Analysis

Examining the lack of a Pepe trend: Key conditions for the next big move

The Open Interest chart showed that speculators were eager to go long, seeking profits from the PEPE move and showing bullish sentiment.

- Pepe bulls continued to defend the 78.6% retracement level.

- The lack of high buying volume meant the momentum was neutral and a strong rally was not yet in sight.

Pepe [PEPE] saw its on-chain metrics weaken yet posted short-term gains over the past few days. Active addresses were down and trading volume was not high either, with whales also showing signs that they were inclined to move to the sidelines.

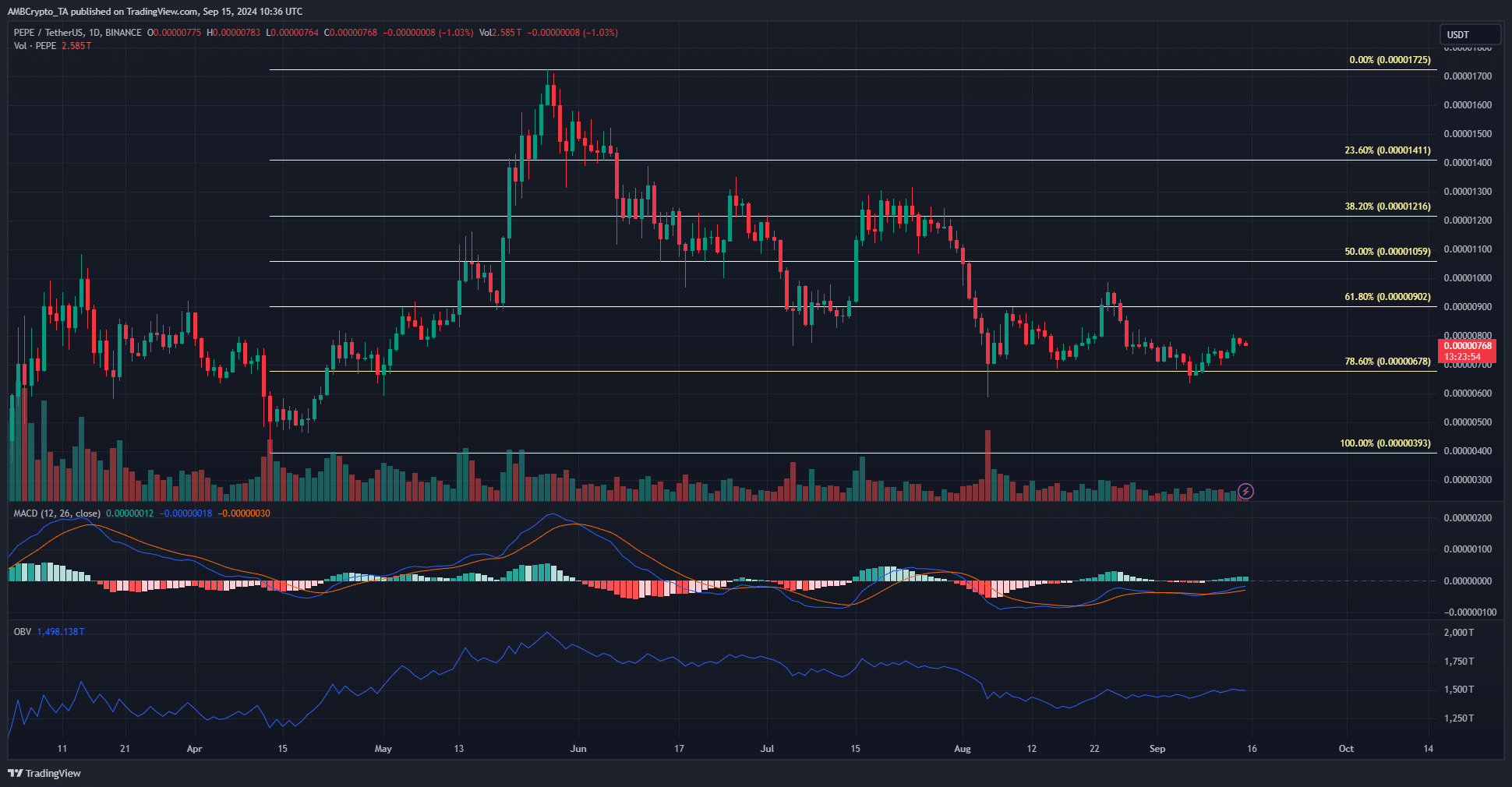

The price action chart showed that the pivotal Fibonacci retracement level was still a support. As long as it remains standing, Pepe bulls retain their hopes.

Pepe volatility could distress swing positions

The Fibonacci levels plotted using the April-May rally were still pertinent. The 78.6% retracement level continued to be respected as support, although some short-term deviations were seen.

This meant that swing traders could enter long positions during a retest of this retracement.

Their stop-loss orders need to account for the short-term volatility around this level. Moreover, neither the momentum nor the buying volume was strong over the past month, suggesting that PEPE is in an accumulation phase.

A daily session close below the $0.000006 level would indicate bears were in control. Until then, buyers can scoop up more PEPE and wait for a recovery.

The OBV has slowly trended higher since August, boosting the chances of a Pepe rally.

Will smart money try to shake people out of their positions?

Source: Hyblock

Prices are attracted to clusters of liquidity, and AMBCrypto noticed one such pocket at the $0.000006 zone. This also marked the lows the meme coin

fell to on the 5th of August.Therefore, traders and investors need to be prepared for a quick downward slump.

Such a drop is not a guarantee but more of a likelihood at this stage, since not each pool of liquidity is successfully tested.

Source: Coinalyze

The market sentiment appeared to be bullish in the short term. After the gains made on the 13th of September, the Open Interest climbed from $235 million to $273 million.

Is your portfolio green? Check the Pepe Profit Calculator

Speculators were eager to go long, seeking profits from the PEPE move and showing bullish sentiment. The minor price dip since then has not seen the OI drop significantly, meaning that the long positions continued to believe in further gains.

This might hurt them in the coming days in case of a sharp Bitcoin [BTC] correction.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion