Examining how Bitcoin ETFs drove Galaxy Digital’s 40% hike

- Galaxy Digital’s net income jumped 40%, with the same attributed to spot Bitcoin ETFs’ impact

- Galaxy Trading also saw a hike in revenue and volumes

Galaxy Digital Holdings Ltd. has emerged as a significant player in the financial realm after seeing a surge in net income by 40% to $422 million. Interestingly, analysts are attributing this growth to the impact of spot Bitcoin [BTC] Exchange Traded Funds (ETFs).

In fact, the upward trajectory coincided with a notable resurgence in net inflows observed in spot Bitcoin ETFs on 14 May, following four consecutive weeks of outflows. According to reports, there were total inflows of $116.8 million last week, indicating renewed interest among investors.

Good day for Bitcoin

These inflows might have had an impact on the price action of Bitcoin too. After flashing all reds over the past week, Bitcoin, at press time, was recovering on the charts following a 6% hike in 24 hours.

The same was confirmed by the Relative Strength Index climbing close to the 50-level on the charts.

Providing further insights into Galaxy Digital’s Q1 results, analyst Joseph Vafi noted,

“Spot bitcoin ETF approvals have been a major catalyst for the increase in counterparty engagement as some of the more traditional asset managers and hedge funds are entering/reentering the space.”

According to the firm’s first-quarter report,

“Trading reported counterparty trading revenue of $66 million in the first quarter, primarily driven by increased revenue from derivatives and favorable asset price movements.”

Galaxy Digital’s Q1 report

The report further claimed that counterparty trading volumes appreciated by 78%, compared to the prior quarter. This, while the average loan book size expanded to $664 million.

This underlines the increasing importance of platforms like Galaxy Trading in facilitating digital asset exchange and investment.

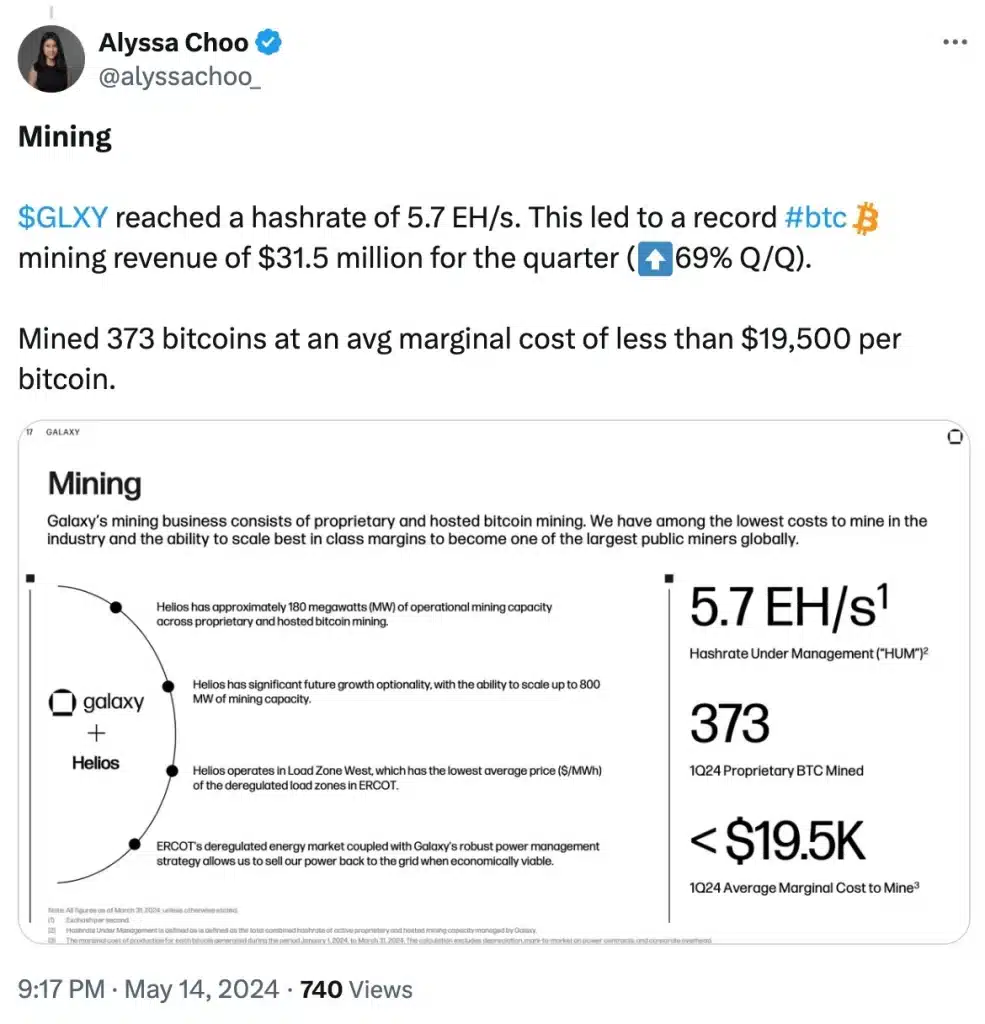

Additionally, Galaxy posted a record Bitcoin mining revenue of $31.5 million, a 69% hike from the previous quarter.

Here, it’s worth noting that the company mined 373 bitcoins at an average cost of less than $19,500 per Bitcoin, highlighting its efficiency in its mining processes.

Remarking on the same, Mike Novogratz, CEO of Galaxy Digital Holdings Ltd, said,

“Our first-quarter results underscore the strength and resilience of our business model.”

In conclusion, while optimism prevails, market uncertainties remain unpredictable. However, the launch of the Invesco Galaxy Bitcoin ETF, along with two new XTrackers Exchange Traded Commodities in partnership with DWS Group, paints a promising path forward for the firm.