Altcoin

Examining REEF crypto’s 80% decline in 24 hours – How, why, and what next?

REEF crypto flashed mixed signals after its recent dump. What’s next for the altcoin?

- REEF crypto fell by 80% in 48 hours

- Is a rebound likely as weighted sentiment hits a monthly high?

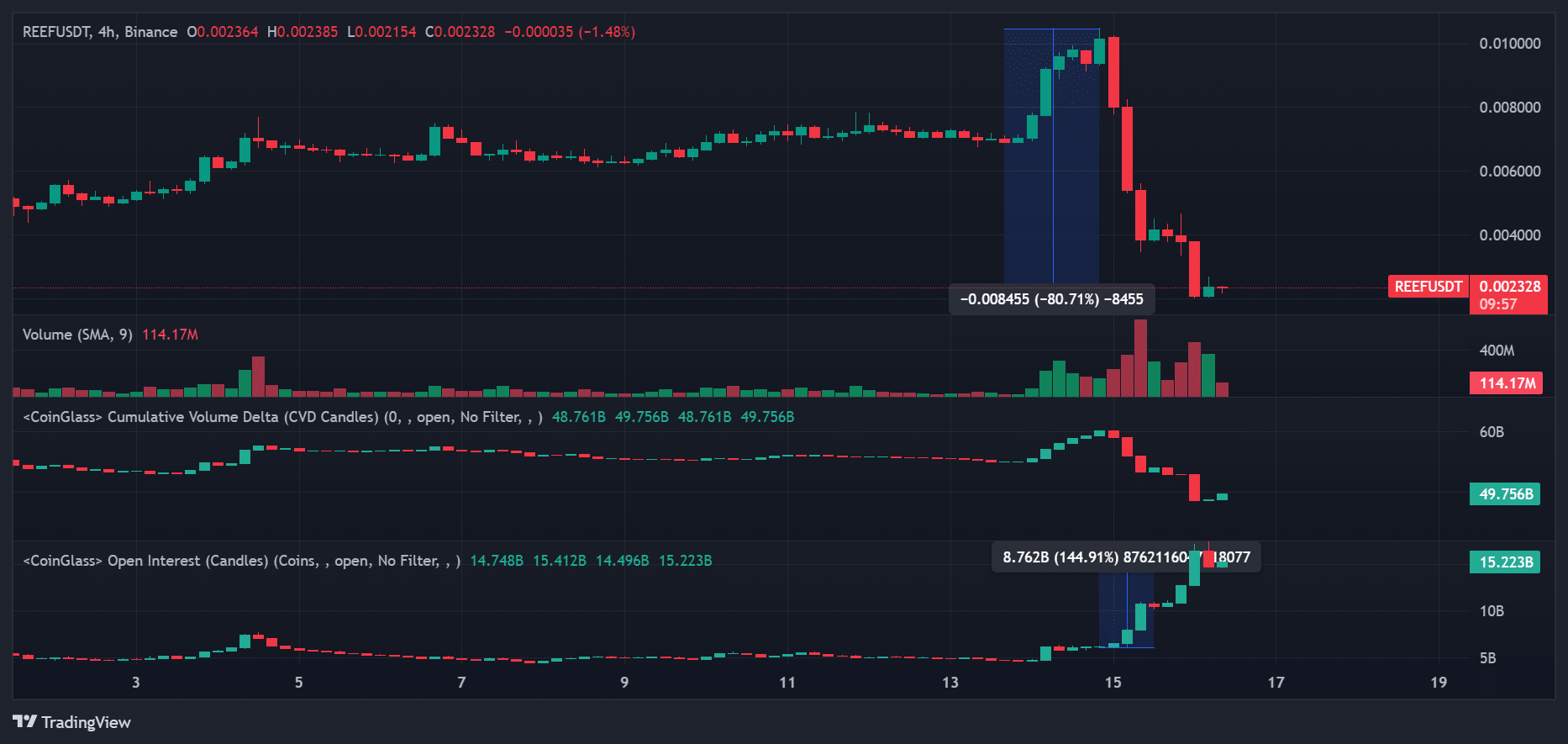

REEF crypto, the native token of the Reef chain, extended its mid-week decline to a whopping 80% in 48 hours. It dropped from $0.01 to $0.002, unnerving investors, especially holders who jumped onto the token’s bandwagon recently.

Leveraged bears majorly drove the decline as Open Interest (OI) surged by 8.7 billion REEF as the price slumped. This suggested that more speculators opened leveraged short positions, pulling REEF even lower on the charts.

That being said, REEF had one of the wildest recoveries since September. It rallied by a whopping 1500% after delisting from Binance spot trading in August. So, what do the metrics say about its potential?

REEF’s sentiment hits monthly high

Source: Santiment

At press time, REEF’s Weighted Sentiment had reversed and climbed to a monthly high. It meant speculators were bullish on the token’s upside potential after the plunge. By extension, this could mean a potential price reversal for the token.

However, supply pressure was still present in exchanges. In fact, Santiment’s data revealed a spike in supply on exchanges, underscoring significant REEF tokens were moved to CEXs for offloading during the dump.

Additionally, supply outside exchanges declined – A sign of a weak accumulation trend for the token. This low demand and high supply pressure scenario didn’t paint a strong price reversal for REEF, at least at press time.

Short-term supply pressure was also evident among smart money on the Binance exchange. According to the Top Trader Long/Short ratio, 51% of positions shorted the asset.

Simply put, despite the improving market sentiment, traders are still skeptical of a strong rebound based on their positioning.