Factors affecting Bitcoin’s topsy-turvy way amid market-capitulation

The last five days witnessed the rise of Bitcoin’s price from $38,779 to $42,736, only to witness a drop, with the price of BTC standing at $39,584 at the time of writing. Post 6 April 2022, the king coin has been majorly resting below the neutral 50 mark on the RSI.

In fact, the latest report released by On-chain analysis platform Glassnode further states that the crypto market is expected to struggle in gaining any meaningful momentum to the upper side due to a lack of buying pressure from investors.

Here’s the metric assessment

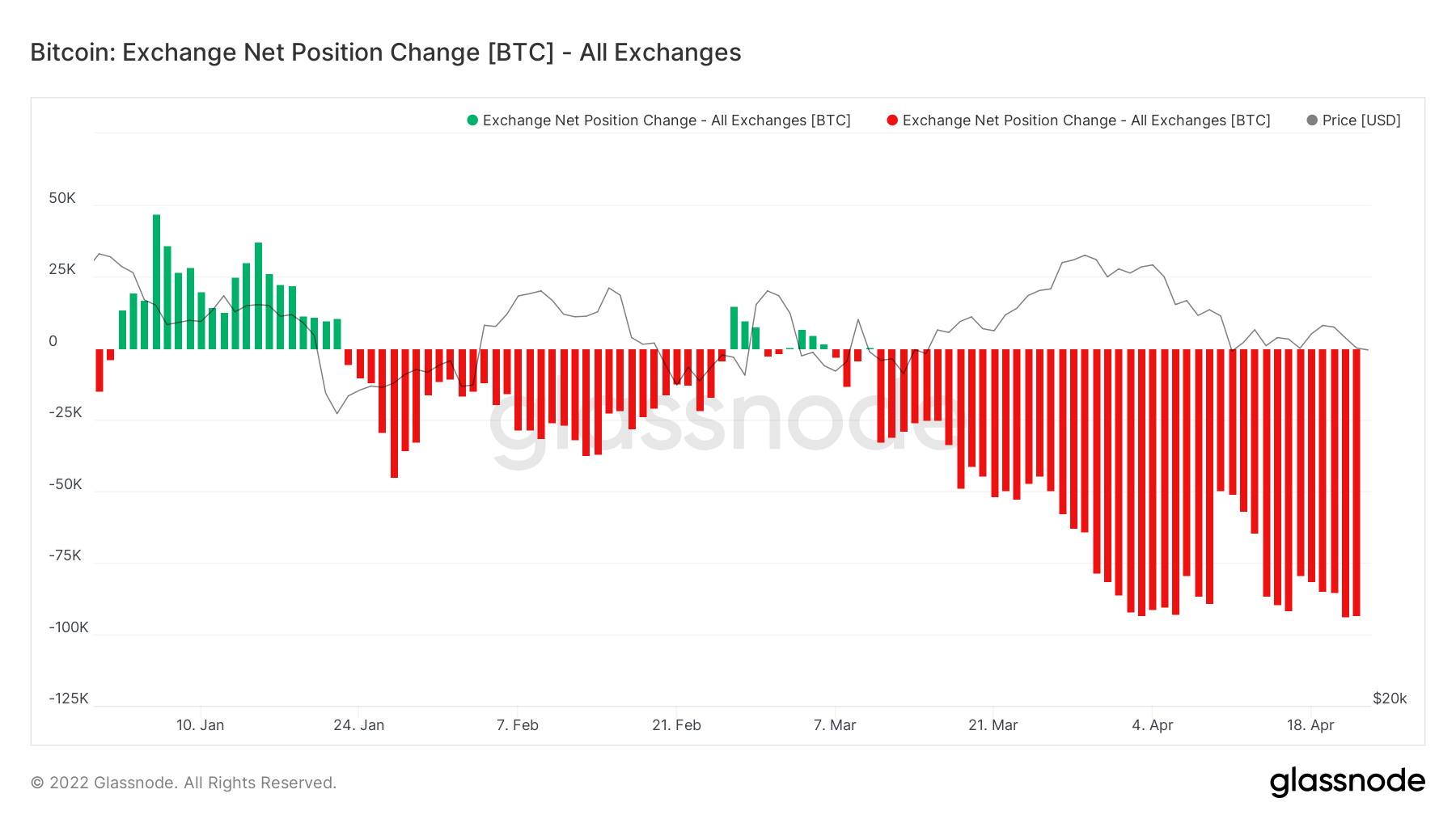

The chart given above depicts that the volume of Bitcoin pumped into the exchange is less than the volume of the token that has left the exchange. This simply indicates that traders and organizations are willing to hold on to the token despite the price fluctuations it has been witnessing in the last three months.

