Ethereum’s transaction fee sets a new record, the L2s can’t keep calm

Ethereum, the largest altcoin underwent the much-anticipated Merge that saw it transition into a Proof-of-Stake (PoS) consensus. Well, the mechanism has changed, but ETH continues to give mixed signals to traders.

Two sides of the same coin

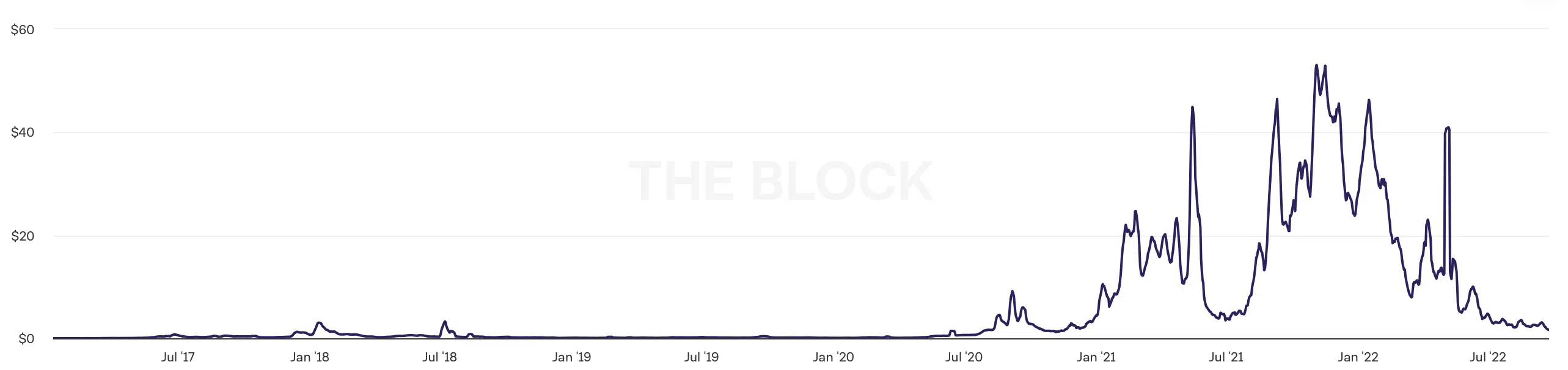

Despite being one of the most prominent blockchains, Ethereum’s biggest drawback was its extraordinarily high transaction costs. Consider this- the Ethereum network charged an average gas fee of about $40 per month between January 2021 and May 2022, with 1 May 2022 seeing the highest average daily gas price of $196.638.

But these scenarios seem to have taken a toss especially now after the Merge. Ethereum transactions have reportedly become a lot cheaper. As per data from The Block, on 22 September, Ethereum’s transaction costs were at their lowest point in the past two years.

The average gas fee of the Ethereum network has decreased to 0.0011 ETH ($1.5). Well, keeping Merge aside, there could be other reasons for the fall in gas fees.

It could be the broader market drawdown- the crypto markets witnessed a major crash in the last two months, driving crypto prices down. ETH, at press time, was trading around $1.2k. Ergo, falling by more than half from its peak.

Another reason for the fall in gas fees could be major liquidation, especially in the NFT domain. Interest in speculative NFT buying dropped significantly on Ethereum. Consider one narrative involving the largest NFT marketplace, OpenSea.

OpenSea contributed to a huge portion of the total gas consumption but has fallen significantly since January. It consumed 230,000 ETH or roughly 16,400 ETH month-over-month (MoM). But within the last 30 days, this MoM declined significantly.

At press time, it went well below the MoM average sitting at roughly 1,100 ETH.

