Exploring whether Litecoin can repeat history, reach $110 again

- LTC’s price increased by more than 3% in the last seven days.

- Most indicators looked bullish, but a few metrics suggested otherwise.

Litecoin [LTC] investors had a comfortable week as the coin’s price surged. The weekly rally allowed LTC to reach a critical level that could soon result in a further bull run if things fall in place.

Therefore, AMBCrypto delved deeper into LTC’s current state to understand what to expect from it.

Litecoin eyes $110

According to CoinMarketCap, Litecoin was up by more than 3% in the last seven days. But the growth rate declined in the past 24 hours as its price moved marginally.

At press time, LTC was trading at $85.44 with a market capitalization of over $6.3 billion. The decline in volatility was not bearish, as LTC was actually consolidating near a key resistance level.

Crypto Rand, a popular crypto analyst, recently posted a tweet highlighting that LTC’s price was about to break above resistance.

Last time, when LTC’s price went above that mark, it allowed the coin to $110 at the beginning of April 2024. If history repeats itself, then investors might witness LTC reach new highs with $110 as its first target.

Therefore, AMBCrypto checked LTC’s metrics to see whether a bull rally lies ahead.

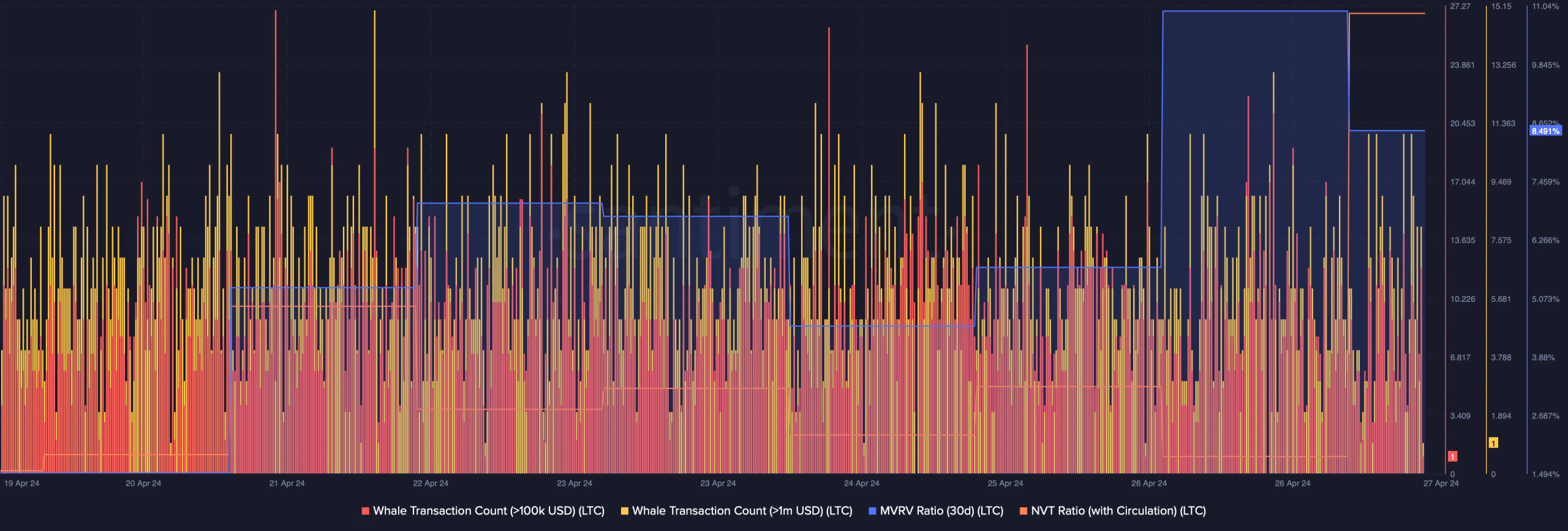

Our analysis of Santiment’s data revealed that whale activity around the coin was high, as its number of whale transactions increased last week.

Another bullish metric was LTC’s MVRV ratio, which went up in the last few days. At press time, the metric had a value of 8.49%.

However, not everything was looking good for Litecoin. For instance, the coin’s NVT ratio shot up sharply, meaning that LTC was overvalued.

