Examining whether Uniswap [UNI] can gain 200% in 2024

![Examining whether Uniswap [UNI] can gain 200% in 2024](https://ambcrypto.com/wp-content/uploads/2024/04/Uniswap-Featured-Image-1200x686.webp)

- Uniswap has the potential to climb past $20 in 2024.

- The recent retracement was deeper than ideal, but that shouldn’t worry long-term holders.

Uniswap [UNI] has filled a higher timeframe fair value gap on the charts. Its deep retracement meant investors might be fearful of further losses.

A deeper look at relevant metrics showed that investors should be enthused instead.

The Bitcoin [BTC] bull run post-halving has not yet started, and there was some debate on when it will arrive. A quiet summer could give buyers more time to accumulate UNI.

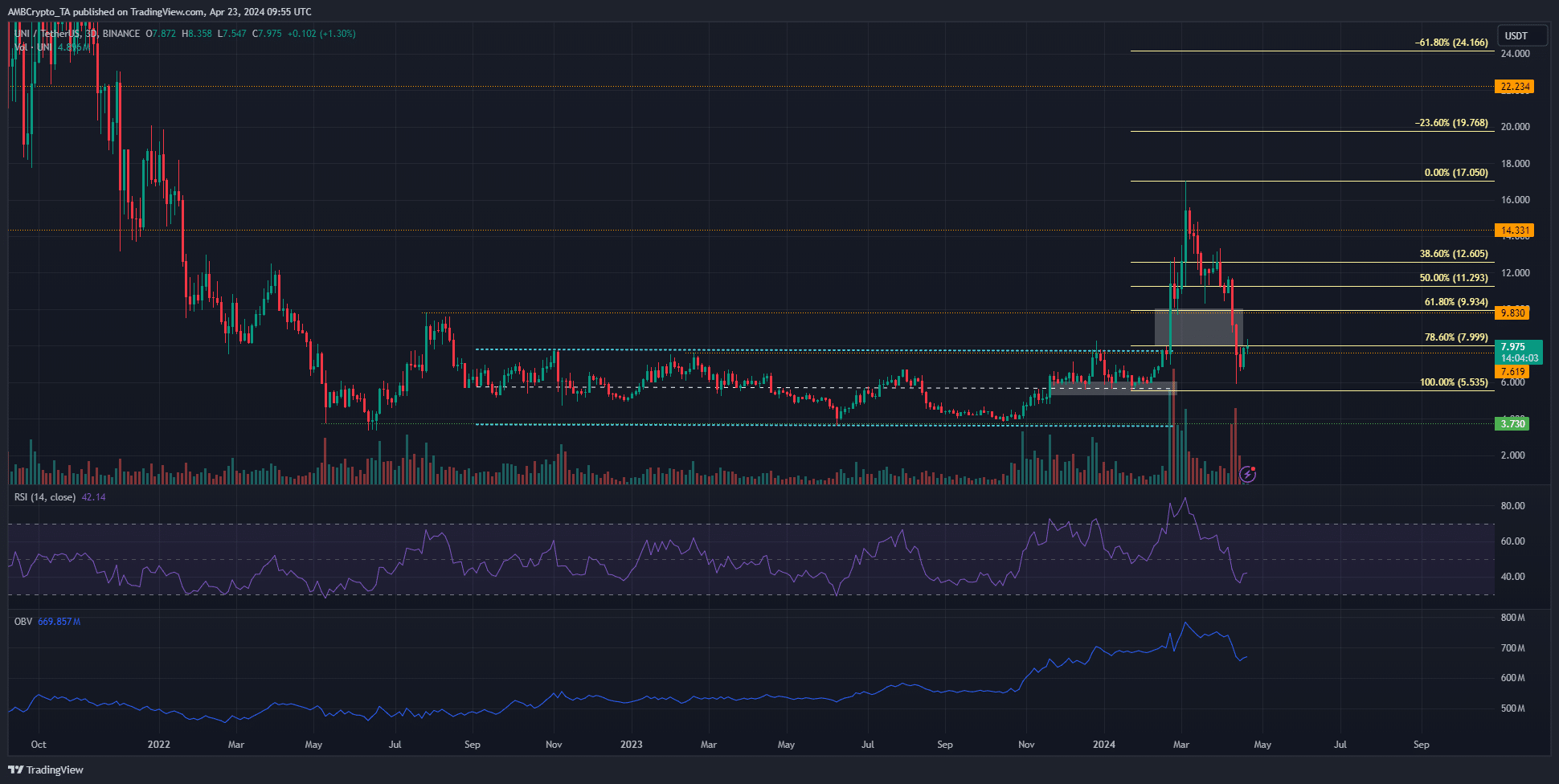

The range breakout and retracement

From May 2022 to mid-February 2024, UNI has traded within a range. This range extended from $3.7 to $7.8 and lasted just over 21 months.

