Altcoin

Famtom: Short sellers, whales fuel FTM’s rally – Is $1 within reach?

FTM transactions exceeding $100,000 have jumped 1,000% from 4.38M to 50.78M.

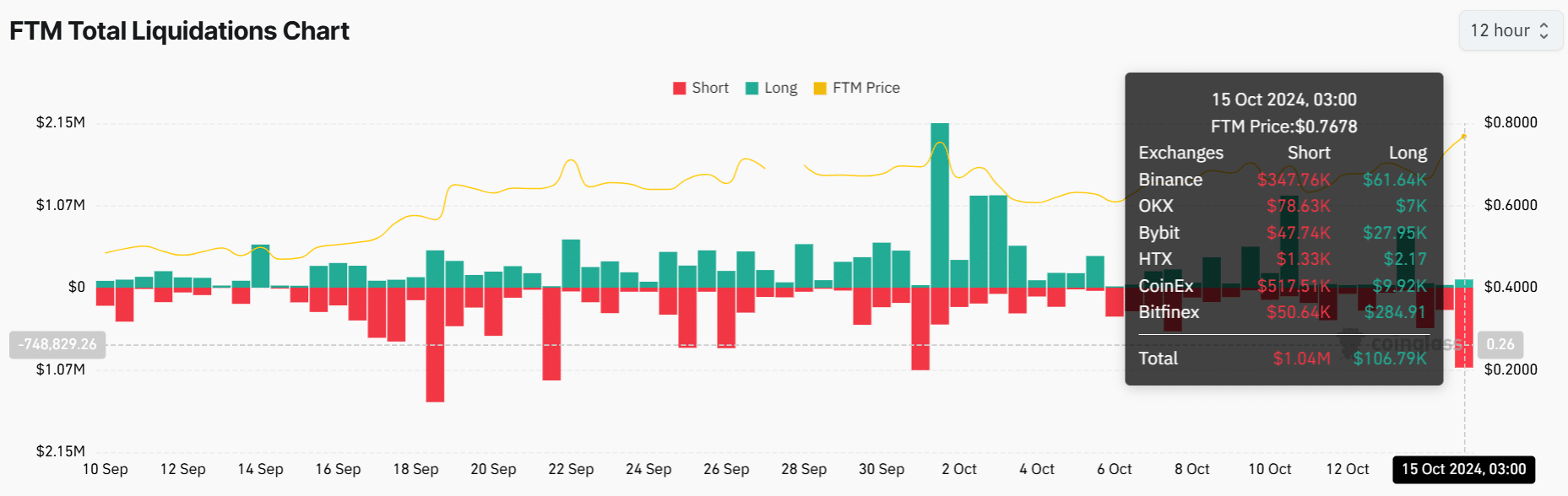

- FTM’s short liquidations spiked to $1M after the price jumped 10% to $0.76.

- Large transaction volumes also spiked by 1,000% showing a surge in whale activity.

Fantom [FTM] has been on a steady uptrend in recent weeks with its 30-day gains surpassing 50%. At press time, FTM traded at $0.76 after a 9% surge in 24 hours.

While bullish sentiment across the broader cryptocurrency market supported this rally, two other catalysts played a role in fueling the uptrend.

Spike in short liquidations

Fantom’s recent gains triggered losses for short sellers after short liquidations topped $1M within 24 hours. This marked the second-highest level of short liquidations this month.

When the price of an asset rallies and hits a short liquidation zone, these traders are forced to buy the token to cover their positions. This additional buying pressure stirred gains for FTM.

FTM’s liquidation heatmap shows there was a hot liquidation zone between $0.76 and $0.78. As the price gained and hit these levels, forced buying by short sellers created upward momentum.

Large transaction volumes surge by 1,000%

A surge in whale activity has also fuelled FTM’s gains to a monthly high. Data from IntoTheBlock shows that FTM transactions exceeding $100,000 jumped from 4.38M to 50.78M. This marks a 1,000% increase.

This spike in large transactions coincided with a price increase, suggesting that whales were likely purchasing FTM. This also fuelled the recent gains.

However, it is important to note that whales control 73% of the total FTM supply. Therefore, a spike in large transactions could trigger price volatility.

Can FTM rally to $1?

FTM bulls gained strength after the 50-day Simple Moving Average (SMA) crossed above the 150-day SMA earlier this week. This crossover coincided with a spike in buying volumes as the volume histogram bars show.

The 50-day SMA is tipping north and approaching the 200-day SMA, and if it crosses above it, Fantom will have formed a golden cross, which will increase the bullish sentiment.

The Relative Strength Index (RSI) at 64 shows that buyers are more than sellers, as bullish momentum shows strength.

Read Fantom’s [FTM] Price Prediction 2024–2025

If this buying pressure continues and FTM holds levels above $0.76, the next major resistance zone lies above $1.

One factor that could support this big price move is the surge in open interest. FTM’s open interest has spiked by 19% to $243M at press time, its highest level since May.