Altcoin

Examining why NEIRO’s price might soon decline by 47%

NEIRO might be struggling on the charts, but will its fortunes change soon?

- After a significant price drop, the token entered a consolidation phase

- Market sentiment turned increasingly bearish, with many traders actively selling NEIRO

Over the past week, NEIRO has faced a tough time, with its valued dropping by 13.73% on the charts. And yet, it soon recovered with a 1.33% uptick, with the altcoin trading within an accumulation phase at press time.

According to AMBCrypto, its ongoing bearish pattern might be in line with the broader market’s recent sell-off. This suggested that NEIRO could see more downward pressure soon.

NEIRO trades within a classic bearish pattern

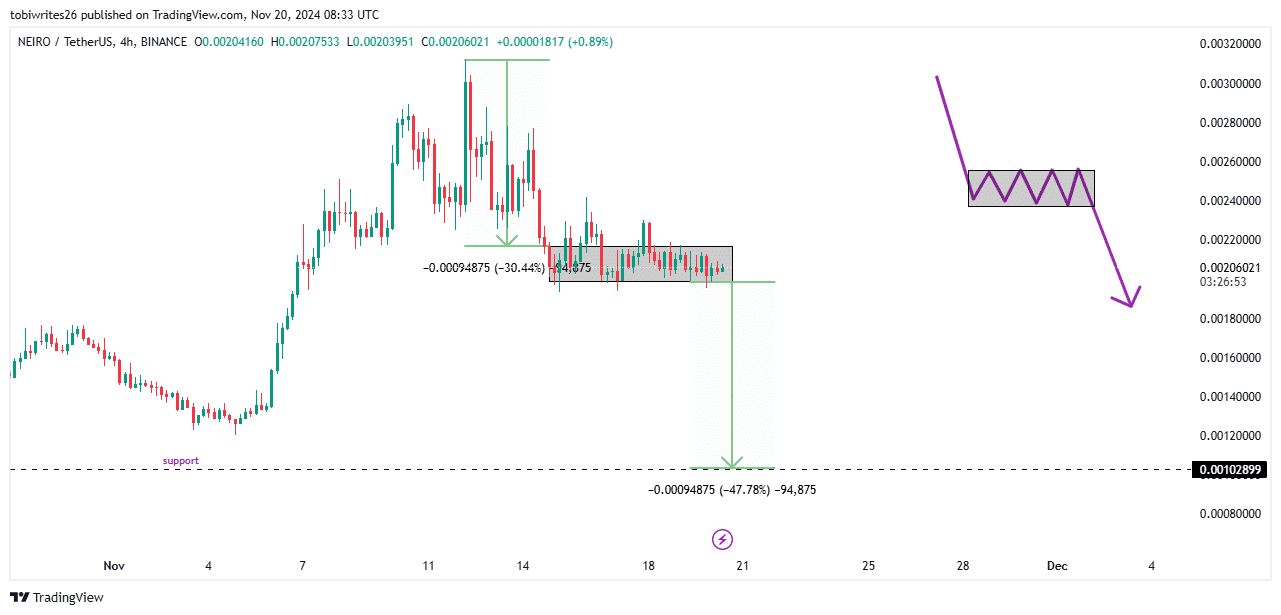

NEIRO, at the time of writing, was following a typical bearish pattern characterized by a price drop, consolidation, and then another decline. In fact, after recording a drop on the charts, the altcoin seemed to be consolidating.

After this consolidation phase, NEIRO can be expected to face a significant decline, one mirroring its initial drop but potentially falling by 47.78%. This would bring its price down to the key support level at 0.000102899.

NEIRO last traded at this level during a major rally in October. If this scenario unfolds, NEIRO will erase all of its November gains.

At the time of writing, the altcoin had accrued gains of 11.86% over the month.

Bears take over as participants sell for profit

Recent metrics from IntoTheBlock revealed that the market might be favoring bears (sellers) over bulls (buyers), with more sellers active. Over the last seven days, the number of bears rose to 70, while bulls have remained at just 63.

IntoTheBlock’s indicator determines the dominance of bulls or bears based on those who buy or sell more than 1% of the total trading volume. With the bears in control, this finding pointed to a higher level of selling activity.

Moreover, the total number of addresses holding NEIRO climbed as the crypto’s price fell. This suggested that despite holding the asset, many addresses have been gradually selling their holdings, contributing to the downward price movement.

If these trends persist, NEIRO may soon break out of its consolidation phase and decline further.

Weighted sentiment drops, pushing buyers out

Finally, Coinglass’s data revealed that the OI-weighted funding rate dropped to 0.041% on the 8-hour interval chart.

The OI-weighted funding rate adjusts the funding rate in perpetual Futures contracts based on the distribution of Open Interest (OI) between long and short positions.

In this particular case, a drop in the funding rate pointed to a shift in market sentiment towards bearishness. This alluded to the market pushing more buyers out and allowing sellers to take advantage of the situation.