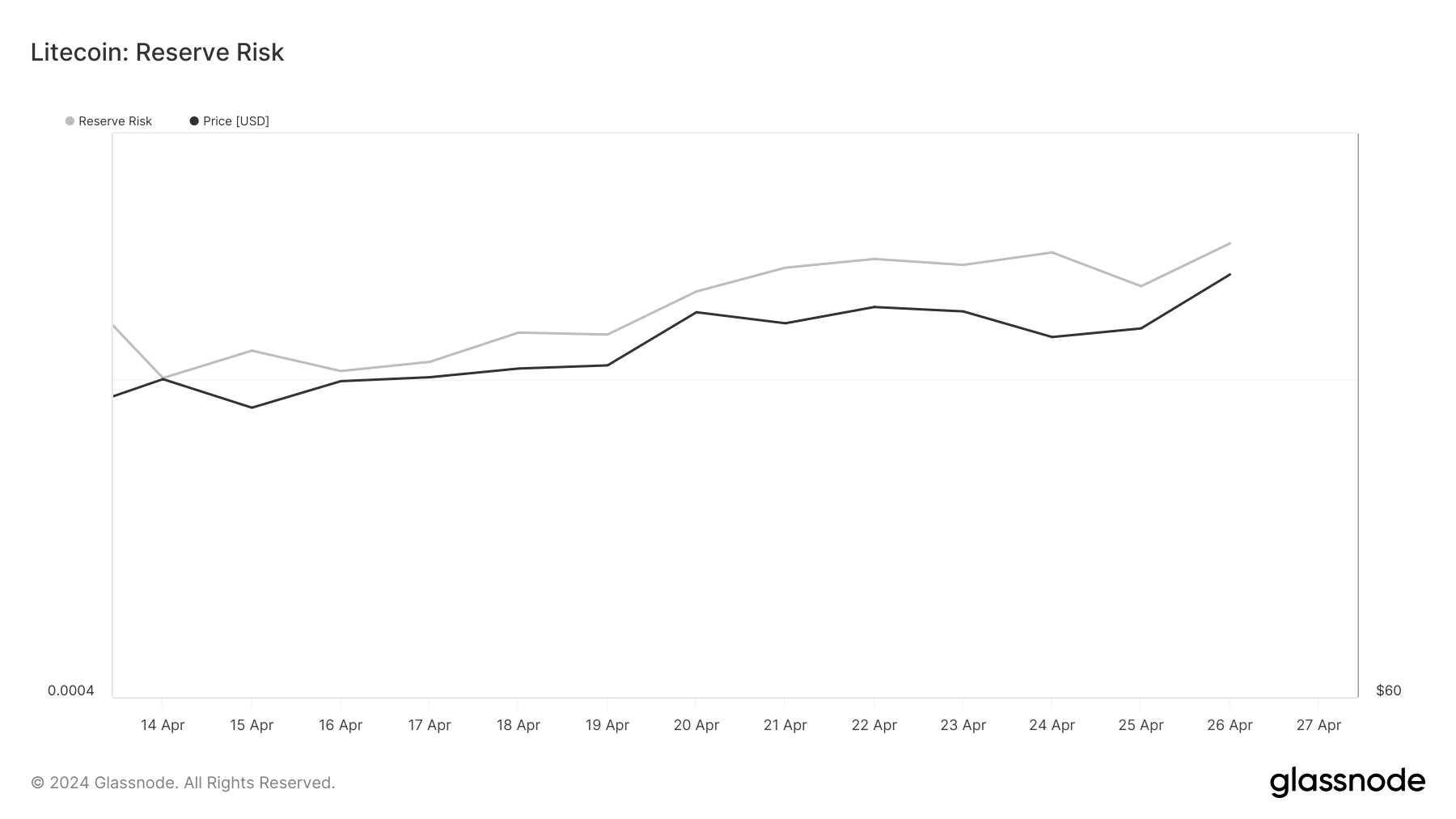

On top of that, our look at Glassnode’s data revealed that LTC’s reserve risk increased. For the uninitiated, high reserve risk indicates a situation in which confidence is low and price is high.

This was bearish, as a hike in the metric generally results in a price correction.

What to expect?

