Examining if Bitcoin’s price will slide to $58K post-halving

- BTC was down by more than 4.5% in the last 24 hours.

- Market indicators and metrics hinted at a continued price decline.

The wait is coming to an end as Bitcoin [BTC] will undergo its fourth halving in just a few hours.

The importance of this process has given rise to multiple speculations related to how the king of crypto’s price might react in the near term.

To understand what to expect from BTC post-halving, AMBCrypto analyzed BTC’s on-chain data.

Bitcoin halving is happening soon

The halving is one of the most major events in the crypto space, as it affects Bitcoin’s supply. After the process is completed, BTC miners’ rewards will be reduced by half.

As enthusiasts waited eagerly, BTC bears continued to dominate the market.

According to CoinMarketCap, BTC was down by more than 13% last week. In fact, in the last 24 hours alone, the coin’s value dropped by nearly 4%.

At press time, it was trading at $60,995 with a market capitalization of over $1.2 trillion.

The halving also might not have an immediate positive impact on the coin’s price.

Michael van de Poppe, a popular crypto analyst, recently posted a tweet highlighting that investors might witness several calmer days before another impulse.

Bitcoin’s Fear and Greed Index’s value was also dropping as it was getting closer to the neural mark. This also suggested a few slow-moving days. At press time, the indicator had a value of 57.

A price drop is likely

AMBCrypto then checked other datasets to see whether bears would exert more pressure.

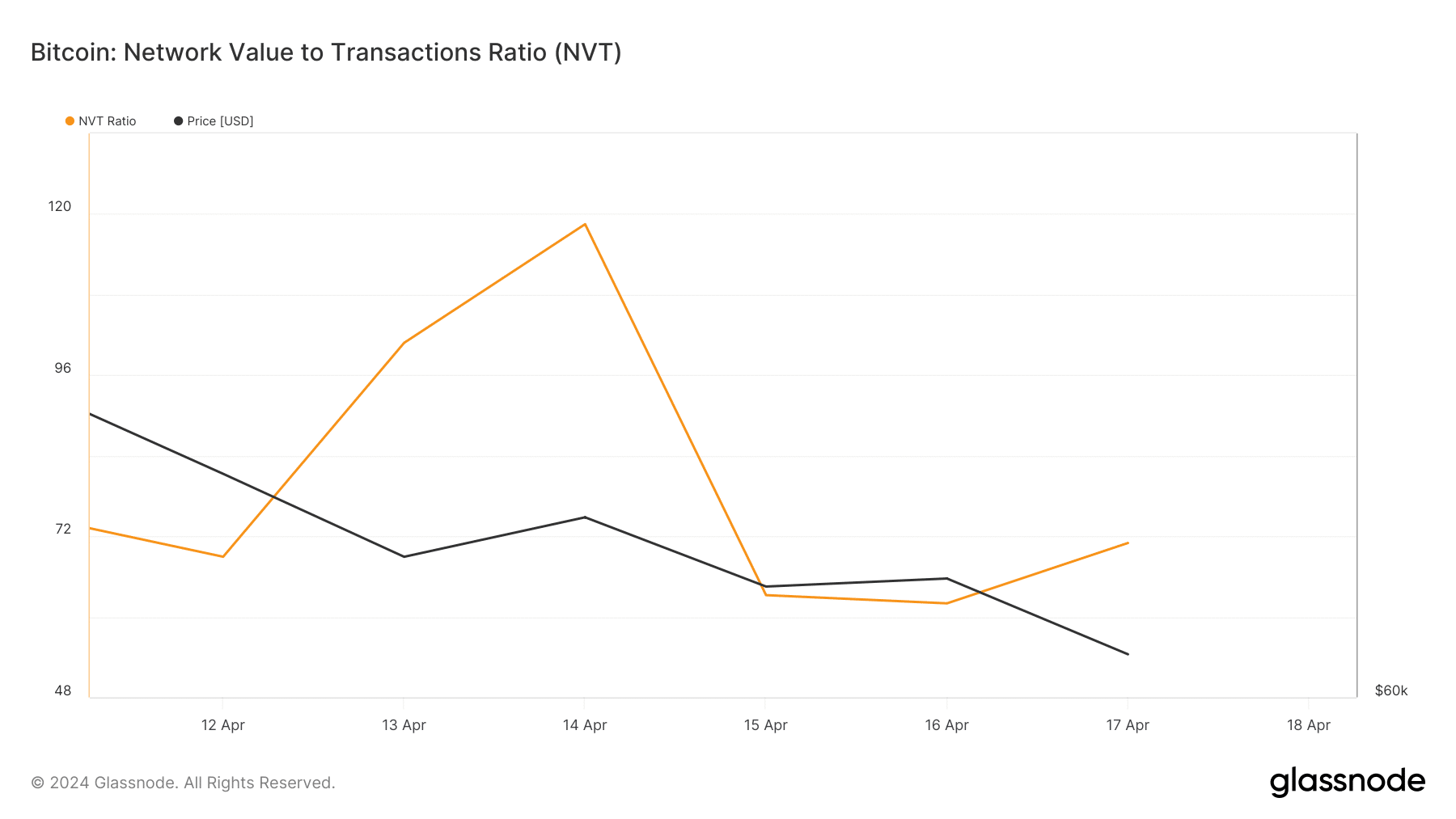

Our analysis of Glassnode’s data revealed that after a sharp decline on the 15th of April, BTC’s network to value (NVT) ratio registered an uptick.

