ETH’s $3,200 test: Will Ethereum whales drive the rally or cause a setback?

- Ethereum’s price surge to $3,200 draws attention to Ethereum whales and long-term holders.

- Increased whale activity could fuel further growth, but profit-taking by LTHs may limit upside.

After months of consolidation, Ethereum [ETH] has rallied significantly in response to a surge in Bitcoin’s value, bringing it to a critical resistance level around $3,200.

The coming weeks will be pivotal, as market participants monitor the actions of long-term holders (LTHs) and Ethereum whales. Their behavior could either propel Ethereum’s price higher or introduce fresh selling pressure, testing the sustainability of this latest rally.

Ethereum’s price increase

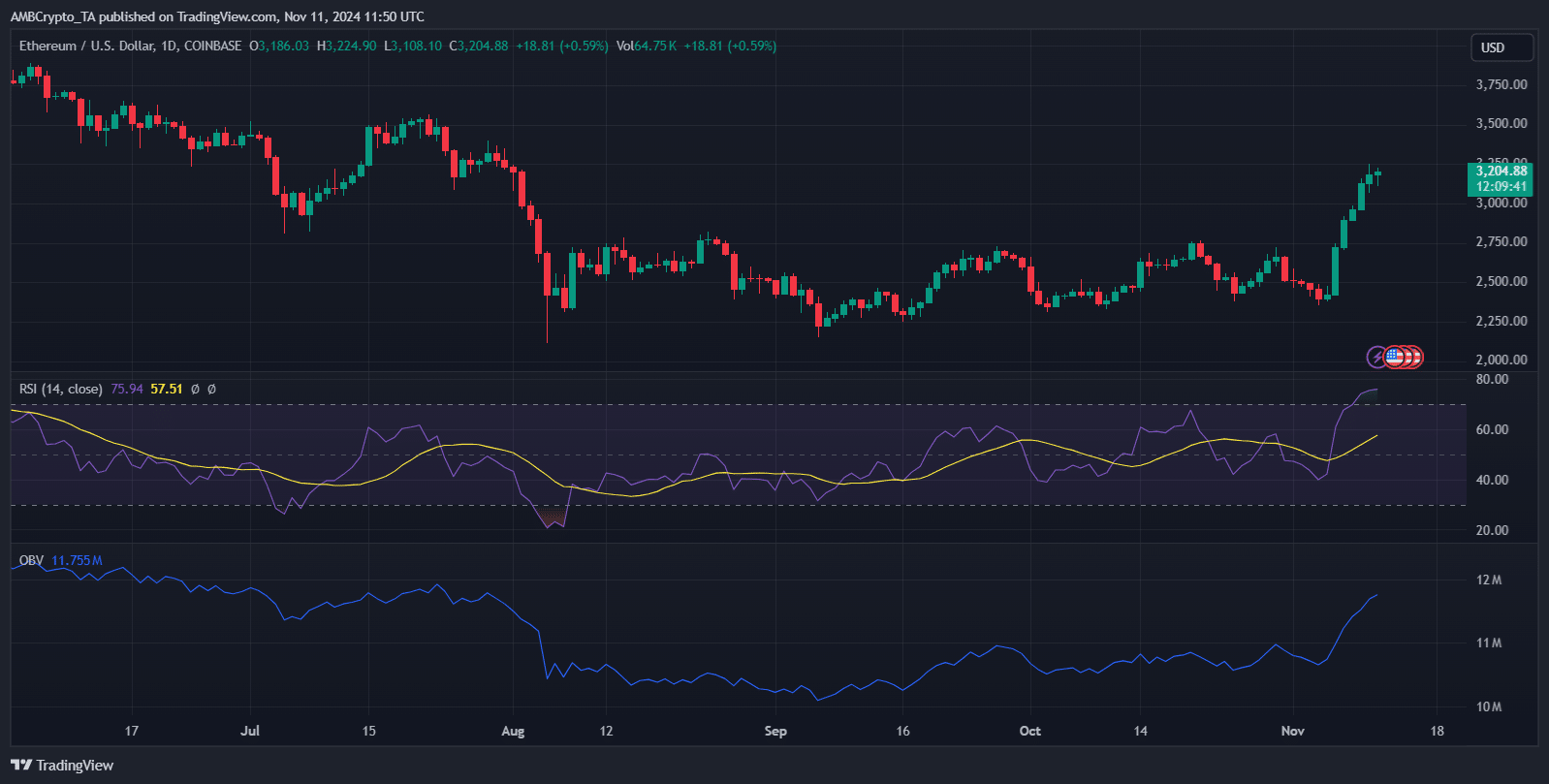

Ethereum’s price has rallied recently, nearing a key resistance level around $3,200 following months of consolidation around $2,700.

