Fantom [FTM] crypto price prediction: Why $1.6 is near

![Fantom [FTM] crypto price prediction: Why $1.6 is near](https://ambcrypto.com/wp-content/uploads/2024/12/Fantompriceprediction.jpg)

- Fantom will upgrade to a faster and cheaper Sonic mainnet.

- Will a short squeeze push FTM above the $1.6 roadblock?

On the 15th of December, Fantom [FTM] pumped 16% ahead of a major upgrade and rebranding to Sonic [S] this week.

The upgrade will make the L1 blockchain faster, cheaper, and developer-friendly. All these will make it more competitive against rivals like Solana [SOL], Ethereum [ETH], and Avalanche [AVAX].

Besides, the new token, Sonic [S], will be swapped 1:1 to FTM to maintain value. Will the new narrative boost the token’s value?

Fantom [FTM] crypto price prediction

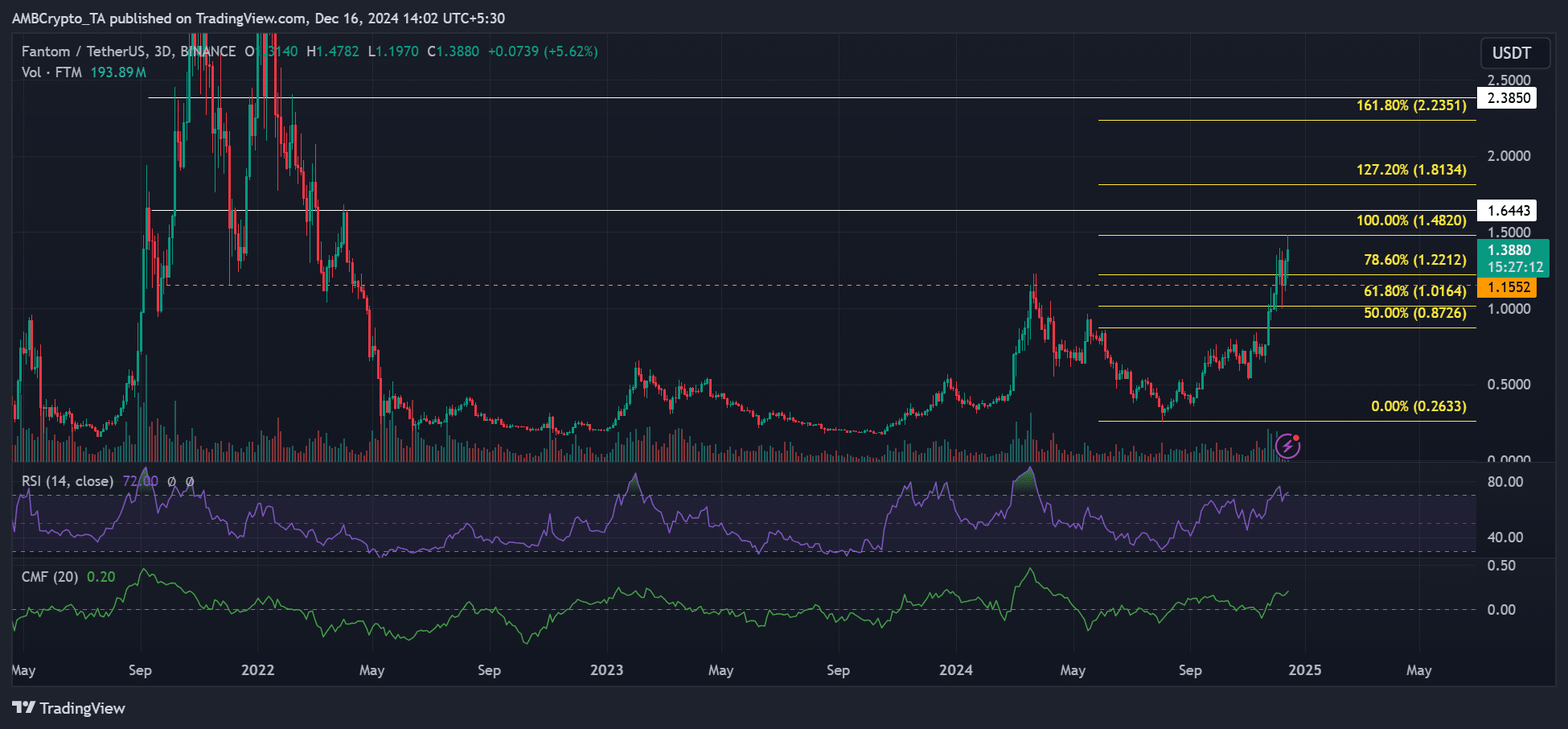

