Exploring TON’s road to recovery – Key levels and indicators to watch

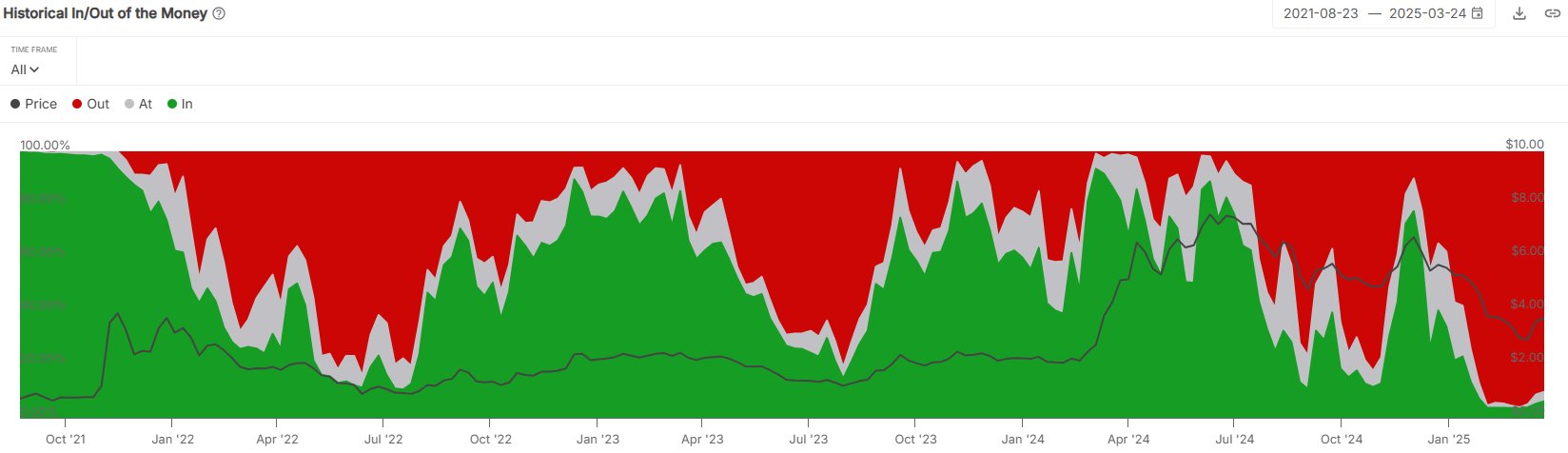

- Number of TON holders at a loss slightly eased from 100% to 90% after March’s recovery

- Several catalysts like Bitcoin’s rebound, Grok integration, and VC backing boosted TON’s recovery

Toncoin [TON], the native token of the Telegram-linked chain – The Open Network – saw a relief rebound in March, briefly easing holders’ loss.

The altcoin dropped by 67% after peaking above $7 last December to a new low of $2.3 in mid-March. According to Into The Block, the Q1 drawdown dragged all holders underwater, but the recent 72% bounce eased the distress.

“Its (TON) steady upswing now has roughly 10% of holders back in profit.”

TON’s recovery catalysts

The broader market rebounded in March and followed Bitcoin’s upswing to $88k from $78k. In fact, TON recovered by +60% during the lift-up.

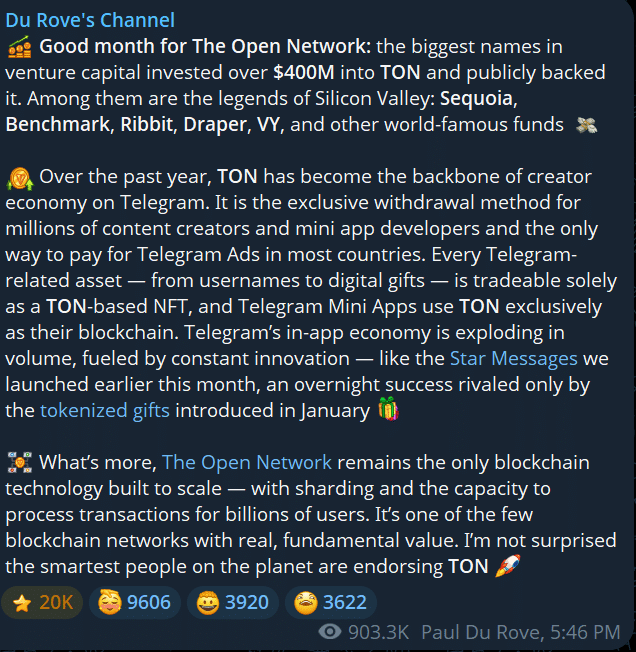

However, TON extended the recovery on Wednesday and Thursday to 72% thanks to Grok AI’s integration and another round of backing from top Silicon Valley VCs (venture capitalists).

Telegram founder Pavel Durov stated that the chain got $400M, reinforcing confidence from top tech investors.

Following the two catalysts, 1.1 million TON tokens were withdrawn from exchanges, marking a renewed accumulation spree for the altcoin.

Even so, TON retraced some of its recent gains as BTC dipped after a hot U.S inflation print on Friday. The altcoin was down nearly 10% in the past 48 hours, dropping from $4 to $3.6. However, over 90% of holders are still doing so at a loss, and they could wait to break even before dumping some of their holdings.

On the price charts, TON was back into its February range of $3.5 and $4 at press time. The altcoin could range above $3.5 if there isn’t broader weak sentiment in Q2 or even re-target $5, which doubled as a 200DMA (daily moving average). In fact, TON bulls will only be out of the woods if they reclaim the 200DMA.

However, in case of a renewed sell-off in Q2, TON could breach below $3.5, with immediate likely support at $3.0 or 2.5.

Bitcoin’s next move amid macro uncertainty could determine whether TON’s recovery will be extended.

As such, investors and traders should track BTC movement and macro updates.