The 14-day RSI stood at approximately 76, indicating overbought conditions and suggesting a potential for price consolidation or a pullback as traders may start to take profits.

However, an overbought RSI can also reflect strong bullish momentum, which could fuel a breakout if sustained.

The OBV was trending sharply upward, indicating strong volume accumulation backing this price movement. This suggests that whale activity could be supporting the rally.

Such significant buying interest is crucial for ETH to break through the current resistance and sustain further gains. If whales continue to accumulate, ETH may push higher.

Whale activity and its impact

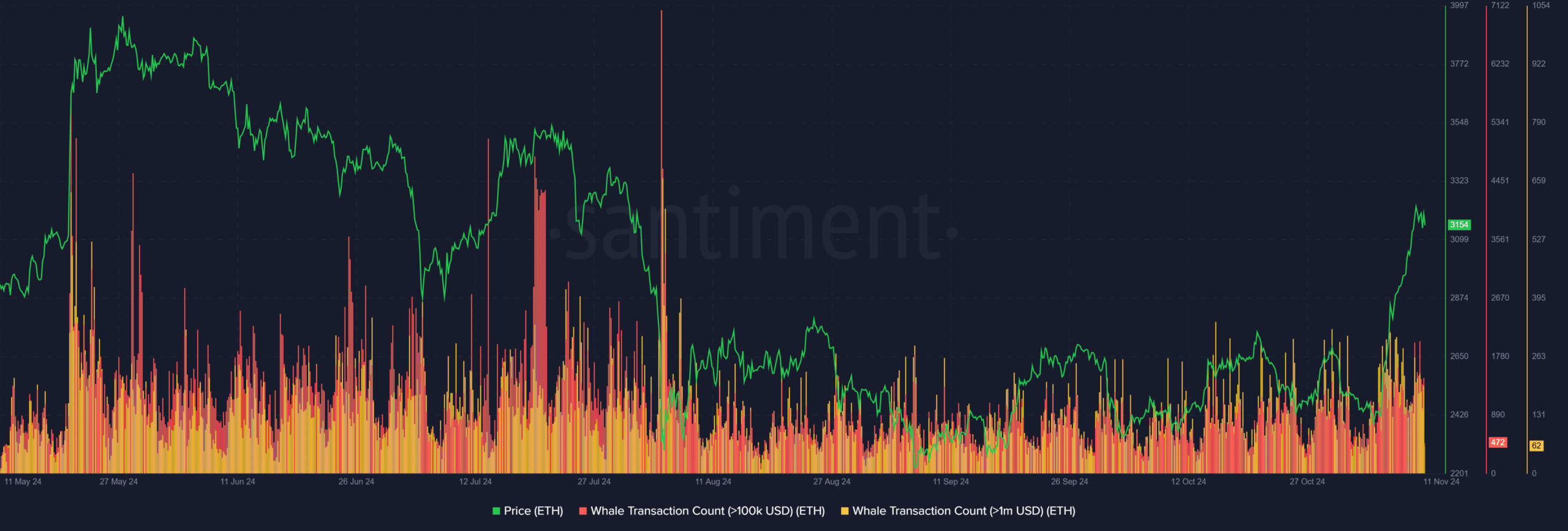

Whales play a pivotal role in Ethereum’s price dynamics. The recent surge in whale transaction volume and steady accumulation underscores their influence in driving the bullish momentum.

This strategic positioning by large investors often signals confidence in sustained upward movement. Their continued activity is a strong indicator that the current rally is underpinned by solid, high-capital backing, potentially foreshadowing further price advances.

