Ethereum

Ethereum’s remarkable bull run: Profits and trends unveiled

Ethereum’s surging value brings profits for holders, but stagnant new addresses indicate a challenge in engaging fresh users amid market highs.

- ETH’s 180-day MVRV moved above 1%.

- Daily new Ethereum addresses dropped below 70,000.

Of late, Ethereum’s [ETH] price trend has been notably strong. We may be on the verge of a new uptrend, as recent data suggests that certain groups of holders are beginning to profit. How have holders at various levels fared during the current price surge?

Realistic or not, here’s ETH’s market cap in BTC’s terms

Ethereum maintains a bull trend

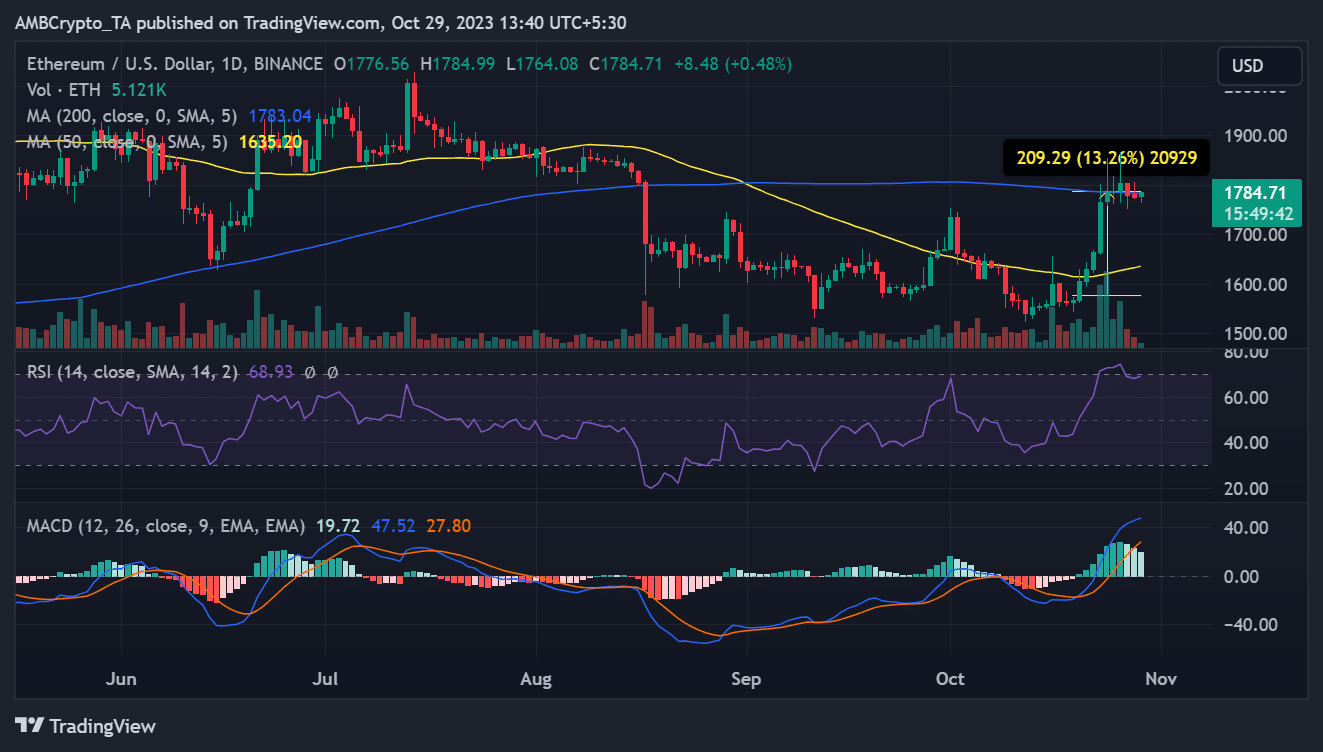

On the daily timeframe chart, Ethereum

has seen a gain of approximately 13% since the start of its uptrend. Although there was a recent minor decline, it pales in comparison to the substantial gains observed in the past few days.At the time of writing, Ethereum was trading above the $1,780 price level, with a gain of less than 1%. Additionally, the recent consecutive declines have pushed its Relative Strength Index (RSI) below 70.

Nevertheless, this dip below the 70 mark hasn’t undermined the ongoing bullish trend.

Furthermore, with the current trend, some Ethereum (ETH) holders have finally started to see profits.

Ethereum MVRV shows entry to profitability

As per the Market Value to Realized Value (MVRV) chart by Santiment, some holders have finally entered profitability. Specifically, the 180-day MVRV from Santiment indicated that holders in this group were holding over 1% profit at press time.

The chart displayed an MVRV surpassing the 1 mark and reaching 1.7% at the time of this writing. This is particularly noteworthy since this group had been in a loss position for more than three months.

Additionally, this recent development raises the possibility of Ethereum experiencing further upward trends as more holders are now in profit. Furthermore, an examination of the 90-day MVRV revealed even greater profitability within this group.

The chart illustrated a 90-day MVRV exceeding 7% as of the present moment. With various categories of holders now holding assets at a profit, ETH may be poised for a more substantial bullish run.

New addresses show less impressive trend

While Ethereum has been witnessing notable uptrends, it appeared that these movements have not triggered a substantial response from new users. This observation could be drawn from the new address metric on Glassnode.

Is your portfolio green? Check out the ETH Profit Calculator

Additionally, a closer examination of this metric revealed a lack of significant recent trends, with a notable decline in the number of daily new addresses. At the time of this writing, this decline was evident, with the number of new addresses standing at 65,525.

This suggested that on-chain activities were being driven by existing addresses, instead of an influx of new users.