In March, the rally reached $17.06, a level UNI last traded at in January 2022.

The fair value gap on the 3-day timeframe (white box) was filled, and UNI dipped even lower to reach $5.9. While this wasn’t ideal, it does not mean a significant rally is now impossible.

The nearly two-year range breakout and retracement to the former range highs presented a fantastic buying opportunity.

The Fibonacci levels showed that the 61.8% extension level at $24 was a target in the coming months. This would represent gains of 200%.

The potential altcoin season meant even higher gains could come toward the end of the current cycle.

Other factors that buoy investor confidence

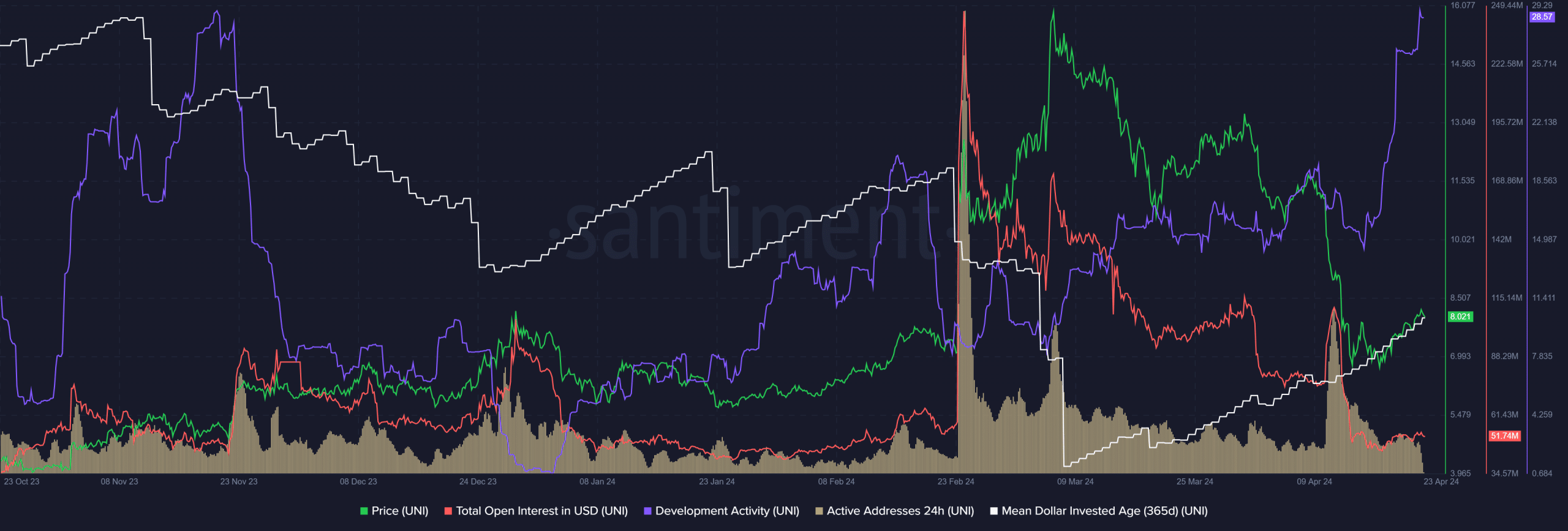

Source: Santiment

A prominent one was the rising development activity. It reached a new high for the past six months.

The active addresses count has stalled, but together they showed that long-term UNI holders have reason to be optimistic.

The mean dollar invested age has crept higher since March, while prices fell lower. This was a sign of accumulation.

Is your portfolio green? Check out the UNI Profit Calculator

The Open Interest was the lowest it has been since late January. Once again, it showed that the market has purged speculators looking for a quick short-term rally.

This could be healthy in the long-term, as the current bounce appeared to be driven by spot demand.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.