On the 3-day chart, FTM defended the March highs of $1.2 as support and was in a bullish market structure. This could embolden bulls to eye upside targets at $1.6 or $2.38.

The RSI climbed to the overbought territory, underscoring strong demand for FTM in the past few days. The positive inflows, as shown by the CMF (Chaikin Money Flow), could further indicate demand for FTM.

But flipping $1.6 into support could accelerate FTM’s odds of pushing higher ahead of the upgrade.

Mixed whale signals

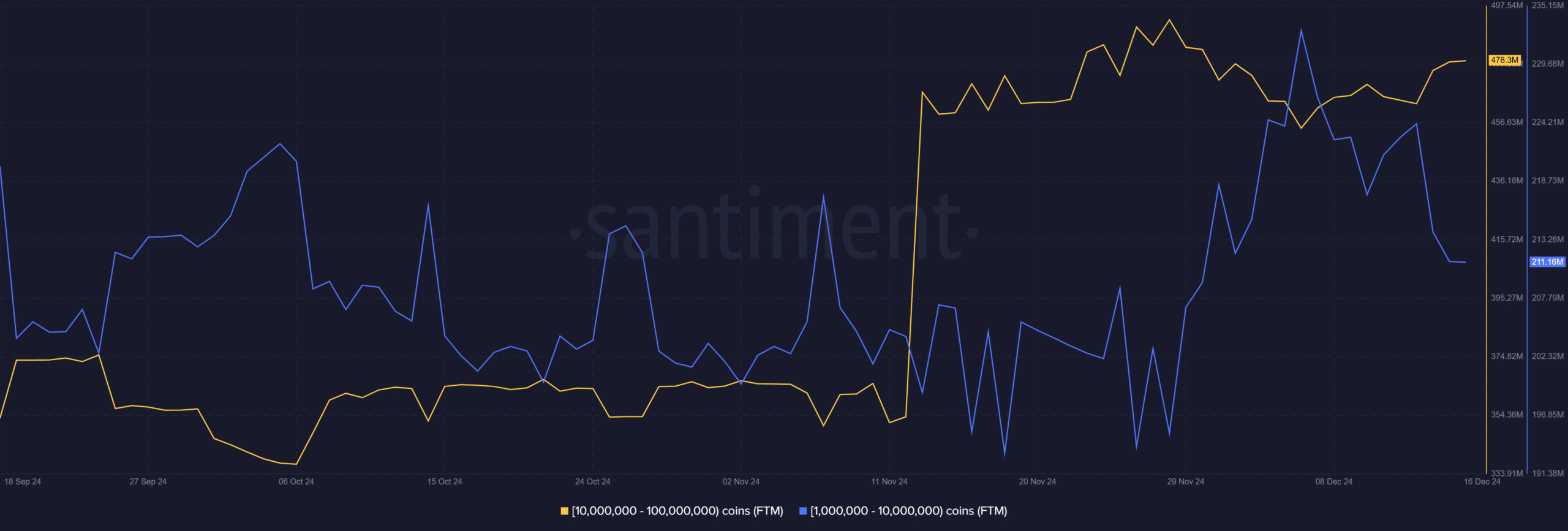

In the past 10 trading days, whales holding 10M-100M FTM acquired 24M tokens. But another whale cohort holding 1M-10M tokens has been selling.

The 10M-100M whale wallets held nearly 500M FTM, twice as much as the 1M-10M whale wallets, which had 210M tokens.

So, the accumulation spree by the dominant whale category suggested a bullish conviction on the token.

