Fantom flashes bearish signals – Will FTM drop by 8%?

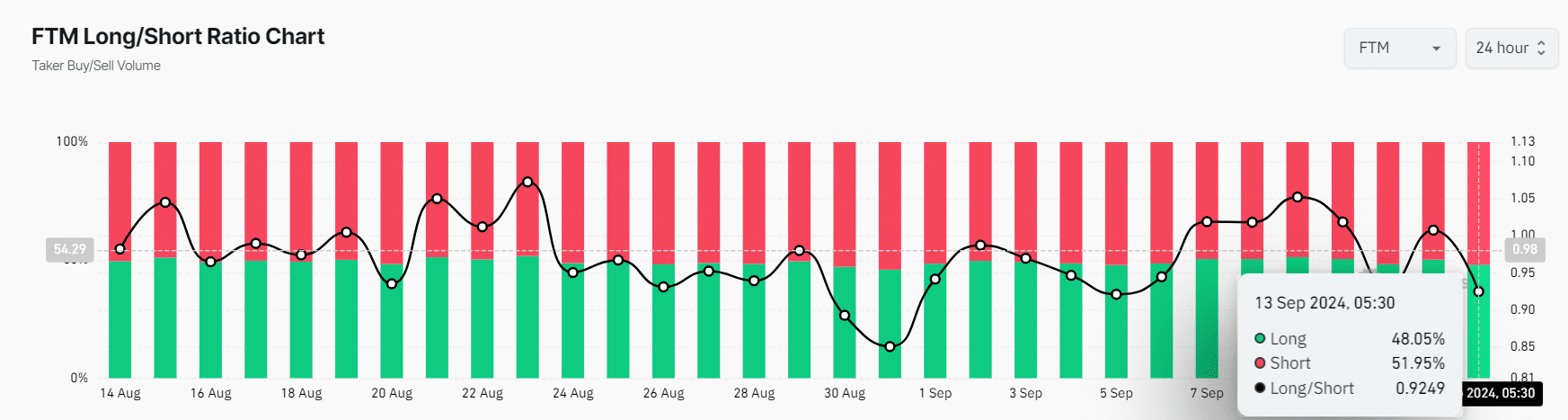

- FTM’s Long/Short Ratio was 0.924 at press time, indicating trader bearish market sentiment.

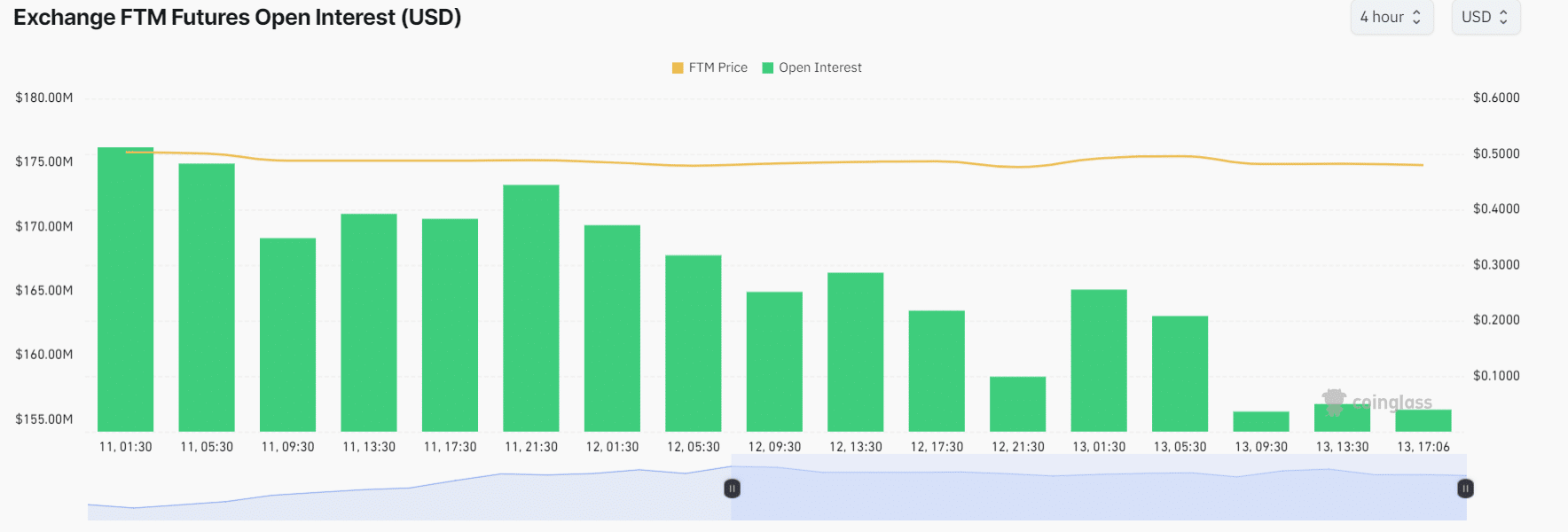

- FTM’s Futures Open Interest has declined by 7.5% in the last 24 hours.

Fantom [FTM] is currently in a crucial make-or-break situation. However, per on-chain data, it seems poised for a price decline in the coming days.

Despite the formation of a bullish inverted head and shoulder price action pattern on a daily time frame, FTM’s outlook appears bearish.

FTM technical analysis and key levels

According to AMBCrypto’s technical analysis, FTM has been consolidating within a tight range between $0.472 and $0.50 for four consecutive days and was at the lower boundary of that zone at press time.

It was trading below the 200 Exponential Moving Average (EMA) on the daily time frame, indicating a downtrend.

Based on the historical price momentum, if FTM breaches its lower level and closes a daily candle below the $0.469 level, there is a high possibility it could experience a price drop of over 8% to the $0.431 level.

Conversely, if the market sentiment shifts and FTM closes a daily candle above the $0.50 level, it could rise by 9% to the $0.55 level.

However, the current consolidation followed a significant price rally of over 40% between the 7th and the 10th of September.

It appeared that the current market sentiment is more favorable for scalpers, who typically trade in a range-bound market, rather than for investors or swing traders.

FTM looks bearish, on-chain

Fantom’s on-chain datasets were also flashing a bearish signal at press time. According to the on-chain analytic firm Coinglass, FTM’s Long/Short Ratio stood at 0.924 at press time.

A value below 1 indicates trader bearish market sentiment or vice versa.

Furthermore, 52% of top traders held short positions at this time, while 48% held long positions.

On the other hand, FTM’s Futures Open Interest declined by 7.5% in the last 24 hours, indicating that traders were either liquidating their long positions due to the fear of a potential price crash or the current choppy market conditions.

Open Interest has been continuously declining since the 11th of September.

Moreover, FTM’s OI-Weighted Funding Rate is negative and in red, suggesting a bearish market sentiment.

Read Fantom’s [FTM] Price Prediction 2024–2025

After examining all the parameters, it seems that the bears are currently controlling the asset and have the potential to liquidate more long positions.

At press time, FTM was trading near the $0.48 level after a price decline of over 2.5% in the last 24 hours. Its trading volume has dropped by 27% during the same period, indicating lower participation from traders.