Ethereum’s path to $6000: Before that rally, here’s what you can expect

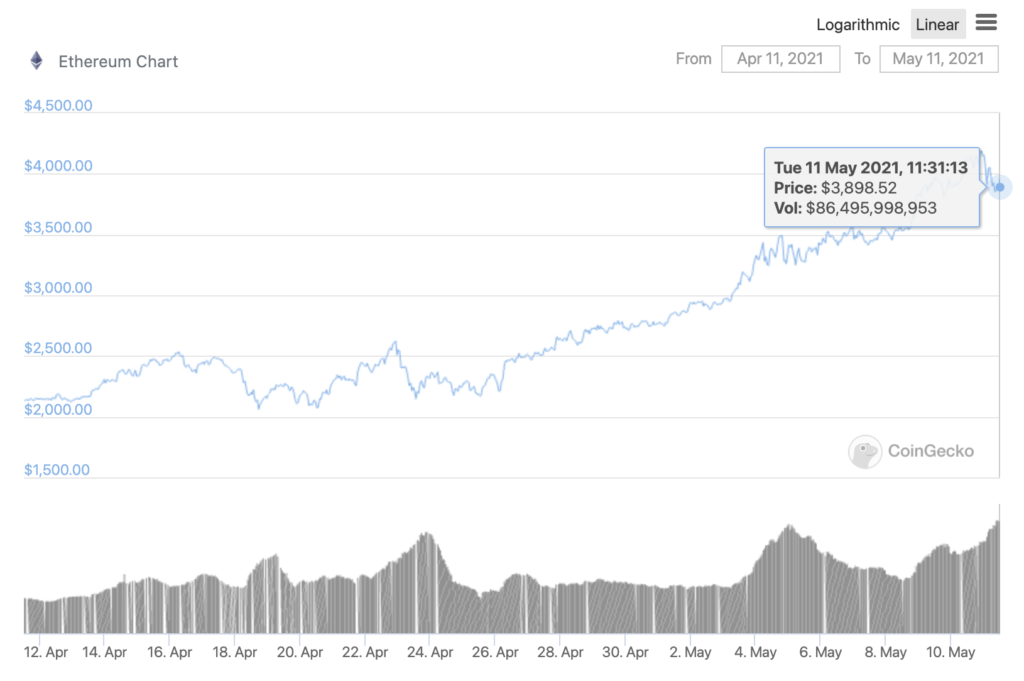

Typically, the cryptocurrency market witnesses retraced highs of several altcoins. This was the case with Ethereum; the alt dropped below the $3800 level within 24 hours after breaching a new ATH. The new ATH above $4197 was held briefly before a near 5% drop in price.

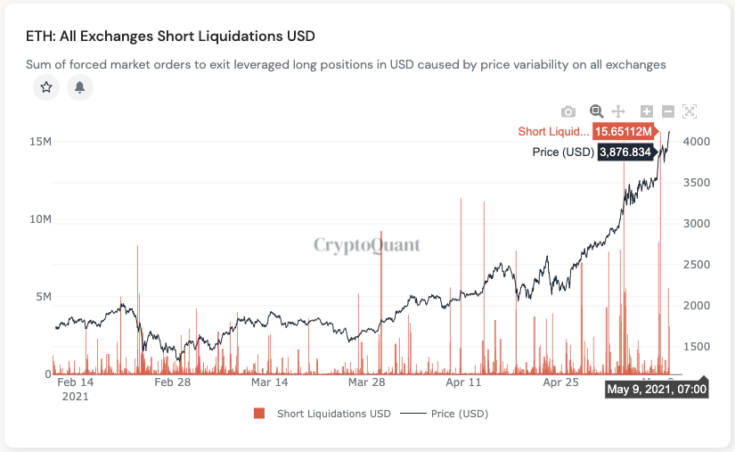

The trade volume has increased by over 20% across exchanges. These metrics signal an incoming bearish sentiment among retail traders. Despite bullish long-term predictions for Ethereum’s price in the long-term, the current hourly short liquidations across all derivative exchanges have hit a year high.

ETH Short Liquidations USD || Source: Twitter

ETH hourly short liquidations across all derivative exchanges have hit levels higher than those in Feb 2021. This data only includes ETH/USDT, ETH/USD perpetual futures contracts. In addition to the liquidations across derivative exchanges, there is a shortage of supply since Binance had temporarily suspended ETH withdrawals on May 10, 2021, due to a large volume increase causing a withdrawal backlog.

A backlog in withdrawals could increase the selling pressure on Ethereum in the short term. Bitcoin’s estimated leverage ratio seems to have dropped, based on data from CryptoQuant. This means the cryptocurrency market is not over-leveraged anymore. This also means that there are more retail traders watching Ethereum, thus further increase in selling pressure and the correction is more likely.

However, there are further bullish signals for ETH’s price. ETH’s total value in the 2.0 Deposit Contract just reached an ATH of $18 Billion. This may have a positive impact on the price rally in the long term.

ETH price chart || Source: CoinGecko

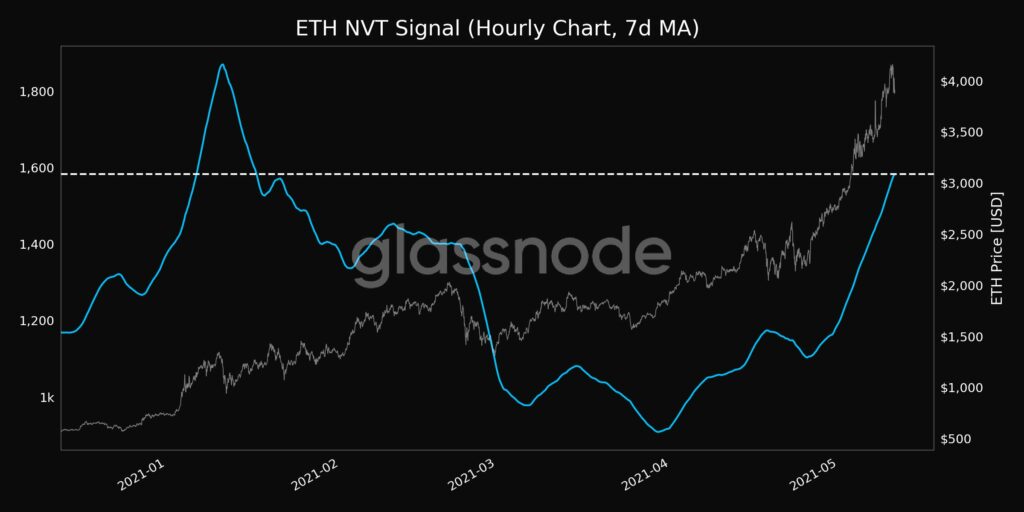

Since the price has hit consecutively higher ATHs since the beginning of 2021, comparing Ethereum’s YTD price performance vs tech-related stocks, ETH has quickly become one of the best-performing assets of 2021, with a 431.9% return. Following three long months, ETH’s NVT signal 7-day moving average hit a 3-month high of 1582 based on data from Glassnode.

ETH NVT Signal || Source: Twitter

Though upcoming major upgrades are expected to have a bullish impact on Ethereum’s price, based on on-chain analysis from into the block, current trader sentiment, social volume signal that there may be a correction. The price may drop below the $3000 level before the rally starts again, the current drop below $3800 may be just the beginning.