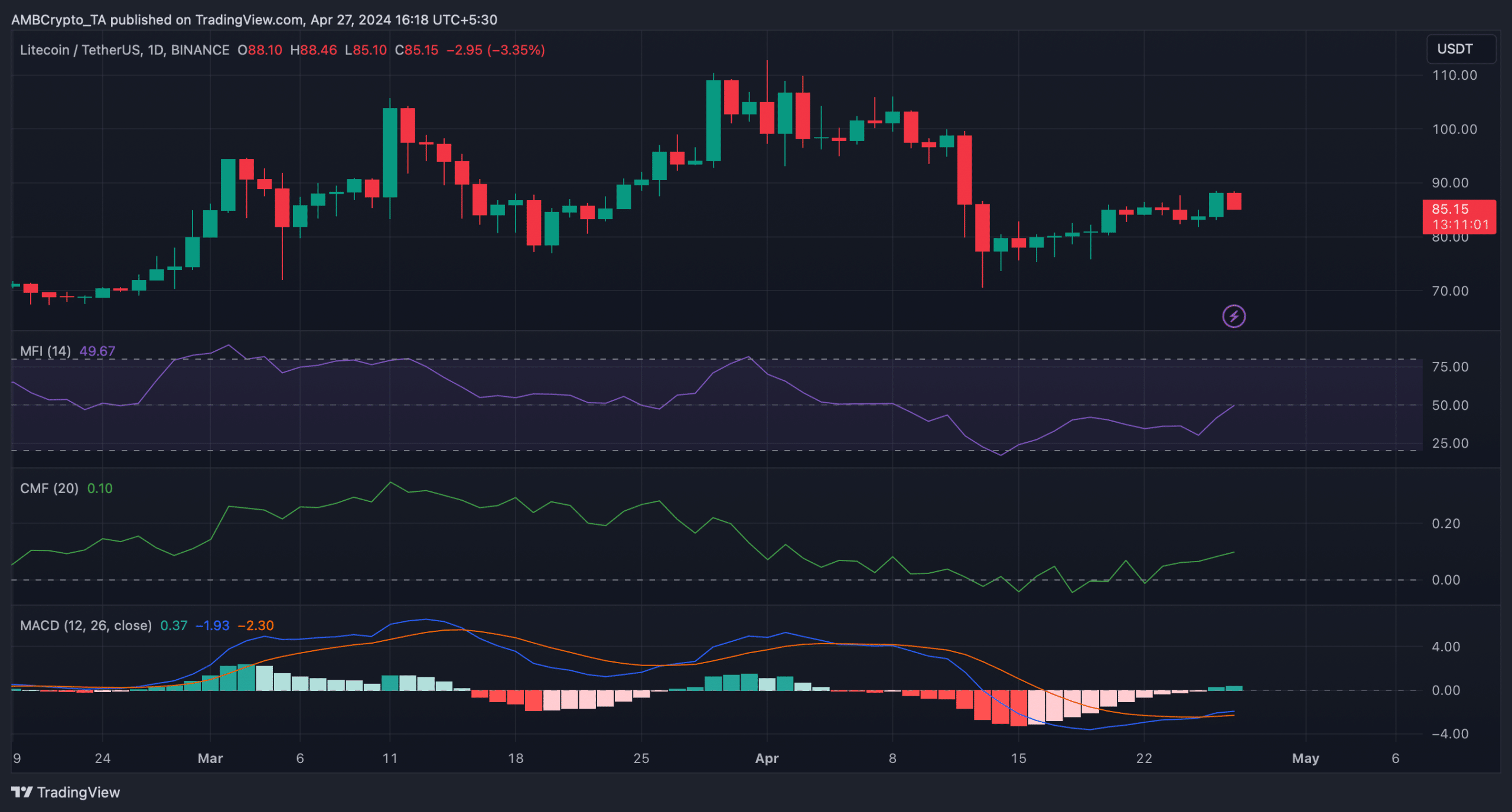

Thankfully, unlike a few metrics, most market indicators looked optimistic. The MACD displayed a bullish crossover. Both its Money Flow Index (MFI) and Chaikin Money Flow (CMF) registered sharp upticks.

These indicators suggested that Litecoin might soon showcase a bull rally, which might allow it to reclaim $110 in the coming weeks.

Read Litecoin’s [LTC] Price Prediction 2024-25

While focus remained on LTC’s price volatility, it was interesting to note that the blockchain’s mining sector witnessed a slight setback.

According to Coinwarz’ data, LTC’s hashrate dropped substantially over the last seven days. At the time of writing, the blockchain’s hashrate stood at 1.01 PH/s.

![Bitcoin [BTC]](https://ambcrypto.com/wp-content/uploads/2025/06/Erastus-2025-06-25T110829.705-1-400x240.png)