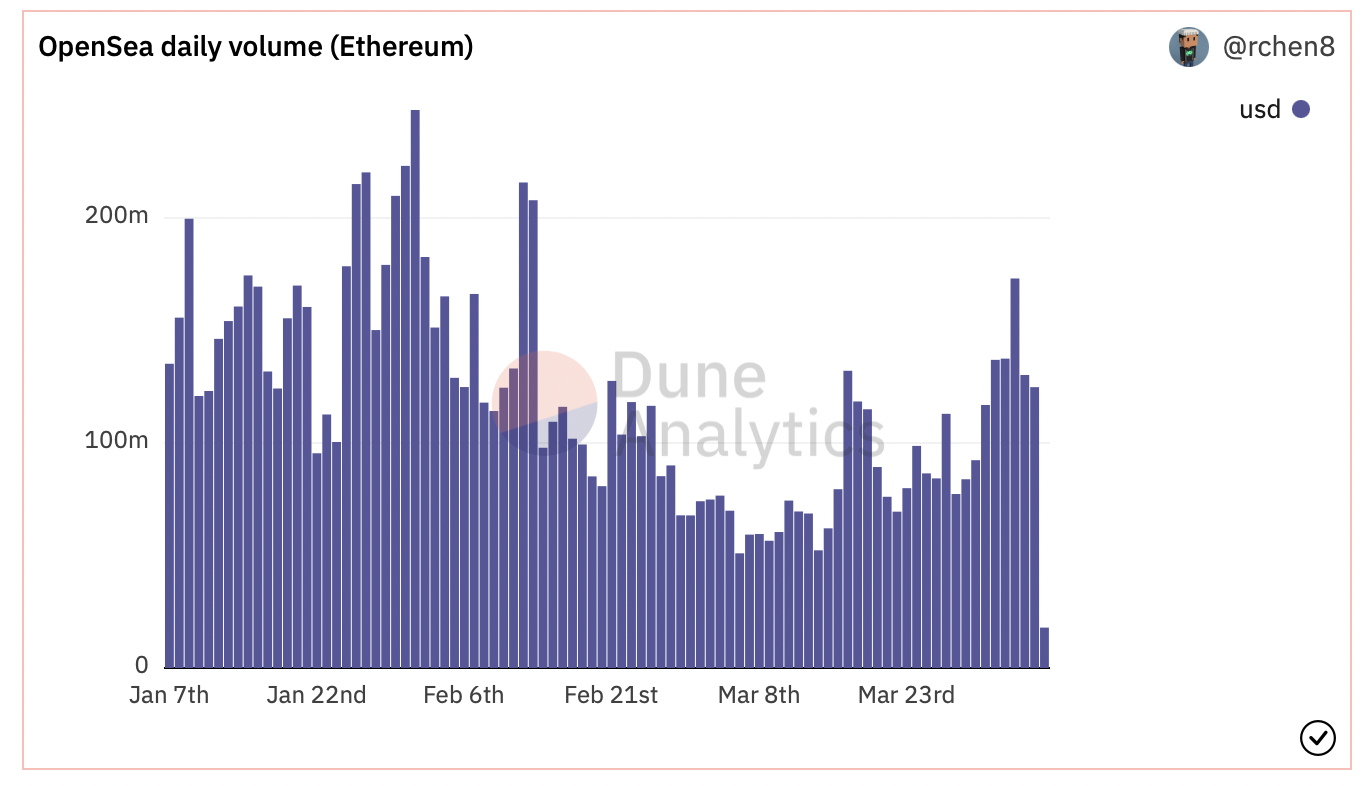

According to Dune Analytics, OpenSea [Ethereum] saw rising stats that hit an all-time high in January 2022. However, since then, there has been a month-by-month drop in volumes, NFTs sold, and monthly fees.

Adding on to that, daily volume for OpenSea [Ethereum] was steadily declining through February and March despite a drastic fall in gas fees.

Source: Dune Analytics

On the other hand, are these rather disappointing stats the result of rising NFT numbers on other blockchains? Well, it depends. Between 7 March and 6 April, Solana saw only five days when transactions crossed 100,000. What’s more, its sales have been falling as well.

At press time, the top-performing NFT collections were CyberBrokers, CloneX, and Mutant Ape Yacht Club, according to CryptoSlam. An Ethereum-based collection, CyberBrokers, saw sales of $9,967,148 after jumping up by around 900% in the last 24 hours. In fact, the top 17 NFT collections were all Ethereum-based at press time.

This tells us that whether gas fees are going up or down, Ethereum’s dominance in the NFT space is still unshaken.

![Ripple [XRP]](https://ambcrypto.com/wp-content/uploads/2025/01/Ritika-1-24-400x240.webp)