Greener pasture

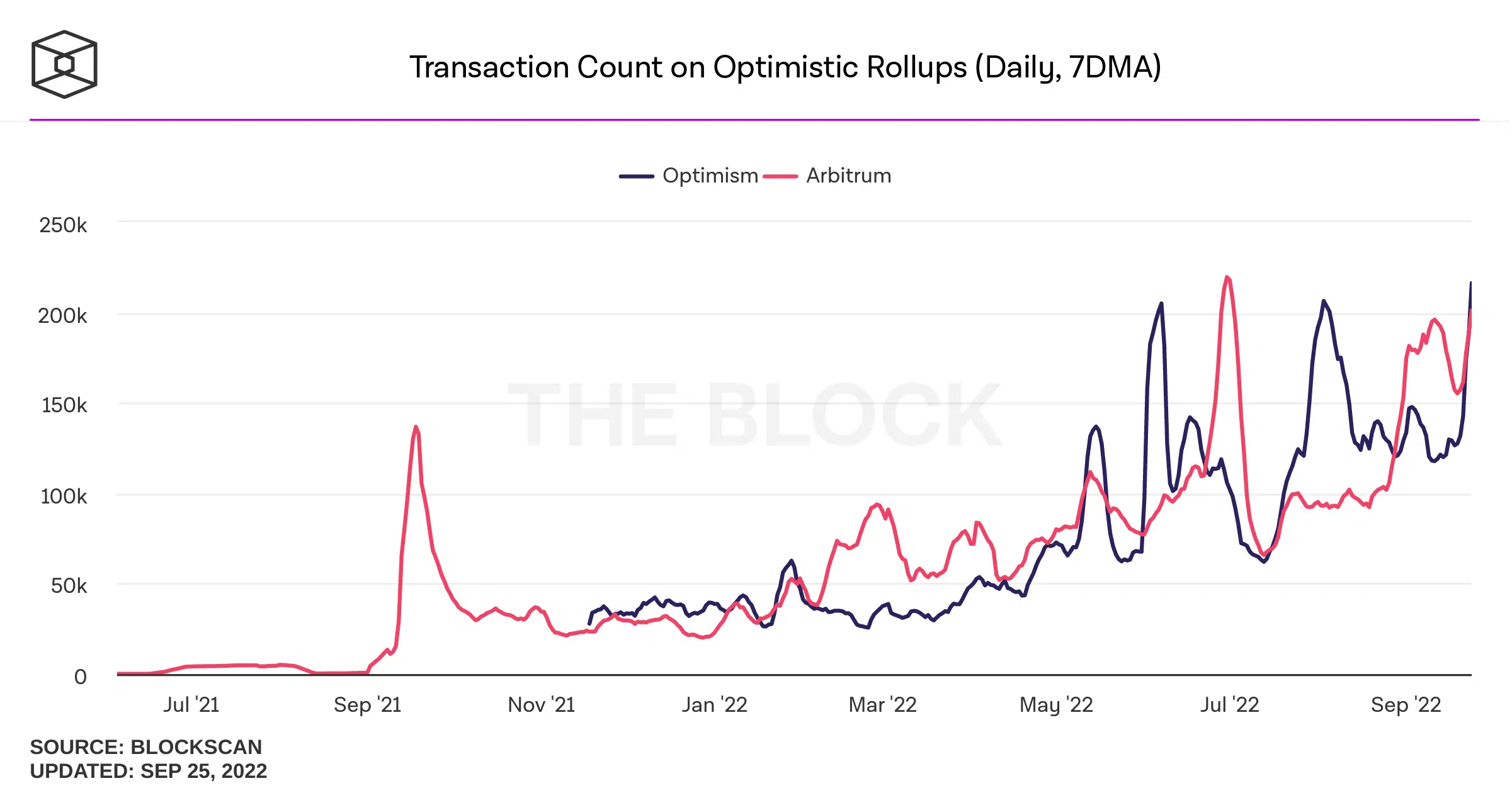

Moving on to the other side, ETH’s metrics did see some interesting narrative, thanks to growth in L2s, Arbitrum, and Optimism.

In fact, active addresses on the Ethereum network surged by 60% on the same platform. Ethereum’s layer two (L2) scaling solutions — mainly those based on optimistic rollups — became more popular.

While it is true that Ethereum transaction costs recorded new lows, the number of transactions on these L2 blockchains went up.