Read Fantom [FTM] Price Prediction 2024-2025

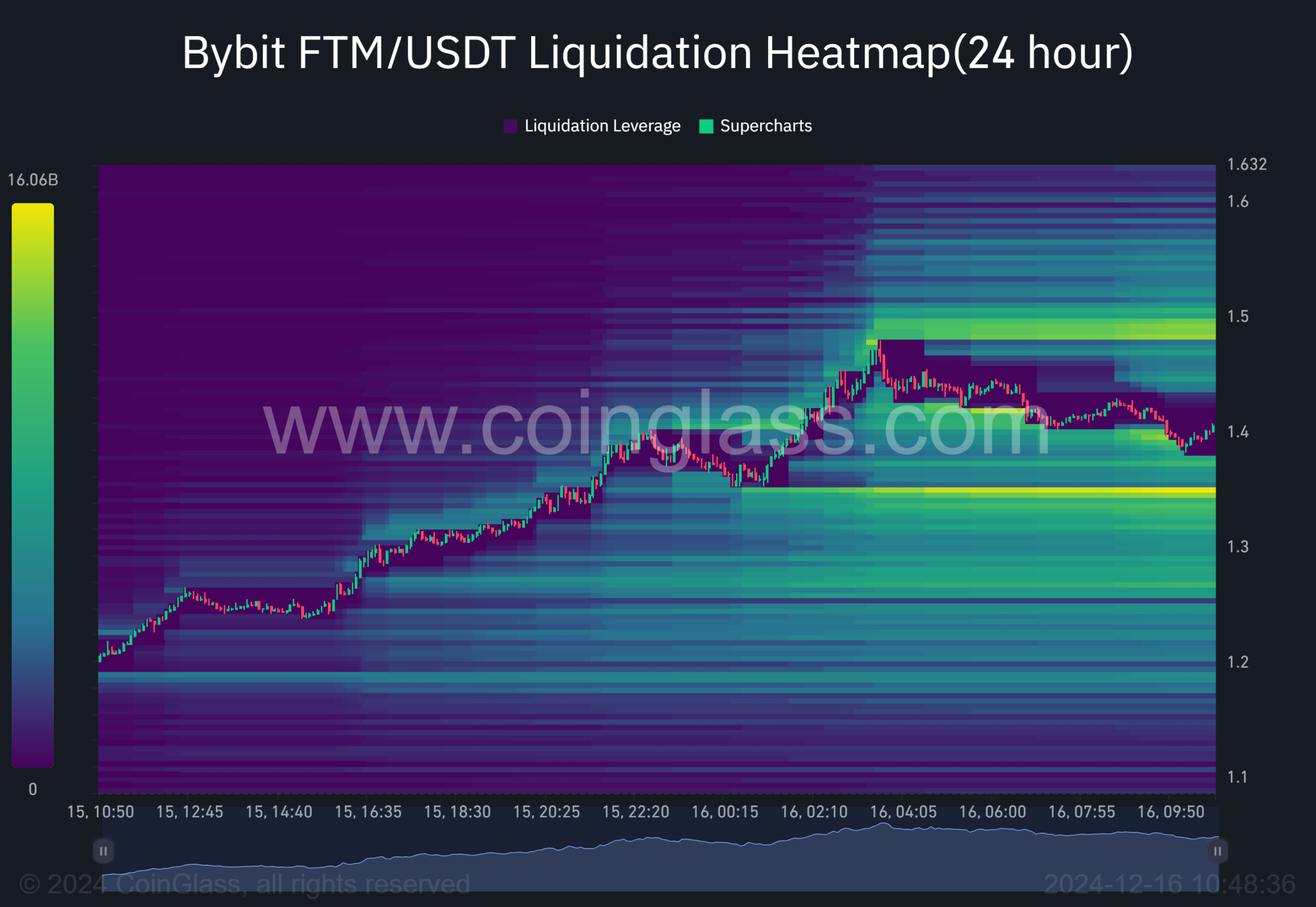

In the meantime, the liquidation heatmap showed massive short liquidations at $1.5 (overhead bright levels) and long liquidations at $1.38. In most cases, price action always follows liquidity.

So, through liquidity sweep, FTM’s price might tap both liquidity areas. If that’s the case, a clearance of the $1.6 roadblock could only be possible through a short squeeze above $1.5.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion