Exploring how Bitcoin’s price can benefit from the macro trends in 2024

- Bitcoin’s price now has a strong correlation to macro events, including Fed rate decisions

- Analysts expect a range breakout, but they disagree on when it might happen

Bitcoin [BTC] rallied by 7.5% to tap $66,000 on the price charts following the release of lower-than-expected key U.S inflation data. The positive reaction to cooler inflation data is part of Bitcoin’s broader movement following major macro events, including Fed rate expectations.

Rob Hadick, General Partner at the crypto-venture firm Dragonfly, recently commented on the same, referring to Bitcoin as a ‘macro’ asset. According to the exec,

“I think Bitcoin is a macro asset, it seems to trading in line with how much liquidity is in the market.”

He went on to add that the market will react to anything that affects liquidity, including quantitative easing, reduction in balance balances, or Fed rate decisions.

Will ‘better’ macro conditions help Bitcoin in 2024?

According to CoinShares’ data, the stronger correlation between BTC and macro events, especially Fed rate decisions, intensified recently after flows into new U.S spot BTC ETFs dried up.

Most market watchers noted that overall liquidity was sluggish, which explained BTC’s muted price action over the last few weeks. In fact, one of the watchers, crypto-analyst Jamie Coutts, claimed that while global liquidity was on an uptrend, momentum has been flat.

Another market watcher and Bitcoin analyst, Willy Woo, confirmed the ‘sluggish’ liquidity pace but projected a breakout in October 2024.

“Global liquidity forming a bullish ascending triangle. Expected breakout before Oct 2024. #Bitcoin 2025 will be one for the record books.”

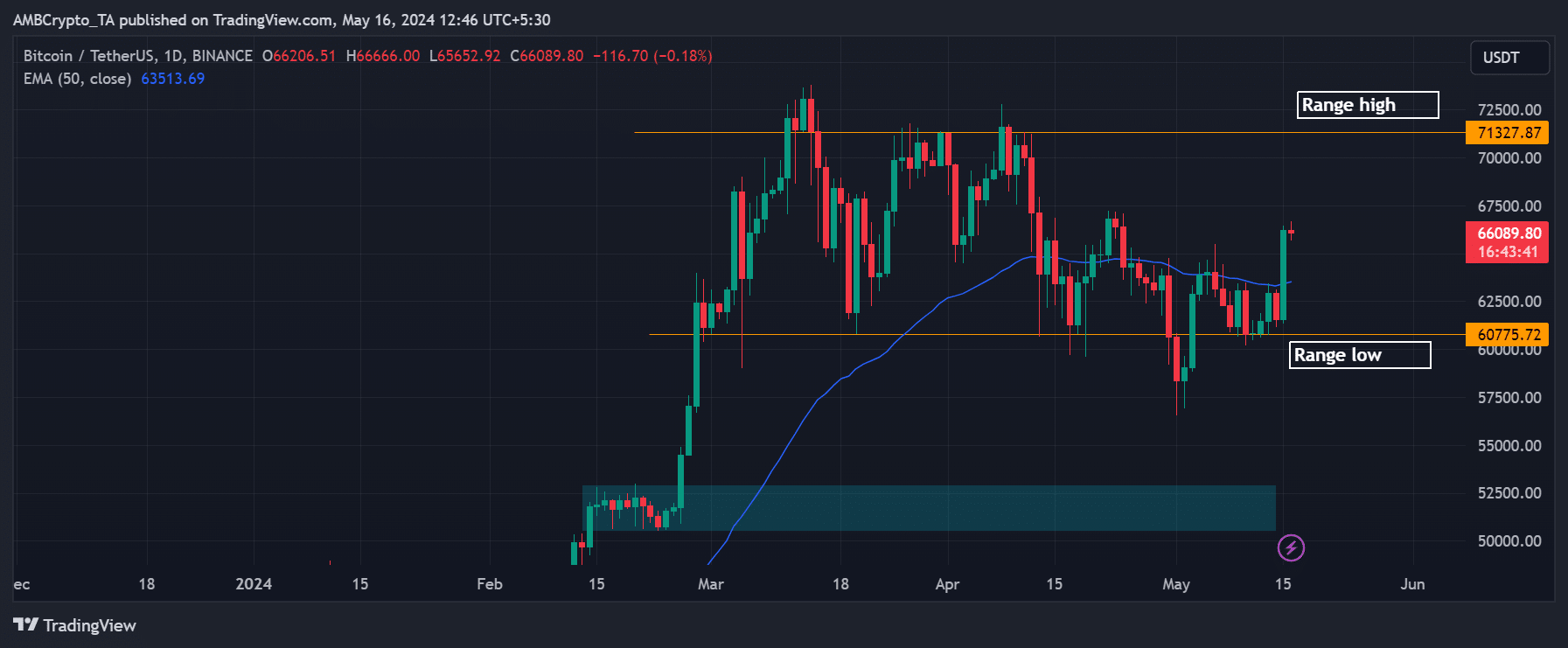

Based on the aforementioned global liquidity projections, BTC could extend its ongoing consolidation ($60K—$72K) until early Q4 2024. The timeline of the above forecast is slightly different from Mike Novogratz’s predictions.

Mike Novogratz, Founder of Galaxy Digital, projected a possible range breakout by the end of Q2.

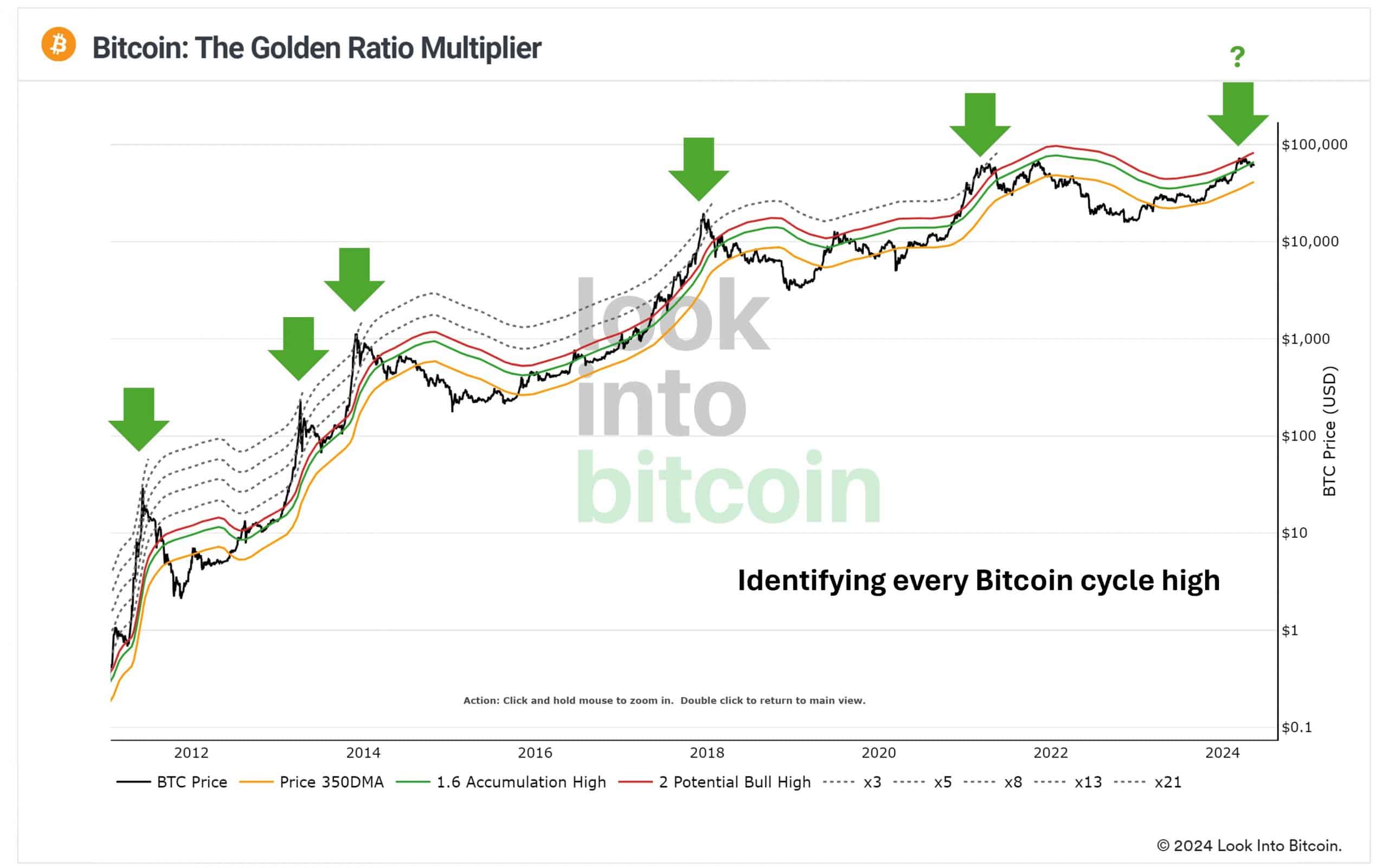

He’s not the only one either. Philip Swift, founder of the analysis platform Look Into Bitcoin, mentioned that based on the Golden Ratio Multiplier, BTC could explode twice or thrice its current value.

“The GR Multiplier did a great job in Bitcoin’s adoption phase. We’re now entering a new phase (supercycle?! kek)”

The GR multiplier gauges short and long-term price projections based on Bitcoin’s adoption curve and market cycles.

Although it accurately predicted previous market cycle tops, Swift believes that the current GR Multiplier ‘top’ suggests BTC’s adoption phase is coming to an end.

“Bitcoin is coming to the end of its Adoption growth phase and entering a more mature phase, integrated into global markets. See recent Bitcoin ETF’s as evidence.”

Ergo, analysts expect BTC to break from the range and surge further, but have different timelines for the breakout.

In the short term, BTC could eye the range-high at $71k after flipping the lower and higher timeframe market structures to bullish.