Ethereum’s Open Interest rises: Why you should keep an eye on it

- Ethereum’s recent price spike sparked optimism among traders.

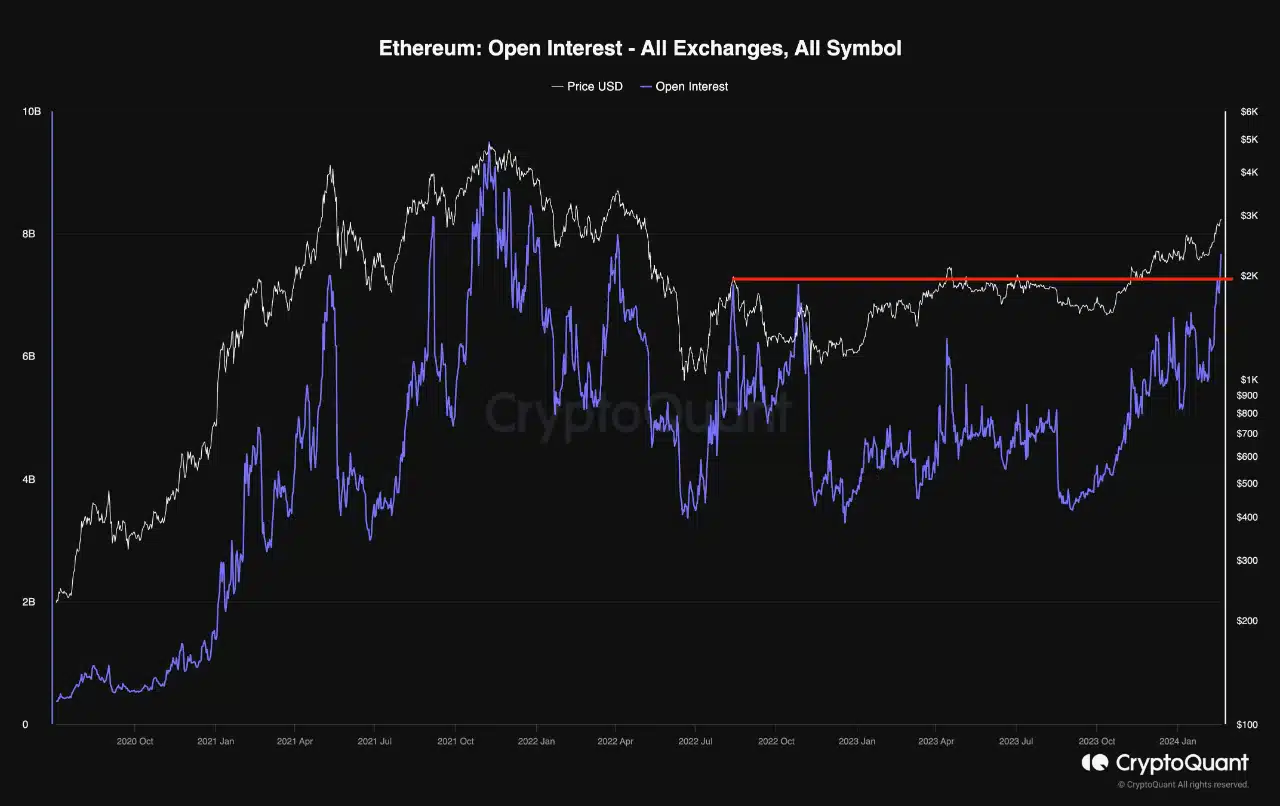

- The altcoin’s Open Interest surged, reaching its highest level since July 2022.

The recent jump in Ethereum’s [ETH] price inspired massive optimism from traders over the last few weeks.

A spike in interest

As per Gretaest_Trader’s data, a crypto analyst on CryptoQuant, there was a marked improvement in the king of altcoins’ Open Interest (OI) over the last few days.

For context, the Open Interest encompasses the total number of open Futures contracts across all exchanges, regardless of trade direction.

The above data also uncovered that the OI had reached its peak levels, which it hadn’t observed since July 2022.

However, this heightened confidence comes with a trade-off – an increased risk of price volatility.

Will ETH reach new highs?

In terms of price, ETH was observed to be doing extremely well. At press time, the king of altcoins was trading at $2,926.08, with its price having grown by 0.15% in the last 24 hours.

The velocity at which ETH was trading had also grown during this period. This suggested that the frequency with which ETH was being traded had picked up significantly in the last few days.

But despite these factors, Ethereum’s Network Growth had plummeted. This decline suggested that new addresses may be losing interest in Ethereum.

So, one could argue that the altcoin’s price jump was a result of existing holders who were accumulating additional ETH, rather than an influx of new participants.

Is your portfolio green? Check out the ETH Profit Calculator

This shift in network dynamics also raised questions about the sustainability of ETH’s current price rally, as it may lack broad-based support from a growing user base.

However, the upcoming Dencun upgrade may attract new liquidity to ETH in the future, which may help sustain the altcoin’s price rally.