An increase in the metric suggests that an asset is overvalued, hinting at a price correction.

CryptoQuant’s data revealed that BTC’s Net Unrealized Profit and Loss (NUPL) was rising. This meant that investors were in a “belief” phase where they were currently in a state of high, unrealized profits.

Nonetheless, the aSORP looked optimistic as it indicated that more investors were selling at a loss. In the middle of a bear market, it can indicate a market bottom.

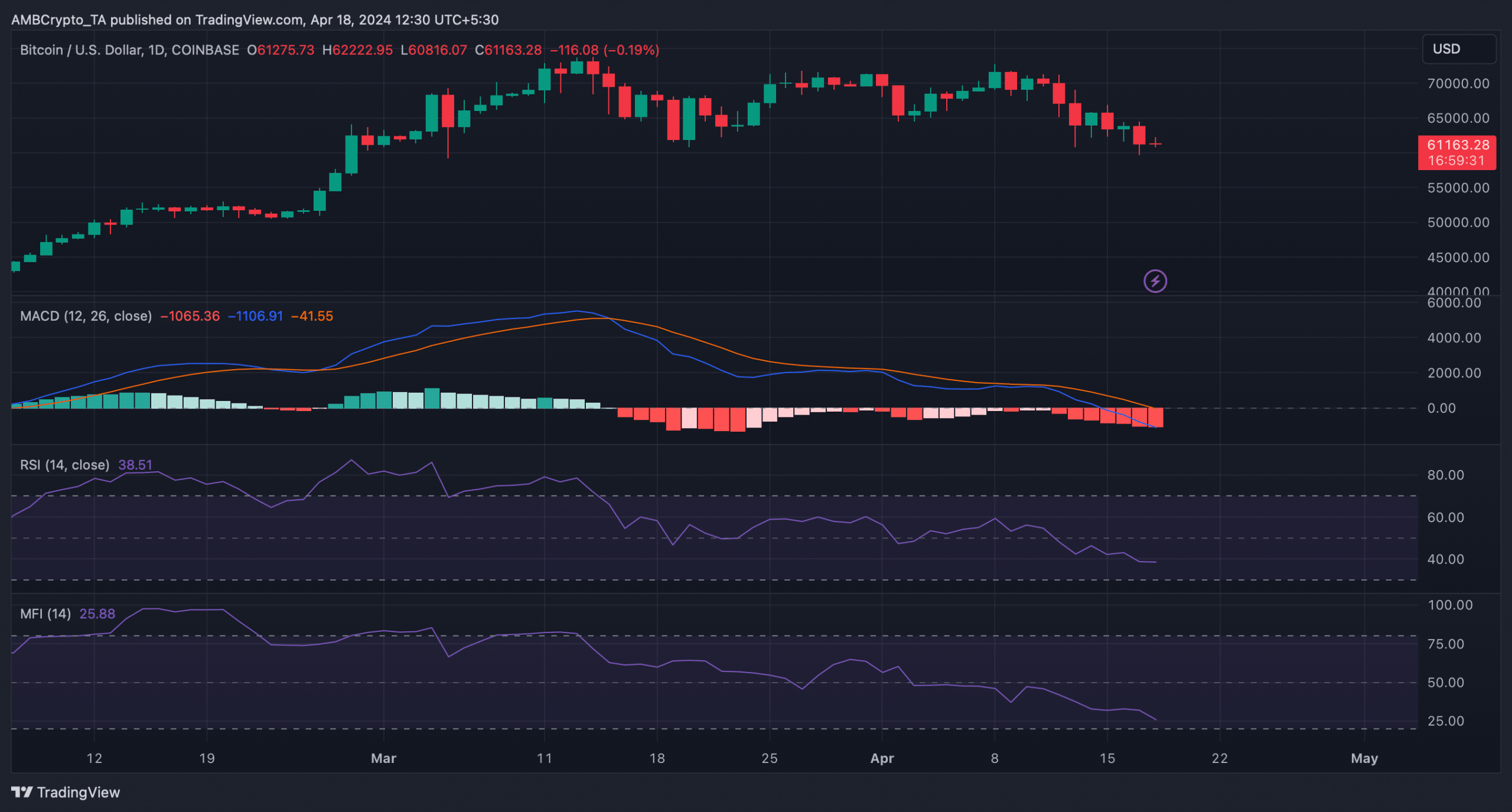

However, technical indicators remained bearish. For instance, both BTC’s Relative Strength Index (RSI) and Money Flow Index (MFI) registered downticks.

The MACD displayed a clear bearish upperhand in the market, hinting at a further price decline.

Read Bitcoin’s [BTC] Price Prediction 2024-25

AMBCrypto then checked Hyblock Capital’s data to find the support levels at which BTC might plummet to post-halving if the downtrend continues. As per our analysis, BTC has a support level near $59,950.

A plummet under that level could be dangerous, as it might push BTC’s price down near $58k, where a substantial amount of BTC will get liquidated.