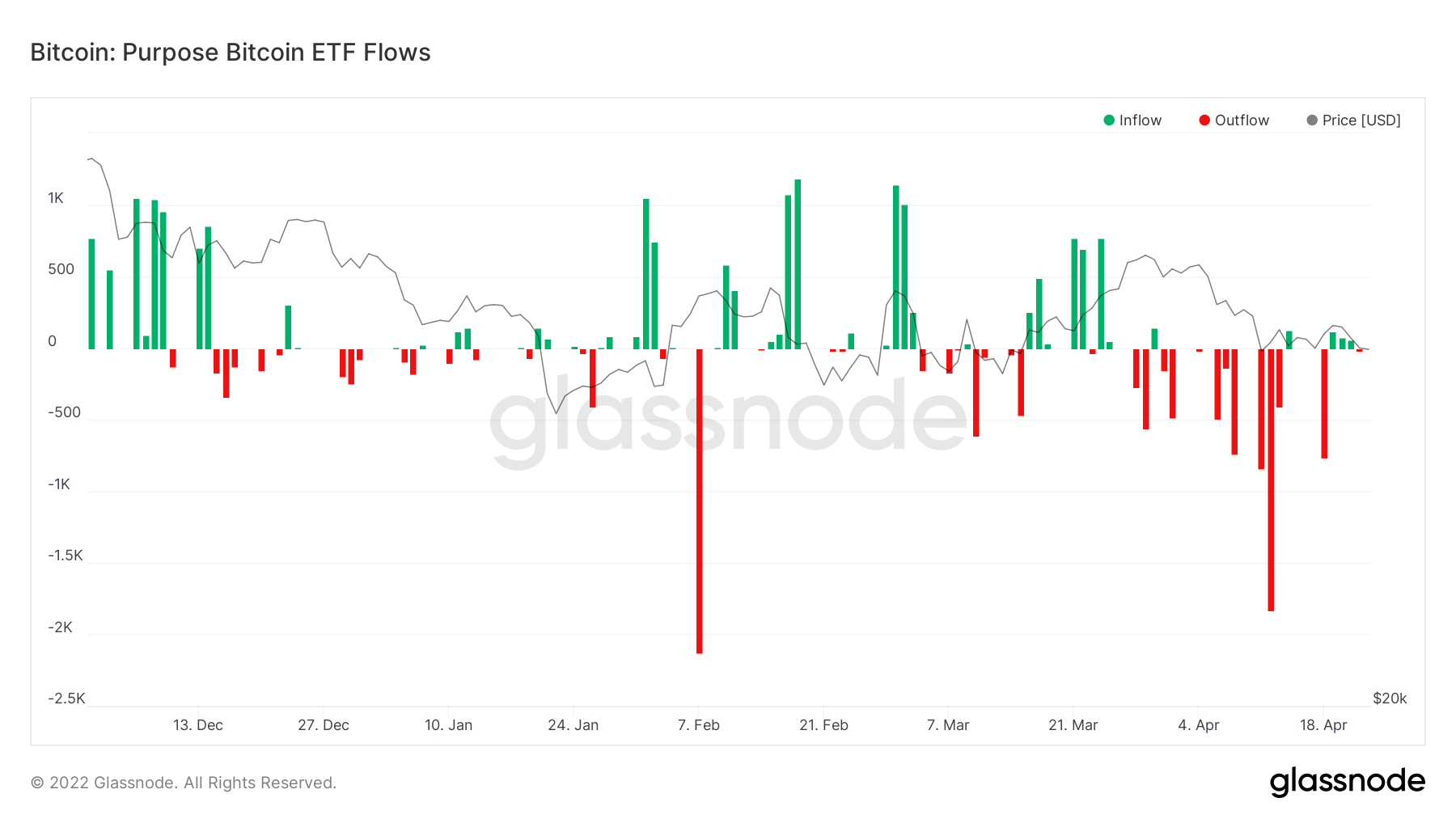

However, the report further went on to depict data related to Purpose Data ETF holdings, representing a significant drop, indicating that major players could possibly be on the lookout to sell off their Bitcoin.

The chart given below indicates that the outflow was extremely bearish in February followed by some bullish movement in the form of inflow, only to lean toward a significant period of bearish movement.

The works of the wallets

Upon comparing and analyzing the holdings of Bitcoin wallets in the last four months, it can be stated that wallets with holdings of more than 0.01, 0.1, and one Bitcoin have witnessed a significant spike.

Most of the Bitcoin at the moment has been accumulated by these wallets, leading to the understanding that smaller players are more inclined and bullish in their outlook toward the token.

There are approximately 3.4 million users that have wallets with holdings of more than 0.1 Bitcoin and approximately 835K users with holdings of more than one Bitcoin. As depicted by the chart given below, there are approximately 9.5 million addresses that hold more than 0.01 Bitcoin.

