Exec hails Bitcoin as ‘most reliable monetary system’ amid BTC’s $19T milestone

- Riot Platforms’ VP of Research highlights Bitcoin’s resilience.

- Market signals point to further upside potential for the king coin.

While the year-end crypto crash of 2024 left many investors reeling, the dawn of 2025 has brought a wave of optimism.

Leading the charge in recovery, Bitcoin [BTC] has reclaimed its spotlight. In addition, altcoins have closely followed suit, rekindling confidence across the market.

Amid this hopeful sentiment, Pierre Rochard, Vice President of Research at Riot Platforms, emphasized BTC’s foundational strength. In the latest post on X, he stated,

“Bitcoin is engineered to be the most reliable monetary system in the world for savings and payments.”

BTC’s latest milestone

This new comment came just a day after Rochard announced that the Bitcoin network processed over $19 trillion in transactions throughout 2024. Thus,

“Decisively proving that bitcoin is both a store-of-value and a medium-of-exchange.”

Worth noting that this represented a significant leap, more than doubling the $8.7 trillion settled in 2023. The surge was particularly striking given the two-year decline in transaction volumes following the 2021 bull market.

2024: A monumental year for Bitcoin

Bitcoin’s remarkable performance in 2024 was not an isolated phenomenon—it was bolstered by key macro and institutional developments.

The U.S. approval of Bitcoin exchange-traded funds (ETFs) was a watershed moment, driving institutional inflows and broadening the asset’s appeal to mainstream investors.

Adding to the momentum was Bitcoin’s April halving event, which halved its mining rewards, intensifying its scarcity-driven allure.

The political backdrop further fueled excitement. Dubbed the “Trump pump,” the U.S. presidential election and speculation about the country adopting a strategic Bitcoin reserve created a bullish frenzy.

The ripple effects were felt globally as other nations began exploring similar strategies, cementing Bitcoin’s role in geopolitical and economic dialogues.

The culmination of these factors propelled Bitcoin to a historic peak of $108,000.

Nevertheless, the market euphoria faced a sobering reality, with BTC dipping to end the year near $91,000—a stark reminder of its inherent volatility.

Will Bitcoin continue its comeback?

But things may take a turn for the better as the price was seen recovering with the onset of 2025.

AMBCrypto’s latest analysis highlighted a significant shift in market sentiment, with BTC exiting the “extreme greed” zone for the first time since November’s election-driven rally.

This newfound balance could pave the way for sustainable growth.

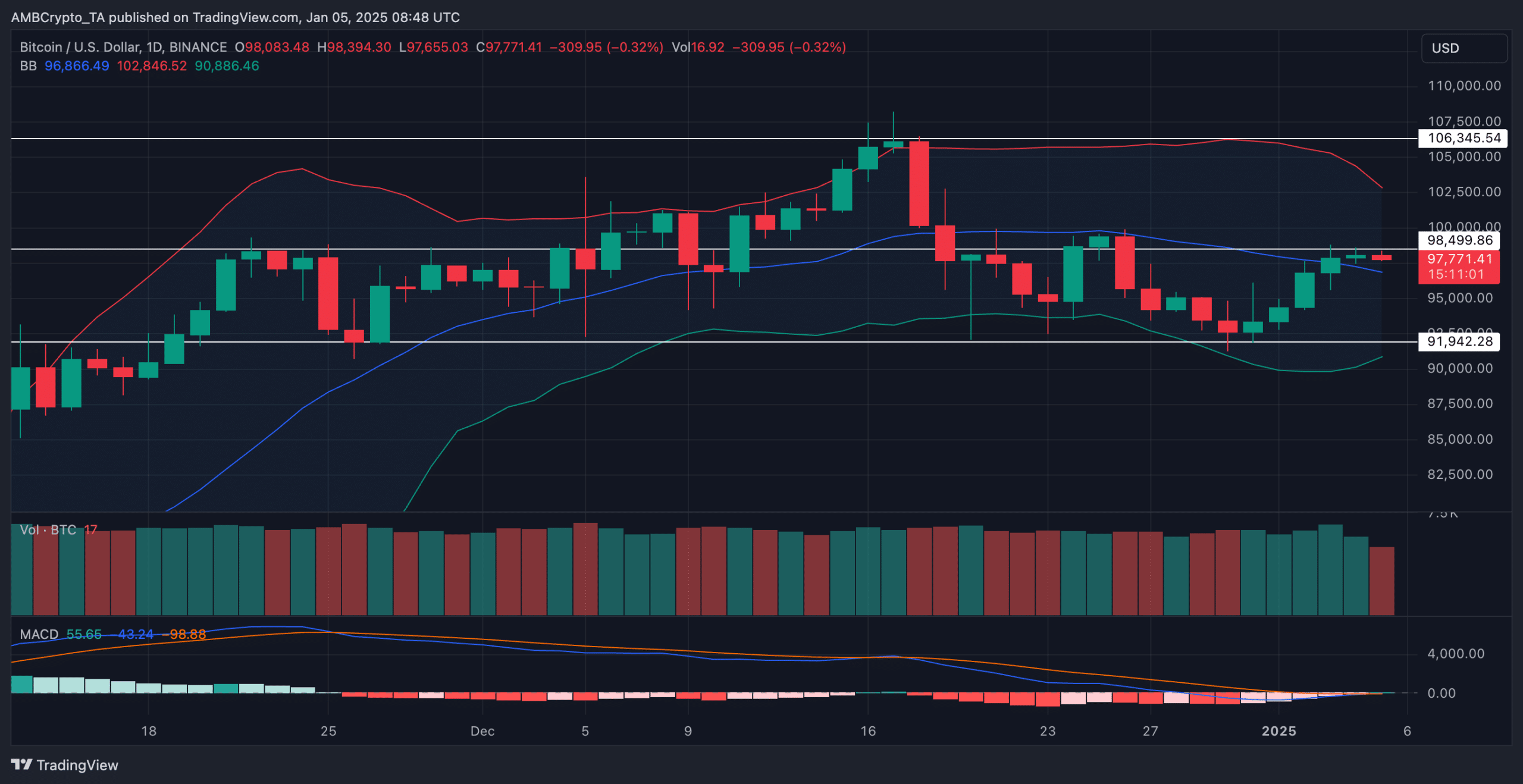

Technical indicators reinforced this optimism. A bullish MACD crossover on the daily chart and Bitcoin’s position above the 20-day MA suggested upward momentum.

At press time, Bitcoin was trading at $97,771, reflecting a 3% weekly gain, though slightly down by 0.23% in daily movements.