Role of LTHs in Ethereum price action

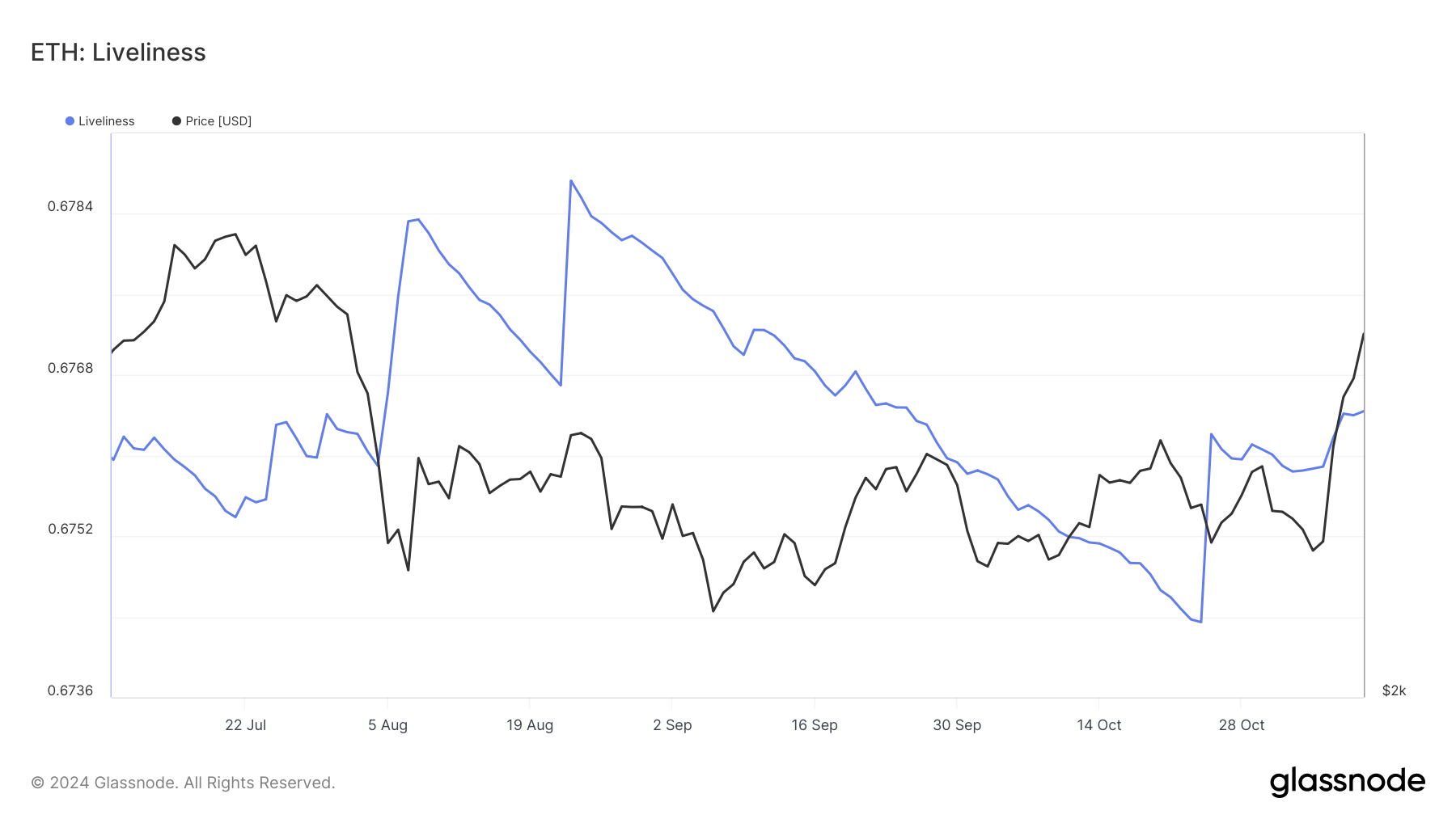

Throughout September and October, Ethereum’s liveliness was on a steady decline, hinting at accumulation by long-term holders (LTHs) as the market found equilibrium at lower price levels.

LTHs, known for their resilience during volatility, often provide a stabilizing force, absorbing supply and mitigating sharp drops.

Read Ethereum Price Prediction 2024-25

However, the recent uptick in liveliness amid ETH’s climb toward $3,200 signals that some of these seasoned holders may be taking profits.

This subtle change could act as a bellwether for shifting market dynamics – indicating a potential tapering of the rally’s momentum as LTH distribution could introduce renewed supply pressure.