Ethereum’s price teeters: What about its bullish prediction?

- ETH may fall to $2,215 as large sell-off spreads.

- Traders are confident that the altcoin will recover in no time.

According to Whale Alert, a whale sent 14,610 Ethereum [ETH] tokens to the Coinbase exchange on the 30th of December. The transaction was the second one within 12 hours after an initial transfer involving 9,991 ETH.

As of this writing, the value of the transaction was worth $33.50 million. The move is a sign that the altcoin might be at risk of selling pressure.

If the cryptocurrency keeps experiencing a high inflow into exchanges, then the price could drop from $2,220.

Interestingly, the last week of 2023 has given the ETH a turnaround. On the 28th of December, the value of ETH hit $2,415 as AMBCrypto reported.

This increase gave the Ethereum community a glimmer of hope that the ETH price season to shine was close.

No backing down on the potential

However, the past few days indicated that ETH holders might need to wait a little longer for an extended rally. But what do traders think of the price action?

AMBCrypto analyzed ETH’s funding rate via the crypto analysis tool Santiment.

Funding rates show if long are paying a funding fee to shorts. It also indicates if it’s the other way around. If the Funding Rate is positive, then most traders are bullish. Also, a negative Funding Rate suggests more short positions than longs.

At press time, ETH’s Funding Rate was 0.031%. This reading suggested that traders were bullish on the price at press time.

Another metric to consider in assessing market perception toward ETH is the Weighted Sentiment. From the chart above, the Weighted Sentiment had dropped from 2.47 to 0.48.

The decline suggested the broader market was being careful in betting on the Ethereum native cryptocurrency.

ETH eyes another downturn

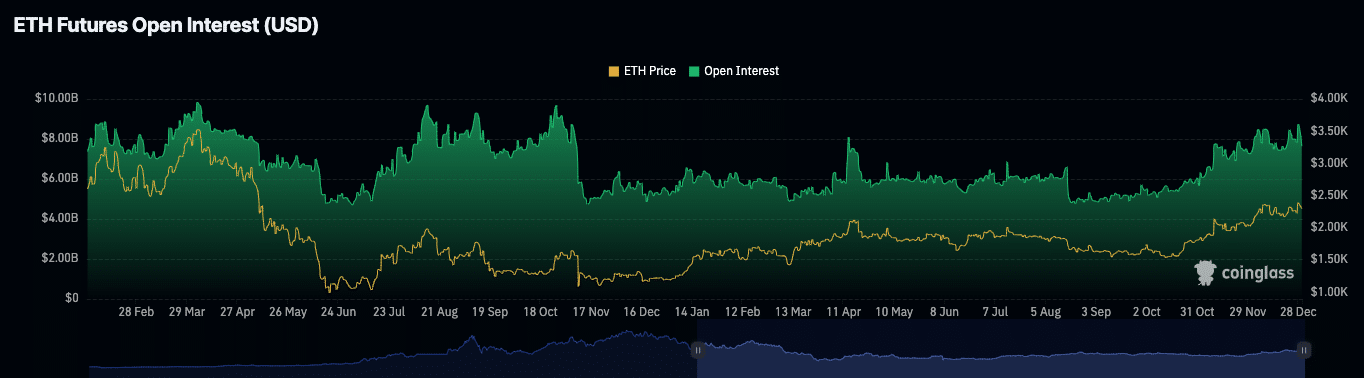

Regarding the Open Interest, Coinglass showed that the indicator had risen to $8.40 billion. Open Interest measures market sentiment and strength behind price trends.

So, the increase means that money was flowing into contracts related to ETH. However, it could also be a sign of strength for the downward trend ETH’s price was going through.

From the ETH/USD 4-hour chart, the altcoin had felt the impact of the sell-offs as the price decreased to $2,290. A look at the Awesome Oscillator (AO) also showed that the momentum around the coin was bearish.

At the time of writing, the AO was -10.45.

Should the indicator remain that way, then ETH’s price might plunge further. Another indicator to consider was the Fibonacci Retracement. At press time, the 0.786 Fib Retracement level was at $2,215.

Is your portfolio green? Check out the ETH Profit Calculator

This position indicated that ETH might drop to the region as long as selling pressure remained.

However, $2,215 could be a good entry. This is because ETH has the potential to rebound, since the price was a previous support level for the altcoin.