Ethereum

Ethereum’s price to $3000? Here’s why and why not that might happen!

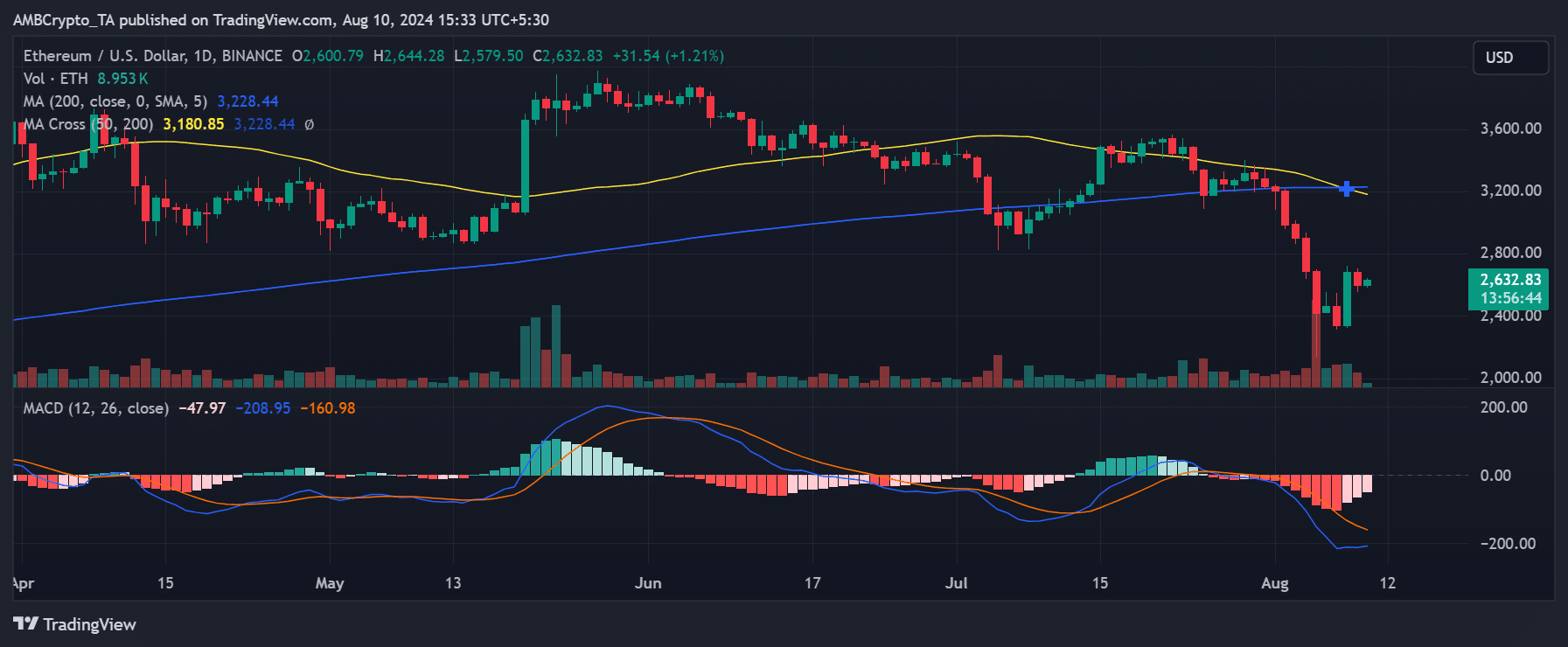

Ethereum is still wavering under $3,000 and a death cross is now here too.

- ETH, at press time, was testing the 0% Fibonacci level

- Its daily active addresses have remained above 400,000 too

Ethereum [ETH] recorded major bouts of depreciation over the last few weeks, pushing its price well below $3,000 – A level it had maintained for some time. Now, while there has been a recent rally, this uptick was not sufficient to restore it above the aforementioned level.

Considering the trend of other indicators and market dynamics, ETH may have some volatility ahead.

Ethereum sees a death cross

The recent price trend of Ethereum, despite a notable increase of 14.56% on 8 August, has led to a concerning technical formation known as a death cross.

This pattern emerged more strongly following a 3.10% decline on 9 August, which brought the price down to approximately $2,601. A death cross occurs when a shorter-term moving average (depicted here by the yellow line) crosses below a longer-term moving average (the blue line), signaling potential long-term bearish sentiment in the market.

Additionally, the Moving Average Convergence Divergence (MACD) analysis indicated that ETH’s momentum was negative. At the time of writing, the MACD line was positioned below the signal line.

However, there seemed to be subtle signs that this downward momentum may be losing strength. The MACD histogram showed signs of convergence, meaning the negative bars were becoming less pronounced. This could be indicative of weakening bearish momentum, which might precede a market reversal.

The bear and bull case for ETH

An analysis of Ethereum

using the Fibonacci Retracement indicator pointed to several potential price trends. At the time of writing, the price had bounced off the lows near $2,140 – the -61.8% Fibonacci retracement level. It was then testing the 0% Fibonacci retracement level at approximately $2,589.77.If the price remains above the 0% level ($2,589.77), it could test the next resistance levels at $2,870.67 (38.6% retracement) and $2,953.64 (50% retracement). Also, a successful breakout above the 50% level may lead to a further recovery towards the 61.8% retracement level at $3,039.51, and potentially higher.

Conversely, if the price fails to hold above the 0% Fibonacci level and faces rejection, it might revisit lower support levels.

A drop below $2,418.02 (23.6% retracement) could set the stage for a retest of the recent low near $2,140. If bearish momentum intensifies, Ethereum might even fall below $2,140, resulting in new lower lows.

Ethereum’s death crosses in the last three years

Here, it’s worth pointing out that Ethereum has seen a death cross for the third time in the last three years. The first instance occurred on 27 January 2022, when Ethereum was trading at approximately $2,500. Following this death cross, the price declined to about $1,500 over the next few months before recovering with a golden cross on 10 February 2023.

The second death cross happened on 2 September 2023, when Ethereum was valued at around $1,600. However, this cross was short-lived, with Ethereum quickly rallying and forming a golden cross on 21 November 2023.

After this golden cross, Ethereum noted significant uptrends, with the altcoin hitting the $4,000-level in early 2024.

Ethereum active addresses stay decent

An analysis of Ethereum’s daily active addresses chart on Santiment revealed a slight decline over the past few days.

Despite this drop, however, the number of active addresses has remained above the 400,000-threshold. On 3 August, active addresses were over 470,000, but by 9 August, this number had fallen to around 425,000. At press time, the number of active addresses stood at over 230,000.

– Read Ethereum (ETH) Price Prediction 2024-25

If daily active addresses continue to decline, this could lead to decreased network activity and further downward pressure on the price.

Conversely, if active addresses stabilize or rise and the price breaks above key resistance levels, Ethereum could see a more sustained recovery.