Wallets with holdings of more than 10 and 100 Bitcoins depicted a combination of bullish and bearish movements, with the movement inclining more toward the bullish side, at the time of writing.

Moreover, the number of addresses with Bitcoin holdings of more than 10 stands at an approximate number of 147K, whereas there are approximately 15.5K users with holdings of more than 100 Bitcoin.

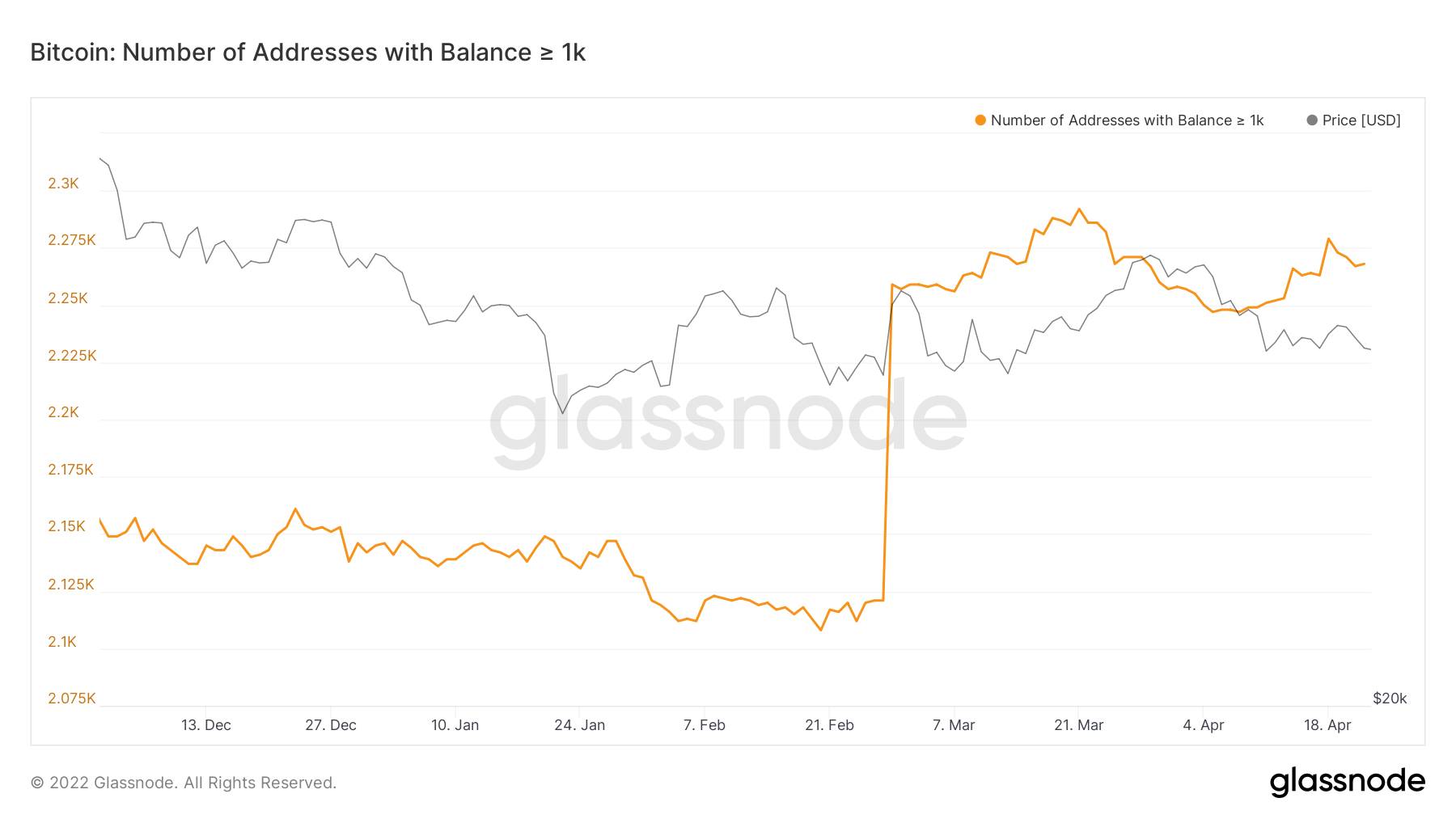

As per additional data from Glassnode, wallets with a holding of more than 1K Bitcoin showed a drastic spike in February 2022, followed by a sideways trend indicating that major players may have a newfound interest in holding on to their Bitcoin investments.

Now, although major players are currently showing some inclination toward investing in BTC, the severely volatile price of Bitcoin may discourage hodlers to maintain their position in the market.

With the current movement of BTC, there is a high possibility of it visiting the $37,000 arena. And, if Bitcoin breaks the support level, it may drop as low as $30,000 as stated by the report.