Exclusive: 36.8% of investors now have memecoin investments!

- Q1 and Q2 performances dictating why investors are allocating more to memecoins – Survey

- PEPE, WIF, BONK prices might hit new highs, but respondents expect BTC to do the same

After speaking to 557 respondents from different parts of the world, AMBCrypto’s exclusive survey revealed that 53.7% of traders, investors, and analysts would choose memecoins over Bitcoin [BTC]. And yet, a significant number believe that Bitcoin will hit the $100,000-level before the end of 2024. The result of this study might not come as a surprise to active players in the market though, and the reasons are obvious.

Are memecoins this cycle’s hedge?

First off, Bitcoin’s price has risen by 53.32% on a Year-To-Date (YTD) basis. However, that is nothing compared to the performance of memecoins — Especially those based on Solana’s [SOL] blockchain.

For instance, dogwifhat’s [WIF] value has jumped by a mind-blowing 1,768% this year, while Bonk [BONK] recorded a 123% hike. Another notable memecoin has been PEPE. Despite Ethereum’s [ETH] lagging behavior, this memecoin registered gains of 945%.

However, the respondents did not just say this out of desire. Instead, AMBCrypto’s survey found that they are putting their money where their mouth is. Specifically, 36.8% of all respondents have allocated some part of their portfolio to memecoins.

Another 25.5% have done so for AI-themed tokens, with DeFi and GameFi sectors finding a place within the holdings of 25.5% and 15.4% of all the respondents. This, despite the second quarter (Q1) of the year starting at a slower pace compared to Q1.

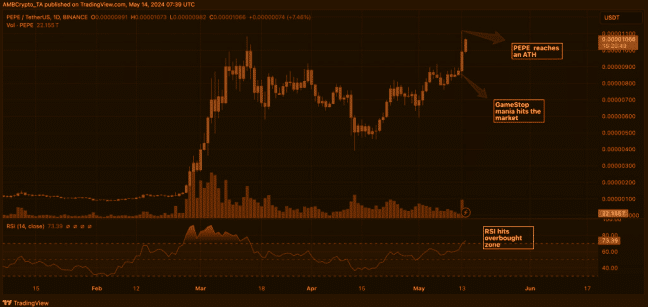

As Q2 began, memecoins shed a good part of their Q1 gains. However, the resurgence of the GameStop (GME) stock put prices back on the uptrend. This was one of the reasons PEPE seemed to surpass its all-time high almost every week.

Bitcoin is still in the conversation

Regardless of the bullish conviction around memecoins, 65.5% of the respondents owned Bitcoin – A sign that the coin remains a big bet, despite the buzzing narrative.

Furthermore, AMBCrypto’s report also revealed that most believe BTC could hike by 80% by December 2024. If this happens, then the price of Bitcoin could be worth $121,953 by the end of the year.

Where does that leave memecoins though? Beyond the report, AMBCrypto looked at the number of holders and sentiment around some of these frog and dog-themed tokens.

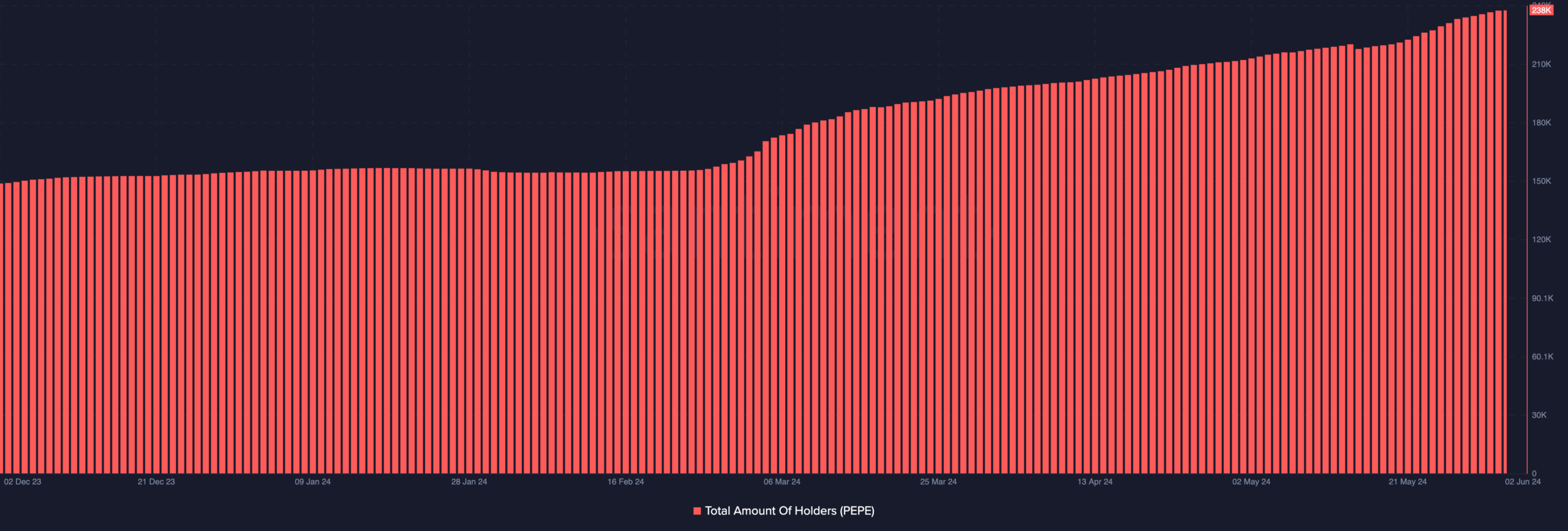

According to data from Santiment, the number of PEPE holders in February was less than 160,000. At press time though, that number had risen to 238,000.

An almost 50% hike in less than three months may be evidence that the memecoin supercycle might not stop anytime soon. Should this be the case, other altcoins with real-world utility might be starved of liquidity.

Finally, AMBCrypto’s report discovered that the emergence of SocialFi has been something to watch out for. For instance, platforms like Friend.tech and Fantasy.Top have been accruing millions of dollars in trading volume.

Realistic or not, here’s PEPE’s market cap in BTC terms

Despite the notable uptick in money flows, memecoins might continue to attract more market participants over any other sector in the market. Still, this does not imply that ETH would continue to lag or BTC would fail to hit $100,000.